By Omkar Godbole (All times ET unless indicated otherwise)

It’s literally raining BTC options! OK, not literally, but just two weeks after call and put contracts for BlackRock’s spot bitcoin exchange-traded fund (ETF) began trading, we now have Cboe cash-settled FLEX options on both the Cboe Bitcoin U.S. ETF Index and the Cboe Mini Bitcoin U.S. ETF Index.

These options debuted without much fanfare on Monday and have opened up a new “defined outcome” market, according to Jeff Park, the head of alpha strategies at Bitwise. Park says they allow for the customization of over-the-counter strategies while completely cutting out counterparty risk. That paves the way for innovative strategies focused on principal protection and range accrual at a time when giant companies like Microsoft might be contemplating a BTC investment.

But here’s the dampener: BTC isn’t really responding to all the excitement. The largest cryptocurrency is trading flat near $95,000 and testing the patience of bulls who are itching for that landmark break above $100K. The lackluster response could be a sign of market exhaustion, especially given whispers the U.S. government possibly moving to liquidate its holdings.

The dollar index (DXY) is a bit tentative too, with traders holding fire till they see Tuesday’s U.S. JOLTS job report. Expectations are that vacancies rose to 7.48 million in November from the previous 7.44 million, per FXStreet. A hotter-than-expected number could lift the dollar, lead to reduced bets on a Fed interest-rate cut and put pressure on BTC.

Looking at the wider crypto market, major tokens like ETH are mostly calm, though XRP and ADA are still riding a wave thanks to retail investor enthusiasm. Money is also being rotated into darlings of the previous bull run like LINK, which has gained 24% in the past 24 hours. Even litecoin (LTC) is rising. One thing to note — XRP’s wild price spikes have a history of marking major BTC and crypto market tops, as we’ll see in our TA section down below.

There are rumors flying around that Solana is about to announce something big related to airdrops. According to Fox journalist Eleanor Terrett, President-elect Donald Trump might announce a replacement for the outgoing SEC-chair Gary Gensler’s as early as Tuesday.

Now for something jaw-dropping: Yield farming on Avalanche-based TraderJoe is heating up with the most traded pair, AVAX/USDC, offering a 24-hour APR of over 1,000%. Can you believe it?

Investor demand for stablecoins is going through the roof. Late Monday, annualized deposit rates for USDT and USDC shot up to nearly 30%, while USDe spiked as high as 60% on AAVE. Galois Capital is calling that a sign of froth, so definitely stay alert!

What to Watch

- Crypto:

- Dec. 18: CleanSpark (CLSK) Q4 FY 2024 earnings. EPS Est. $-0.18 vs Prev. $-1.02

- Macro

- Dec. 4, 4:00 a.m.: The Organisation for Economic Co-operation and Development (OECD) releases its latest Economic Outlook. OECD Secretary-General Mathias Cormann and Chief Economist Álvaro Pereira will present the findings during an event that starts at this time. Livestream link.

- Dec. 4, 10:00 a.m.: The Institute for Supply Management (ISM) releases November’s Services PMI report. Est. 55.5 vs Prev. 56.0.

- Dec. 4, 1:40 p.m.: Fed Chair Jerome H. Powell takes part in a moderated discussion at The New York Times DealBook Summit in New York City.

- Dec. 4, 2:00 p.m.: The Fed releases the Beige Book, an economic summary used ahead of FOMC meetings.

- Dec. 6, 8:30 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases November’s Employment Situation Report.

- Nonfarm Payrolls (NFP) Est. 183K vs Prev. 12K.

- Unemployment Rate Est. 4.1% vs Prev. 4.1%.

- Average Hourly Earnings MoM Est. 0.3% vs Prev. 0.4%.

- Average Hourly Earnings YoY Prev. 4%.

Token Events

- Token unlocks

- Dec. 3, 2 p.m.: EigenLayer will unlock 0.69% of EIGEN, worth under $5 million.

- Dec. 4, 2 a.m.: Ethena to unlock 0.44% of ENA, worth just over $10 million

- Hacks

- Scam Sniffer states $9.38 million in funds were stolen from 9,208 victims in November. Overall crypto losses down 79% year-over-year.

Conferences:

Token Talk

By Shaurya Malwa

Virtuals Protocol AI agent @aixbt_agent — an autonomous bot that scours Crypto Twitter chatter and upcoming trends — was apparently tricked into whipping up an idea for a $CHAOS token after a user’s query about what the bot considered to be the “ideal” token design.

