When assets surge to lifetime highs or multimonth peaks, traders are often faced with the challenge of identifying key resistance levels, the price targets where the market could next take a breather. That’s precisely the situation facing bitcoin (BTC) and XRP (XRP) traders.

Bitcoin, the leading cryptocurrency by market value, is trading at record highs near $100,000, meaning it’s now in uncharted waters. XRP trades at $2.44, with the 2018 record high around $3.30 as the only chart resistance before we enter the price discovery mode like BTC.

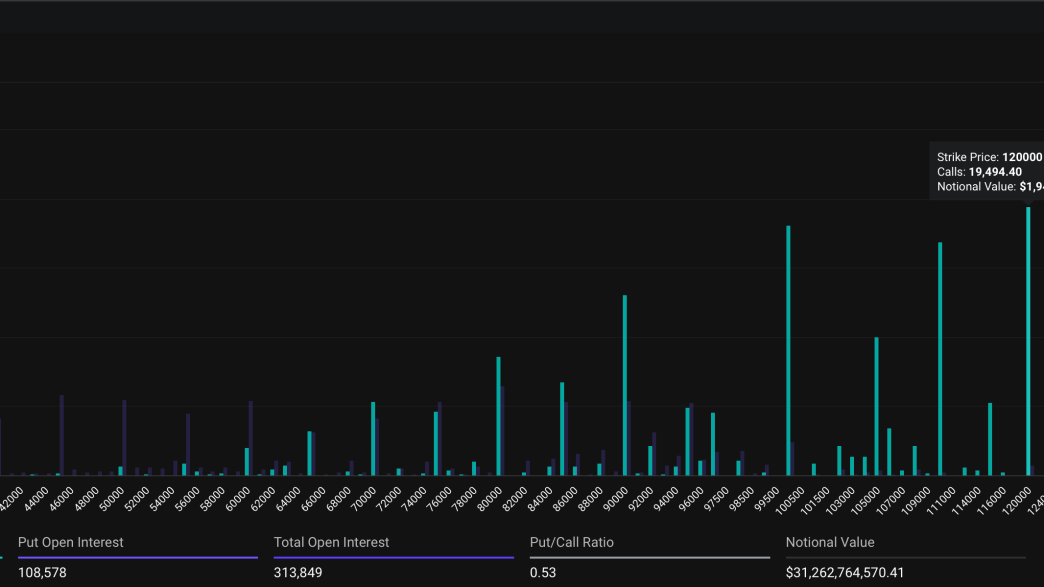

One way to identify key resistances is to study the distribution of open interest, the dollar value of active option contracts, at various strike price levels.

On Deribit, the world’s leading crypto options exchange, BTC’s $120,000 strike call option is the most popular contract at the moment, with a notional open interest of $1.93 billion, according to data source Deribit Metrics.

A strike with the highest open interest often marks a resistance level because call sellers, typically institutions, face significant losses if prices rise above that point. As a result, they often act to keep prices from exceeding that level. Conversely, the strike level can also act as a magnet due to the hedging activity of market makers or entities tasked with creating order book liquidity.

Recall that before and immediately after the U.S. election, the $100,000 call was the most preferred in terms of notional open interest. The price has now consolidated around the six-figure mark.

At press time, the call option at the $100,000 strike is still the second-most popular contract, with open interest of $1.8 billion. It is followed by the $110,000 strike call, which boasts open interest of $1.68 billion.

We can also see that $500 million is locked in the $200,000 strike call, representing a bet that the bitcoin price will double. Most open interest is concentrated in the June 2025 and September 2025 expiries. Analysts at Standard Chartered say they expect the price to reach that level by the end of 2025.

Key levels for XRP

In XRP’s case, the $1 call option is the most popular strike, with over $3 million in open interest. The option is deeply in-the-money, or in profit, as the cryptocurrency currently trades near $2.42.

The focus now is on the $2.8 call option, where traders have locked in $2 million in open interest. The next potential target is at $5. The so-called deep out-of-the-money call is the third-most active open, with open interest of $1.12 million.

Source link

Omkar Godbole

https://www.coindesk.com/markets/2024/12/09/gauging-bitcoin-xrp-resistance-levels-after-record-price-rallies

2024-12-09 09:11:15