Tron’s native token TRX has skyrocketed by 66% in the past 24 hours, earning the title of the top-performing altcoin among the top 100. This impressive rally aligns with a broader altcoin surge driving market-wide gains.

The surge has drawn comparisons to Ripple (XRP), which saw a staggering 300% price increase over the last 30 days. The key question now is: can TRX sustain its upward momentum?

Tron Volume Surpasses $14 Billion, Draws Comparison to XRP

Yesterday, BeInCrypto reported Tron’s new all-time high of $0.23, but the milestone turned out to be just the start of another rally. Earlier today, TRX surged to $0.44 before retreating to $0.39.

This explosive move followed a bold claim by Tron founder Justin Sun, who declared on December 2 via X that TRX is the next XRP fueling speculation and investor excitement. Following the development, Santiment data showed an increase in TRX volume to $14.67 billion.

Volume measures the level of buying and selling in the market and acts as an indicator of interest in a cryptocurrency. From a price perspective, rising volume and increasing price are bullish signs. Therefore, if the volume continues to jump, as well as the price, then TRX could trade higher in the short term.

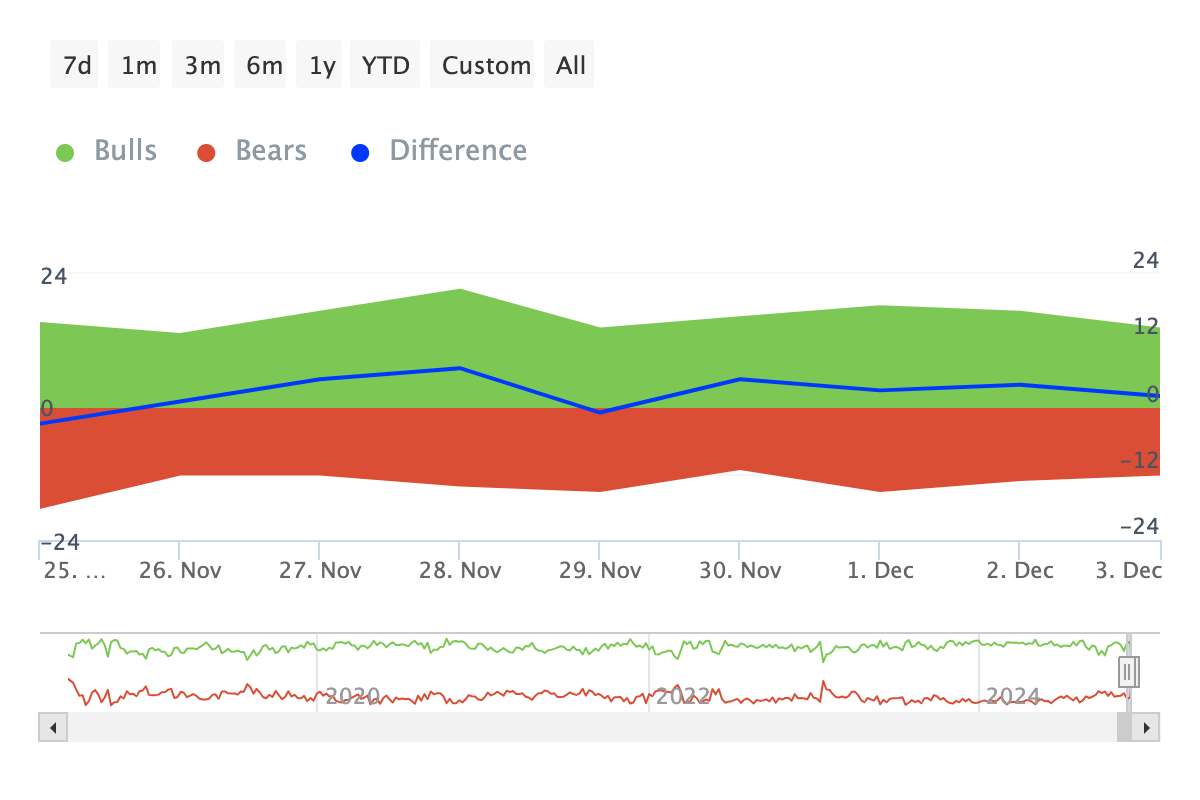

Furthermore, the Bulls and Bears Indicator, which measures the activity of addresses that traded more than 1% of the trading volume, also supports this thesis. For context, bulls are addresses that bought 1% of the volume.

Bears, on the other hand, are addresses that sold a similar amount. When there are more bears than bulls, a cryptocurrency is likely to experience selling pressure. But as the top-performing altcoin, Tron bulls outpaced bears. If sustained, then TRX’s price is likely to bounce back toward $0.44.

TRX Price Prediction: Temporary Setback, Higher Value

On the daily chart, TRX’s price faced resistance at $0.43, which led to its decline to $0.39. However, the Money Flow Index (MFI) reveals that this retracement could be temporary.

The MFI measures the level of capital flow entering a cryptocurrency. When the reading drops, it indicates selling pressure. But in this case, it has continued to rise, suggesting that more liquidity has flowed into the TRX market and is fostering buying pressure.

If this remains the case, Tron’s price could bounce above $0.45. Also, in a highly bullish scenario, it could close in on $1 and match XRP’s performance. On the other hand, if TRX holders, who are all in profit, decide to book gains, the price might drop to $0.33.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Victor Olanrewaju

https://beincrypto.com/trx-becomes-top-performing-altcoin/

2024-12-04 09:45:29