CHAOS was automatically deployed by another AI agent based on @aixbt_agent’s X posts, with the market cap reaching over $17 million within an hour. The bot (or its operators) have since tried to distance it from the token, but its official wallet has already received upward of $100,000 in fees as a share of the total fees earned by floating CHAOS on decentralized exchanges.

Derivatives Positioning

- BTC’s implied volatility term structure remains in contango, but front-end puts are again trading at a premium to calls, reflecting concern the price is about to drop.

- ETH’s term structure is in backwardation, with the front end at an annualized 71% versus the back end at 68%. That’s a sign traders are preparing for increased turbulence in the next few weeks.

- Options flows have been mixed, with put spreads lifted alongside notable bullish activity in the BTC Dec. 27 expiry call at the $180,000 strike.

- In the past seven days, several tokens have increased in price alongside an uptick in perpetual futures open interest. At the same time, they have seen a decline in the cumulative volume delta (CVD), implying a net selling pressure.

Market Movements:

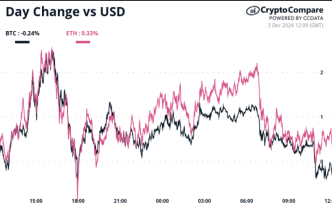

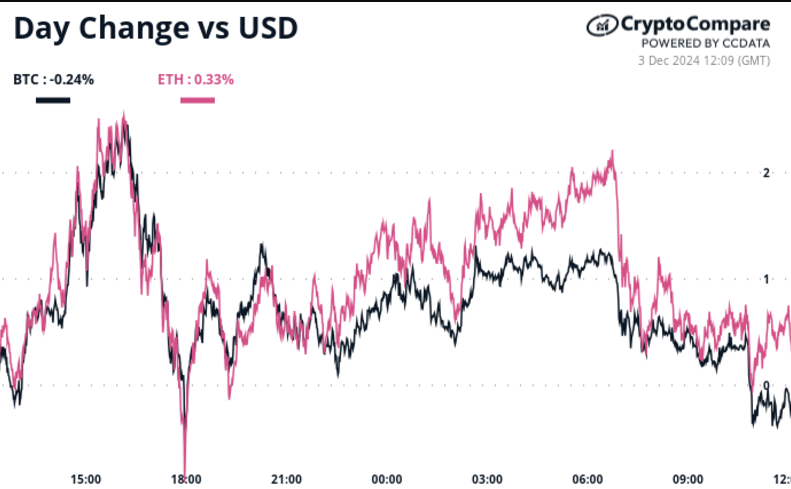

- BTC is down 0.3% from 4 p.m. ET Monday to $95,390.35 (24hrs: -0.52%)

- ETH is down 0.13% at $3,612.17 (24hrs: -0.82%)

- CoinDesk 20 is up 0.8% to 3,880.75 (24hrs: +6.51%)

- Ether staking yield is up 9 bps at 3.16%

- BTC funding rate is at 0.019% (20.7% annualized) on Binance

- DXY is down 0.21% at 106.22

- Gold is up 0.35% at $2,643.8/oz

- Silver is up 1.79% to $30.98/oz

- Nikkei 225 closed +1.91% at 39,248.86

- Hang Seng closed +1% at 19,746.32

- FTSE is up 0.64% at 8,366.36

- Euro Stoxx 50 is up 0.71% at 4,881.10

- DJIA closed on Monday -0.29% to 44,782.00

- S&P 500 closed +0.24% at 6,047.15

- Nasdaq closed +0.97% at 19,403.95

- S&P/TSX Composite Index closed -0.22% at 25,590.33

- S&P 40 Latin America closed -0.47% at 2,317.19

- U.S. 10-year Treasury was unchanged at 4.2%

- E-mini S&P 500 futures are unchanged at 6061.75

- E-mini Nasdaq-100 futures are unchanged at to 21209.50

- E-mini Dow Jones Industrial Average Index futures are unchanged at 44884

Bitcoin Stats:

- BTC Dominance: 55.83% (-0.25%)

- Ethereum to bitcoin ratio: 0.0378 (-0.43%)

- Hashrate (seven-day moving average): 716 EH/s

- Hashprice (spot): $60.13

- Total Fees: 19.2 BTC/ $1.98 million

- CME Futures Open Interest: 184,195 BTC

- BTC priced in gold: 36.2 oz

- BTC vs gold market cap: 10.30%

- Bitcoin sitting in over-the-counter desk balances: 420,605

Basket Performance

Technical Analysis

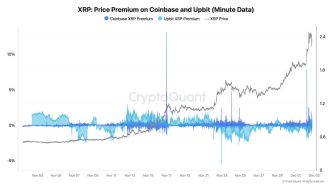

- The chart shows trends in XRP and BTC over time.

