Toncoin (TON) price has surged 45.45% over the last 30 days. The RSI remains near overbought territory, and recent outflows from exchanges highlight reduced selling pressure, suggesting growing confidence among holders.

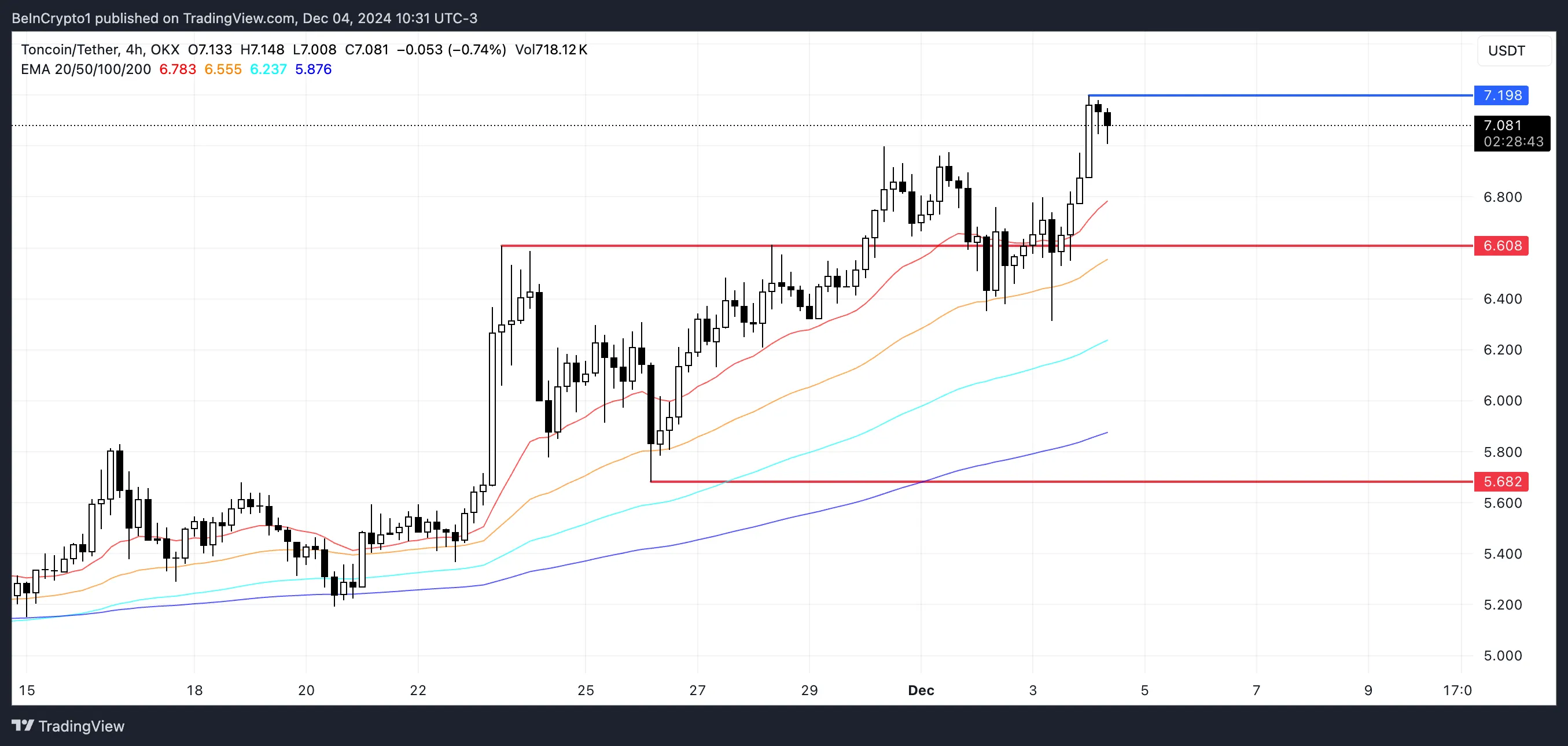

EMA lines further reinforce the bullish trend, with the price staying well above short-term averages. If TON maintains its upward trajectory, it could break the $7.198 resistance and aim for $8 in December, but a reversal might test support levels at $6.6 and $5.6.

TON RSI Is Still Close to 70

TON RSI recently almost touched the overbought threshold of 70 before retreating to its current level of 63. This pullback suggests that buying momentum has slightly weakened but remains relatively strong, as the RSI is still in bullish territory.

