PEPE, the meme coin that gained significant attention earlier this year, recently reached an all-time high (ATH) but has struggled to maintain momentum since. The altcoin has remained stuck in neutral gear and has been unable to gain significant traction.

However, a major development on the horizon could inject new life into the market and drive growth. On December 5, PEPE will be listed on Binance.US. This move is expected to boost liquidity and attract new investors, potentially catalyzing a fresh upward trend for PEPE.

PEPE Looks Ahead

Currently, short-term holders are dominating the PEPE supply. These holders, typically keeping assets for less than a month, account for more than 48% of the total supply. While this indicates a volatile market, it also means that the majority of PEPE holders may be more inclined to sell their positions quickly.

However, despite this dominance, the potential surge in liquidity following PEPE’s listing on Binance.US could counterbalance the selling pressure. Increased trading volume can absorb the selling pressure from short-term holders, offering a window for new investment and price stability. The listing on Binance.US will likely open the door to a broader market of retail and institutional investors.

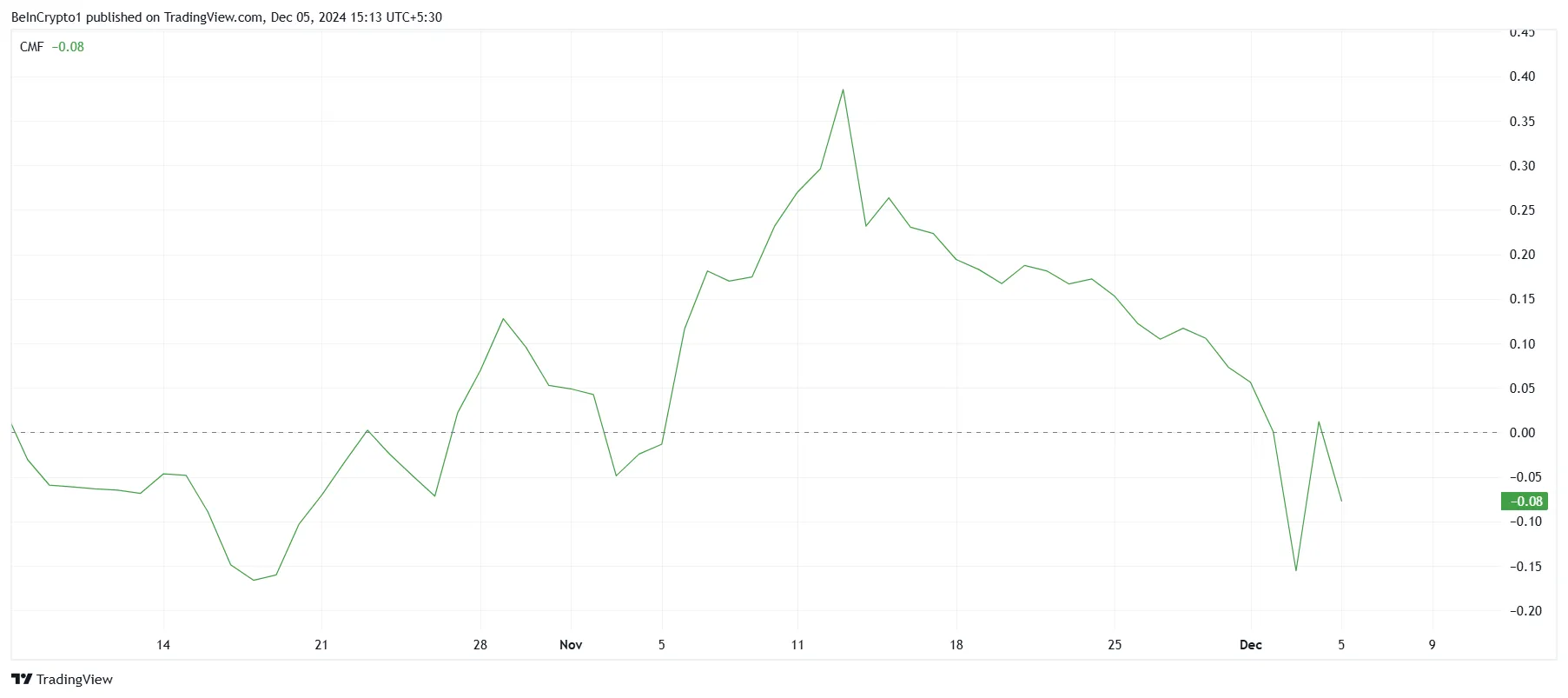

PEPE’s macro momentum, as indicated by the Chaikin Money Flow (CMF), has recently shown a decline. The CMF, which tracks the money flow into and out of an asset, has reflected outflows over the past few weeks.

This downward trend signals that, without fresh investment, PEPE may continue to face challenges in sustaining its previous gains. The decline in the CMF suggests that the current holders are either liquidating their positions or not reinvesting, which could limit PEPE’s growth unless new capital enters the market.

To reverse the current trend, PEPE will need a boost in buying pressure, which could come from the listing on Binance.US. The liquidity influx expected from the listing could counterbalance the outflows reflected in the CMF, driving the meme coin into a new phase of upward momentum. This increase in investor participation would be crucial for sustaining price growth and potentially propelling PEPE back toward its ATH.

PEPE Price Prediction: New ATH Likely

PEPE’s price action has remained within a narrow range of $0.00002334 to $0.00001793 for the past three weeks. For the cryptocurrency to establish a new all-time high (ATH), it must break through this consolidation. A sustained price movement outside this range would indicate a shift in market sentiment.

Currently, PEPE’s ATH stands at $0.00002597, 20% above the current price of $0.00002158. A price increase beyond this point is possible, especially with the ongoing Binance.US listing. Positive market reactions to this event could trigger an upward trend, supporting the potential for new highs and strengthening investor confidence in PEPE’s future prospects.

If PEPE fails to break out of its consolidation phase, it could face downward pressure. In this scenario, a decline to $0.00001489 becomes more likely, weakening any bullish outlook. This drop would challenge the sustainability of PEPE’s price momentum, leading to a more cautious market approach.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Aaryamann Shrivastava

https://beincrypto.com/pepe-listing-on-binance-us-expected-to-trigger-rise/

2024-12-05 13:00:00