Binance, the world’s leading crypto exchange, saw 2024 inflows almost 40% higher than the next ten largest competitors combined. The firm has maintained advantages and diversified income in a chaotic market environment.

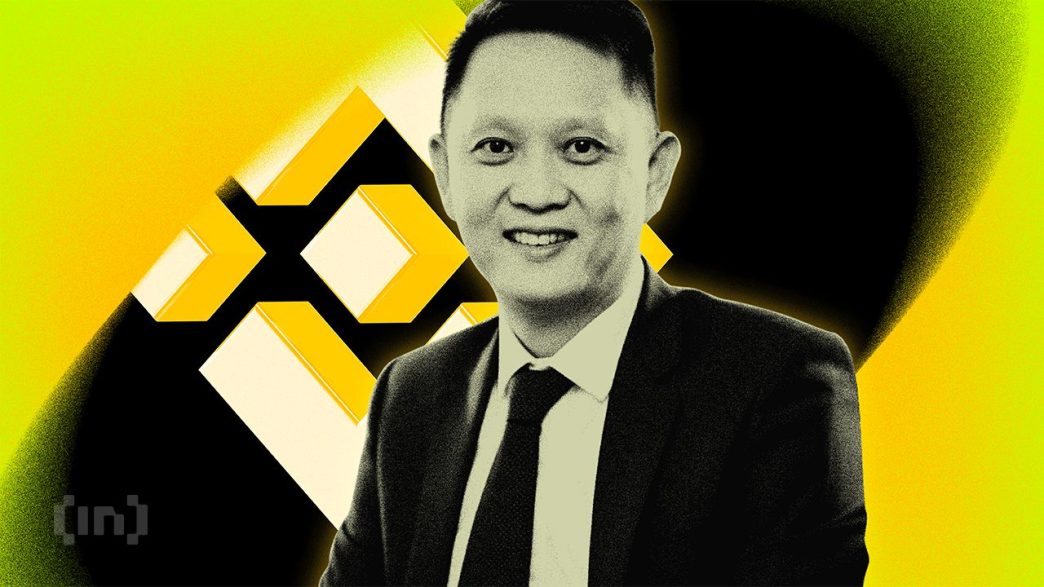

Binance CEO Richard Teng shared the insights with BeInCrypto.

Binance’s 2024 Journey

According to a report shared with BeInCrypto, Binance, the major crypto exchange, is significantly leading in inflows. Specifically, according to data from DeFiLlama, Binance’s 2024 crypto asset inflows are nearly 40% higher than those of its 10 closest competitors combined.

This lead is particularly impressive, considering some chaotic developments at Binance and the wider crypto market in 2024. Former CEO Changpeng “CZ” Zhao served his entire prison sentence for money laundering charges this year and has been banned from serving as CEO for life. Binance has since taken a more proactive approach to regulatory compliance.

Binance has also benefited from the ETF approval and the subsequent capital inflows into the crypto market. CEO Richard Teng claimed in an interview that institutional and corporate investment increased by over 40% this year. Even though the firm has no direct connection to the ETF market, it nonetheless benefitted significantly.

The firm has also explored novel revenue streams in the crypto space. For example, Binance Research analyzed the meme coin boom in 2024 and sought to capitalize on it. This led to a string of prominent new meme coin listings, many of which subsequently exploded.

Additionally, Binance claims that as of November 11, over 80% of meme coins listed on the exchange experienced a major surge after the listing.

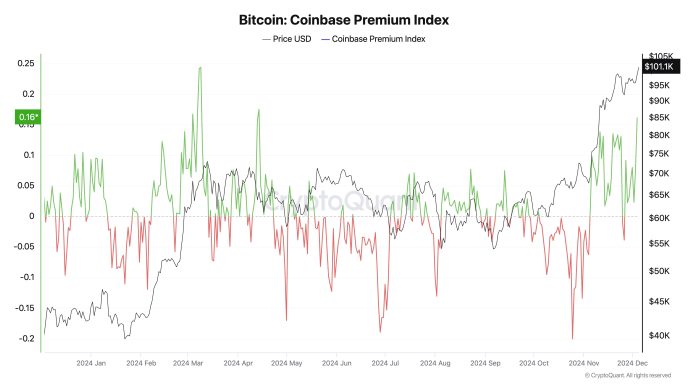

This new meme coin ambition, however, has not detracted from the core business model. Binance still leads on Bitcoin inflows, compared to all other exchanges. The firm is maintaining its previous advantages, and new CEO Richard Teng is looking forward to further conventional growth:

“2024 has been a landmark year for the crypto industry, and we are incredibly grateful to our 244 million users, and counting, who continued to trust Binance as their chosen platform for trading. Their unwavering support and confidence drives us to innovate and provide the best possible experience in the world of digital assets,” Teng told BeInCrypto.

Nonetheless, the company still faces some difficulties. Despite Teng’s attempts to prioritize regulatory compliance, Cambodia banned Binance this week. Additionally, the Indian government declared that Binance owes $85 million in unpaid taxes.

Both of these instances suggest its legal troubles aren’t over.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Landon Manning

https://beincrypto.com/binance-2024-inflows-higher/

2024-12-05 08:24:26