The current reading reflects a market where buyers maintain a slight edge, though it’s unclear if the momentum is enough to push prices significantly higher without further buying pressure.

The RSI (Relative Strength Index) measures the speed and magnitude of price movements, with values above 70 signaling overbought conditions and below 30 indicating oversold levels. TON’s RSI at 63 suggests it is still in a favorable position for potential upside.

If it rises back above 70, as it did at the end of November, TON price could regain momentum and test levels above $7.2, signaling another bullish breakout.

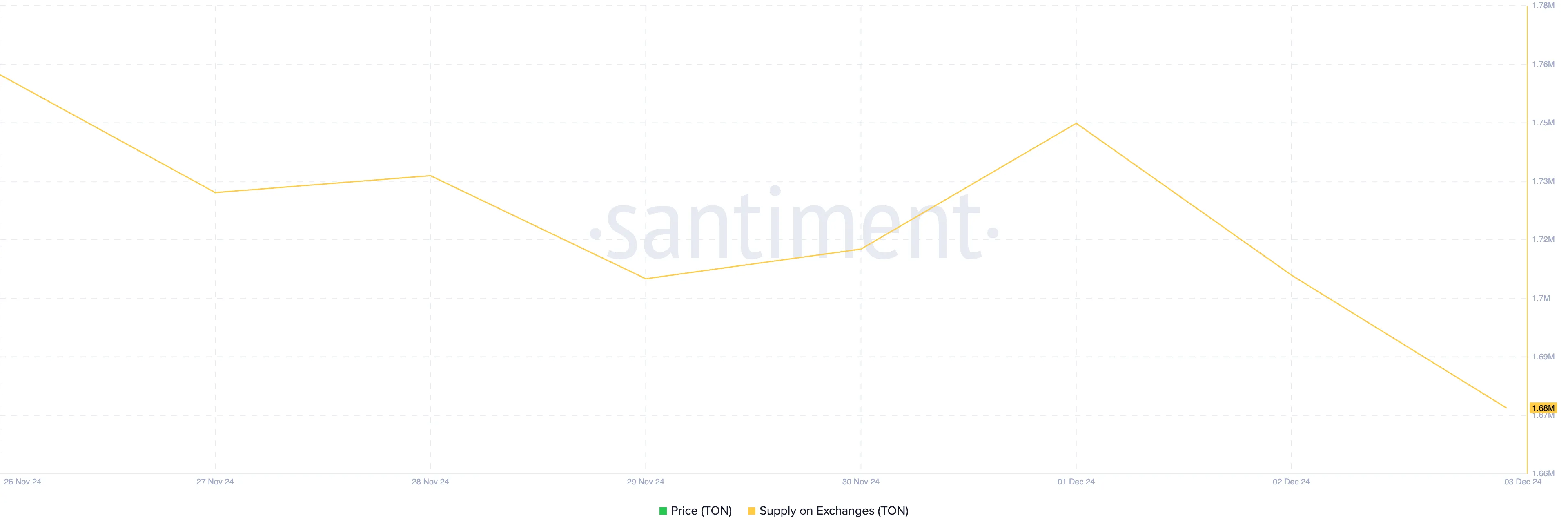

Toncoin Supply on Exchanges Dropped In The Last 3 Days

TON’s Supply on Exchanges has decreased to 1.68 million, down from 1.75 million on December 1. This decline indicates that holders have withdrawn approximately 800,000 TON from exchanges over the past three days.

Such a significant outflow suggests reduced selling pressure and a potential shift toward long-term holding or staking.

Supply on exchanges reflects the amount of a token readily available for trading. A high supply is often seen as bearish, as it implies users might be preparing to sell.

Conversely, a decline in exchange supply, like the current trend for TON, is typically bullish, as it signals accumulation and confidence in the coin’s future performance. If this trend continues, it could support upward price movement as selling liquidity diminishes.

TON Price Prediction: Can It Reach $8 In December?

TON EMA lines remain bullish, with short-term lines positioned above long-term ones and the price trading well above the short-term averages.

This alignment indicates strong upward momentum, reinforcing the current bullish trend. As long as the price stays above these lines, the trend is likely to persist.

If TON sustains its uptrend and breaks the $7.198 resistance, it could extend its rally and potentially test $8 in December, a level not seen since June 2024.

Conversely, if the uptrend reverses and a downtrend emerges, TON price may first test the $6.6 support, with a deeper correction possibly pushing it down to $5.6.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Tiago Amaral

https://beincrypto.com/toncoin-exchanges-supply-declines/

2024-12-04 17:00:00