Bitcoin’s price recently surged to an all-time high (ATH) of $104,087 but has since entered a phase of consolidation. Despite reaching new highs, Bitcoin is struggling to break past the $100,000 barrier.

Investors are cautiously optimistic, but there is concern that the market may be at a tipping point, where a decline could follow if BTC fails to hold above this level.

Bitcoin Faces High Risk

Bitcoin’s market sentiment is currently marked by very high risk, as indicated by the NUPL (Net Unrealized Profit/Loss) metric. The NUPL has surpassed 0.59, which is one standard deviation above the 4-year average.

This indicates a phase of extreme unrealized profit, which often correlates with market euphoria. High levels of NUPL are typically followed by significant corrections, as investor optimism may turn into profit-taking.

The NUPL reading signals that the Bitcoin market is overheating, and this can lead to increased sell pressure. When the market becomes overextended, prices can quickly shift from bullish to bearish as more investors begin to realize their profits. The risk of a correction in the coming weeks remains high as long as NUPL remains above the danger zone.

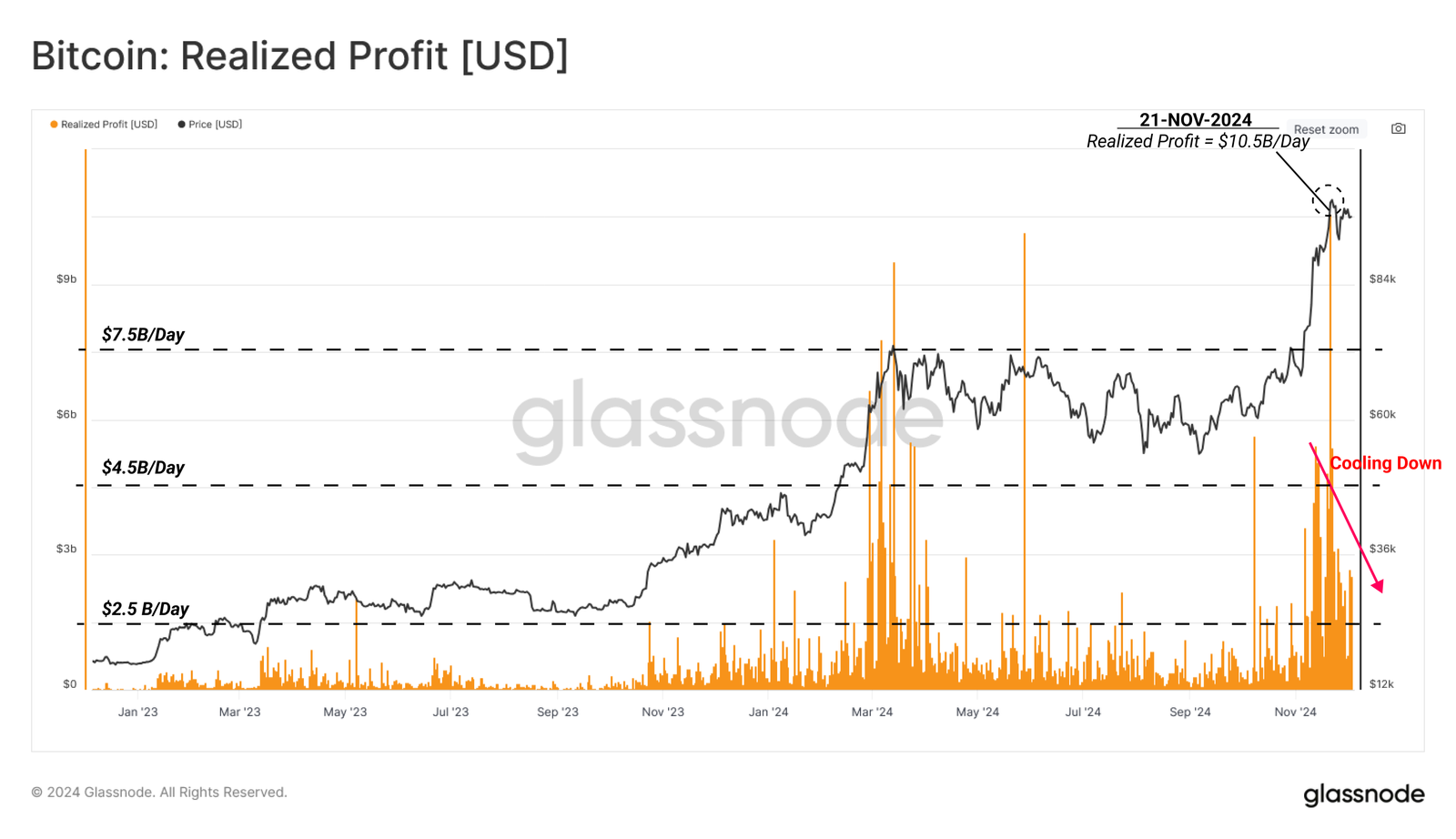

Over the past few days, realized profits have shown signs of decline. This reflects a cautious outlook among investors, who are waiting for more clarity on the direction of the market.

“Realized Profit, which tracks the USD gains from moved coins, peaked at $10.5 billion daily on the run-up towards $100,000. It has since declined to around $2.5 billion per day, representing a 76% drop. This sharp reduction hints towards a marked cool down, suggesting the profit-taking may have been more impulsive than sustained,” Glassnode noted.

BTC Price Prediction: Staying Cautious

Bitcoin’s price is currently range-bound between $100,000 and $89,800, with volatility expected to continue. If BTC manages to break above $100,000 and establish it as a support level, the price could trend higher, potentially approaching $105,000 in the coming weeks. However, if Bitcoin fails to sustain momentum above $100,000, a retest of the $89,800 level is likely.

A failure to hold the $89,800 support level could lead to a significant drop in price, possibly testing the $85,000 support. If selling pressure increases and Bitcoin cannot recover, a further decline could be in store, pushing BTC closer to $75,000. This would indicate a prolonged consolidation period before any further bullish attempts.

In the current market environment, Bitcoin’s ability to reclaim and maintain the $100,000 level is crucial. While the overall sentiment remains bullish, the high NUPL suggests the risk of a correction is real.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Aaryamann Shrivastava

https://beincrypto.com/bitcoin-set-to-face-sell-off/

2024-12-06 14:30:00