Cardano’s price has been moving sideways in recent days, holding steady above $1. Despite avoiding a significant drop, the altcoin is showing signs of fading bullish momentum.

Investor optimism, once strong, has dwindled as ADA struggles to gain upward traction. This shift in sentiment is creating uncertainty about its near-term trajectory.

Cardano Faces a Hack

For the first time in over a month, investor sentiment toward Cardano has turned negative. Optimism surrounding ADA has diminished, raising concerns about its ability to sustain current price levels.

Amid negative sentiments, the Cardano Foundation’s X account got hacked on Sunday. Hackers posted false claims about an SEC lawsuit and promoted a fraudulent token on Solana. While the account was quickly recovered and the posts were deleted, the incident had no direct impact on ADA’s market sentiment.

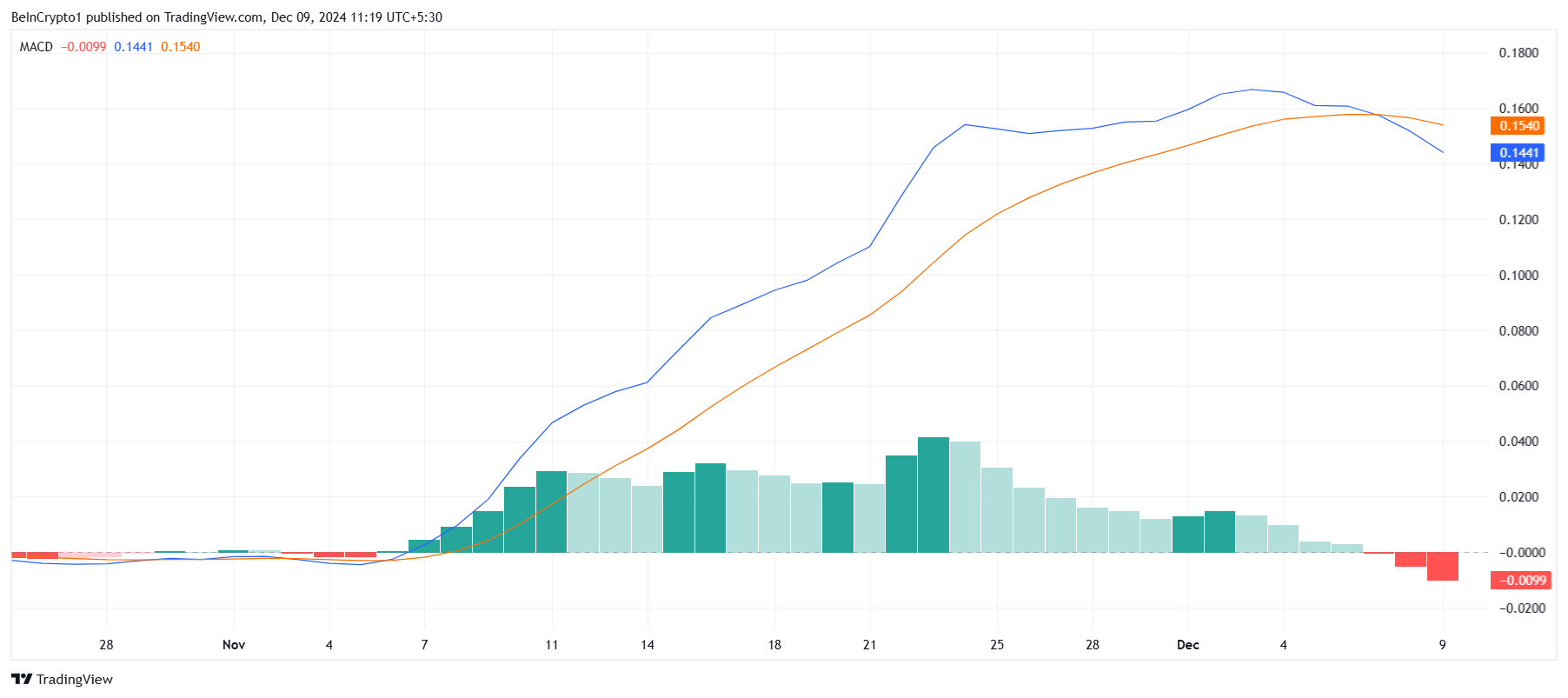

Cardano’s macro momentum has also shifted downward, as indicated by technical indicators. The MACD (Moving Average Convergence Divergence) showed a bearish crossover over the weekend. This signals that ADA may face a potential decline in the near term.

A bearish MACD crossover is often a precursor to downward price movements, particularly when accompanied by weak trading volume.

The lack of strong bullish signals further highlights the challenges for Cardano. Without a significant uptick in momentum, the altcoin may find it difficult to break through critical resistance levels. This macro outlook suggests that ADA’s price could remain under pressure unless broader market conditions improve.

ADA Price Prediction: Staying in Its Lane

Cardano is currently trading at $1.17, just below the $1.20 resistance level. Successfully flipping this resistance into support could pave the way for a rise toward $1.32. Achieving this would require a resurgence of bullish momentum, supported by higher trading volumes and positive sentiment.

If bullish momentum fails to materialize, ADA risks falling to $1.01, a critical support level. A bounce from this point could lead to consolidation, keeping the altcoin range-bound. Prolonged consolidation may delay any significant price recovery, adding to investor uncertainty.

On the other hand, breaking past $1.32 could invalidate the bearish thesis. Such a move would signal renewed strength for ADA, potentially attracting more buyers and pushing the altcoin higher.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Aaryamann Shrivastava

https://beincrypto.com/cardano-price-unfazed-despite-facing-hack/

2024-12-09 06:40:03