Monero (XMR) Price experienced significant growth in November, aligning with a strong month for privacy coins following the nullification of Tornado Cash sanctions.

The renewed interest in the sector drove gains across the top five privacy coins, with Monero rising 21% and maintaining its dominance as the largest privacy coin by market cap.

November Was a Great Month For Privacy Coins

November proved to be a standout month for privacy coins, driven by the nullification of Tornado Cash sanctions, which reignited interest in the sector.

All of the top five privacy coins recorded significant gains, with DASH taking the lead, surging an impressive 167%. This surge shows the renewed market confidence in privacy-focused assets following the regulatory shift.

Monero is the largest privacy coin by a considerable margin and its price increased 21% during the month. With a market cap larger than the combined value of the next four biggest privacy coins, XMR continues to dominate the space.

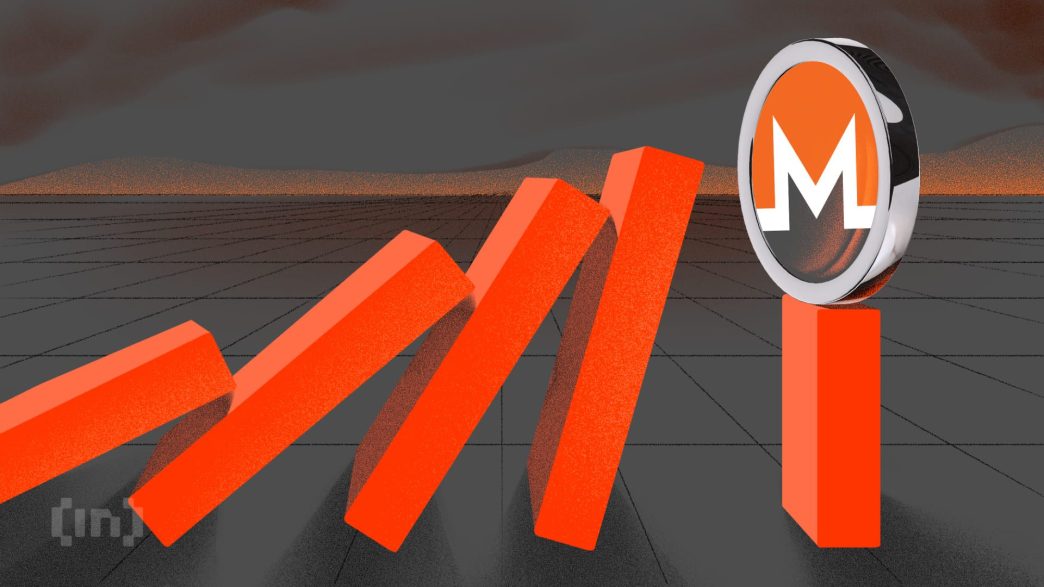

Monero DMI Shows The Current Uptrend Is Strong

Monero DMI chart reveals a strong trend as its ADX has climbed to 41.4, up from below 30 just a day ago, making it one of the biggest gainers among altcoins.

This sharp increase signals that the strength of XMR current trend has intensified significantly, reflecting heightened market momentum.

The ADX (Average Directional Index) measures trend strength, with values above 25 indicating a strong trend and below 25 suggesting a weak or consolidating market. In XMR case, the DMI chart shows D+ at 33.4 and D- at 10, indicating that buyers still have a significant advantage over sellers.

However, the decrease in D+ and the rise in D- suggest that selling pressure is starting to grow, potentially slowing XMR’s bullish momentum if the trend continues.

XMR Price Prediction: Can Monero Price Keep The Bullish Momentum?

XMR’s EMA lines remain bullish, with short-term averages positioned above long-term ones and the price staying above the short-term lines. This setup indicates sustained upward momentum, suggesting that the current uptrend could continue.

If this bullish trajectory holds, Monero price could challenge the $217 resistance and potentially reach $220 and $225, levels not seen since May 2022.

However, the DMI chart signals that a trend reversal is possible, which could bring XMR price down to test its nearest strong support at $166.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Tiago Amaral

https://beincrypto.com/monero-xmr-price-surges-privacy-coins/

2024-12-04 21:00:00