Ripple’s XRP has experienced a significant 25% hike in the last seven days, reaching a high of $2.72. However, recent data indicates that this XRP price jump may have reached a local top due to changes in the state of several indicators.

While the long-term outlook for the altcoin may remain positive, investors may need to be cautious about expecting further short-term gains. Here is why.

The Ripple Token Becomes Overvalued, Buying Pressure Tanks

One indicator suggesting that XRP could halt its rally is the Network Value to Transaction (NVT) ratio. The NVT ratio checks whether a cryptocurrency’s market capitalization is growing faster than its transaction volume. It is a crucial metric for assessing whether a coin is overvalued or undervalued.

When the ratio declines, it means transaction volume on the blockchain has outpaced the market cap growth. In this instance, it means the crypto is undervalued, and a price increase could be close.

However, in XRP’s case, the NVT ratio has risen from 30.68 to 71.65 within the last three days. This notable surge indicates that the cryptocurrency’s market cap has grown faster than transactions on the network, suggesting that the XRP price jump could take a break and that the altcoin might be close to hitting a local top.

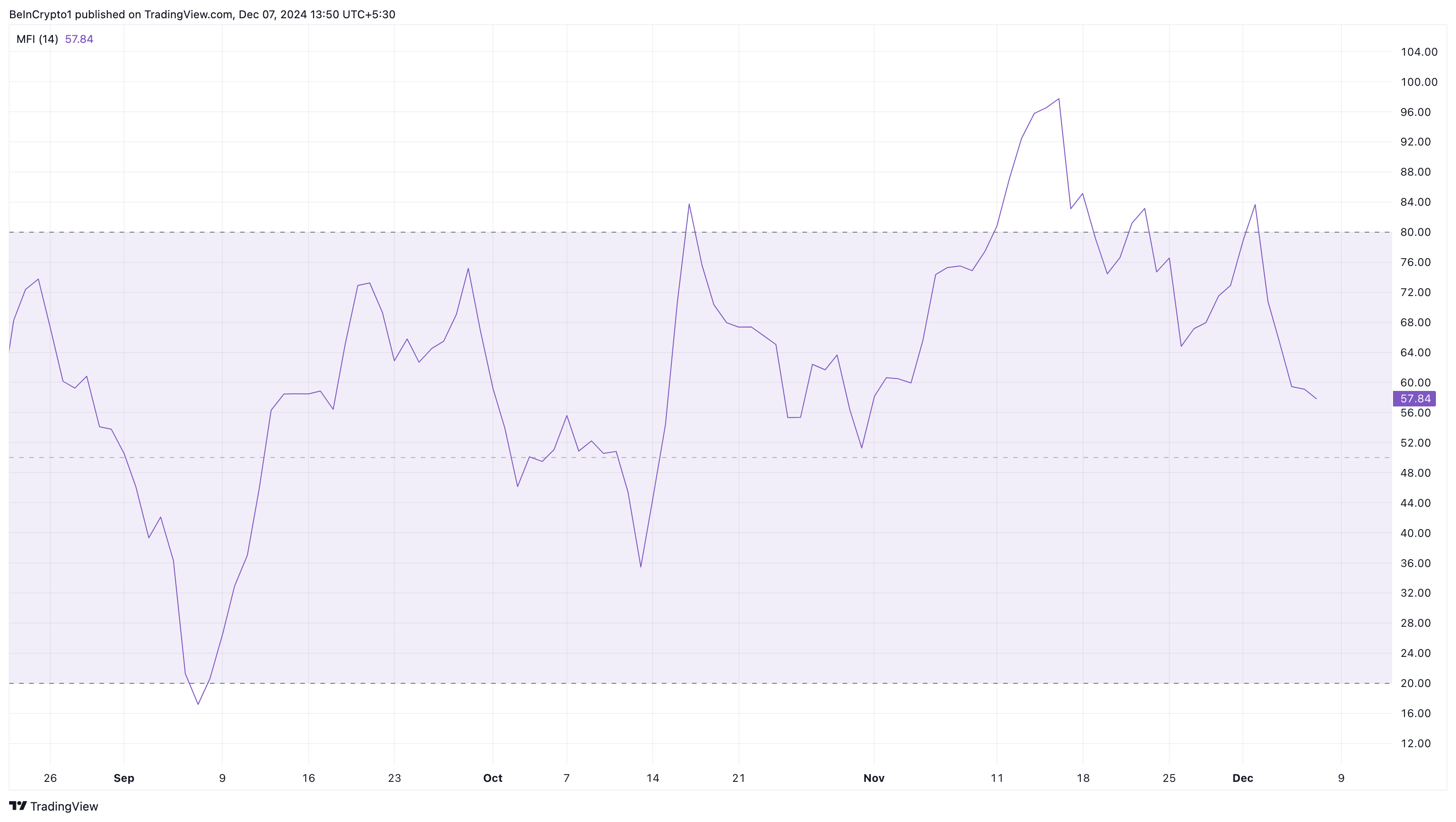

Beyond that, the Money Flow Index (MFI) on the daily chart seems to support this thesis. The MFI is a technical oscillator that uses price and volume to measure buying and selling pressure.

With this data, the indicator can also tell when a crypto is overbought or oversold. When the reading is over 80.00, it is overbought. On the other hand, when it is below 20.00, it is oversold.

According to the chart below, the MFI on the XRP/USD daily chart reached 83.20 on December 3, indicating that the altcoin has become overbought. Since then, the rating has declined, indicating that buying pressure is no longer as high as it was some days back. Should the decline continue, then XRP’s price might find it difficult to climb higher.

XRP Price Prediction: Sub-$2 Levels Coming

Further assessment of the daily chart shows that XRP pullback from $2.72 helped it find support at $2.25. However, the image below reveals lower trading volume around the altcoin, suggesting that another XRP rally might not happen in the short term.

Instead, bears might try to push the price further down below the support that bulls are defending. If that happens, then XRP’s price might decline to $1.85, where the 23.6% Fibonacci ratio positions.

Should selling pressure intensify, the token’s next target could be around $1.40 at the 38.2% Fib level. However, if buying pressure increases and the MFI reading bounces, this prediction might not happen. In that scenario, XRP could climb to surpass $2.90 and reach a yearly high of $3.20.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Victor Olanrewaju

https://beincrypto.com/xrp-price-jump-hints-at-local-top/

2024-12-07 12:30:00