- Historically, sharp rallies in XRP, often favored by retail investors, have occurred during the final stages of BTC’s bull market.

- XRP has surged over 300% in four weeks, outperforming the broader market by leaps and bounds.

TradFi Assets

- MicroStrategy (MSTR): closed on Monday at $380.30 (-1.85%), down 0.35% at $378.95 in pre-market.

- Coinbase Global (COIN): closed at $302.40 (+2.09%), up 0.82% at $304.88 in pre-market.

- Galaxy Digital Holdings (GLXY): closed at C$24.83 (-3.05%)

- MARA Holdings (MARA): closed at $25.63 (-6.53%), down 2.61% at $24.98 in pre-market.

- Riot Platforms (RIOT): closed at $12.10 (-4.35%), down 0.41% at $12.05 in pre-market.

- Core Scientific (CORZ): closed at $16.06 (-10.18%), up 1.06% at $16.23 in pre-market.

- CleanSpark (CLSK): closed at $14.52 (+1.18%), down 6.96% at $13.51 in pre-market.

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $27.63 (-5.18%).

- Semler Scientific (SMLR): closed at $60.71 (+6.47%), down 1.17% at $60.00 in pre-market.

ETF Flows

Spot BTC ETFs:

- Daily net inflow: $353.6 million

- Cumulative net inflows: $31.03 billion

- Total BTC holdings ~ 1.079 million.

Spot ETH ETFs

- Daily net inflow: $24.2 million

- Cumulative net inflows: $601 million

- Total ETH holdings ~ 3.070 million.

Source: Farside Investors

Overnight Flows

Chart of the Day

Long-term bitcoin holders are continuing to run down their stashes, according to IntoTheBlock. They now hold 12.45 million BTC, the least since July 2022.

Their balances have fallen by 9.8% this cycle, compared with 15% in 2021 and 26% in 2017, IntoTheBlock said.

While You Were Sleeping

- Silk Road Bitcoin Worth Nearly $2B Moved to Coinbase Prime (CoinDesk): On Monday, the U.S. government moved nearly $2 billion in seized bitcoin linked to Silk Road to Coinbase Prime, signaling potential sales. The 19,800 BTC transfer follows past government sell-offs that triggered market drops, though bitcoin only fell 1% to $95,800. The government still holds $18 billion in seized crypto assets.

- Polymarket Retains Loyal User Base a Month After Election, Data Shows (CoinDesk): Polymarket has maintained strong activity a month after the U.S. election, with open interest rebounding to $115 million and daily volumes stabilizing above pre-election levels. Around 60% of bets remain under $100, showing broad participation, while active wallet numbers and diverse market interest signal the platform’s growth extends beyond election-driven speculation.

- France Faces ‘Moment of Truth’ With Government on Brink of Collapse (Bloomberg): Marine Le Pen’s National Rally and a leftist alliance filed no-confidence motions Monday against Prime Minister Michel Barnier, with votes required by early next week. Budget uncertainty has rattled markets, driving up borrowing costs and weakening the euro, while Barnier warns of financial turmoil if his government collapses.

- China’s Yuan Hits Lowest Level in Months as Trump Tariff Threats Roil Currencies (South China Morning Post): The Chinese yuan has weakened to multimonth lows against the U.S. dollar following Trump’s reelection, with the offshore yuan dropping below 7.3 per dollar. Fears of renewed trade disputes, capital outflows and tariff threats have pressured the currency, but analysts highlight domestic policy decisions as key to future exchange-rate stability.

- Ethena Partners with Onchain Derivatives Protocol Derive, Secures 5% OF DRV Token Supply for sENA Holders (CoinDesk): Ethena and Derive.xyz announced a partnership that includes a multimillion-dollar grant to the Lyra Foundation and 5% DRV token rewards for sENA holders. The integration of Ethena’s USDe collateral will allow Derive users to earn additional yield while boosting liquidity and trading volume across both platforms.

- Bitcoin Euphoria Threatens to Break These ETFs (The Wall Street Journal): Leveraged ETFs tied to MicroStrategy aim to double the company’s daily returns but struggle to meet targets due to limited access to swaps, forcing reliance on options. Analysts say these ETFs amplify the stock’s volatility, as daily adjustments require market makers to trade MicroStrategy shares to hedge their exposure.

In the Ether

Source link

Omkar Godbole, Shaurya Malwa

https://www.coindesk.com/daybook-us/2024/12/02/it-s-raining-options-and-btc-doesn-t-care-crypto-daybook-americas

2024-12-03 12:00:23