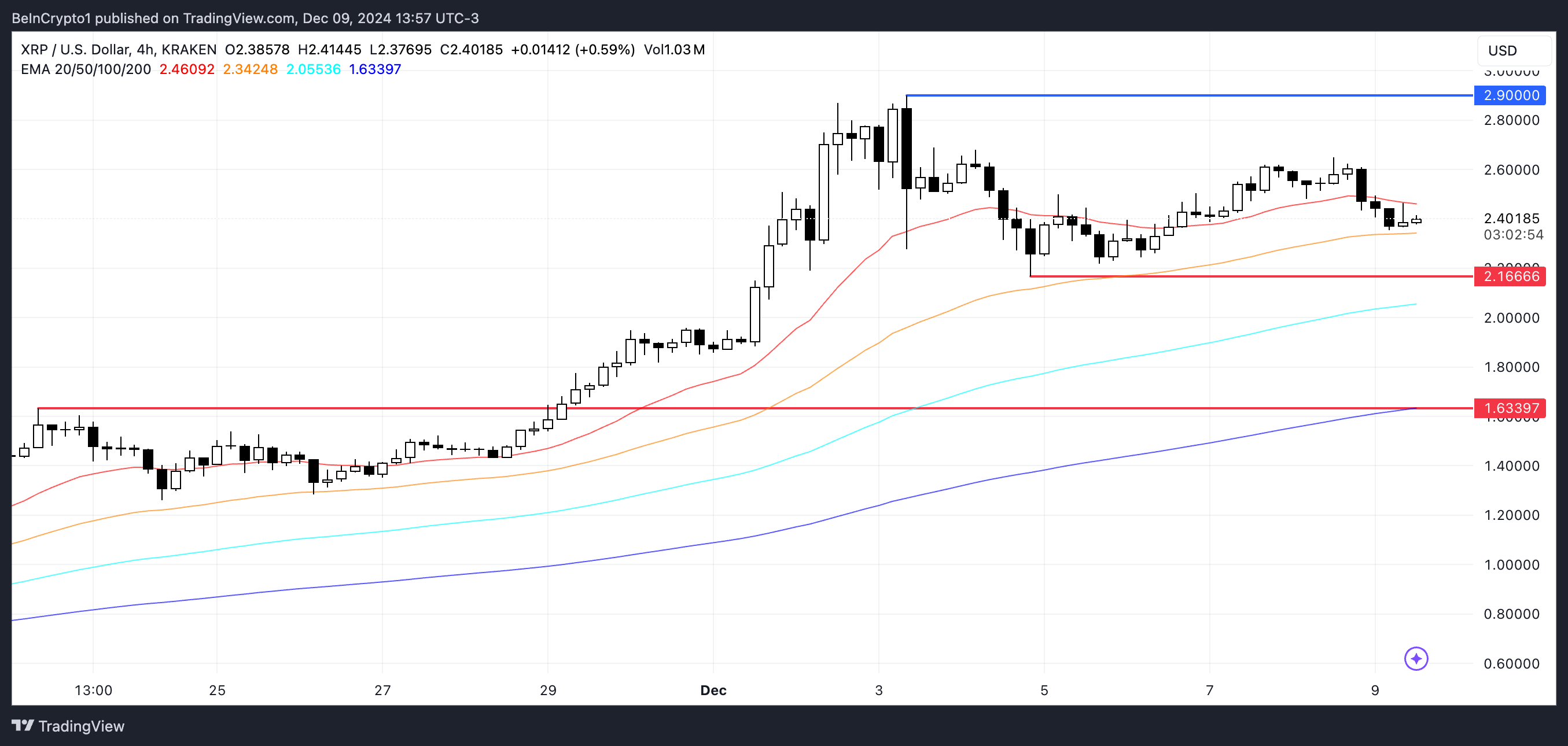

Ripple (XRP) price has surged more than 330% in the last 30 days, surpassing Solana’s market cap and reaching its highest levels in 6 years. However, its RSI is now at 46, a significant drop from the overbought level above 70 that was seen between November 29 and December 3, when XRP peaked around $2.90, its highest level since 2018.

This decline suggests that the bullish momentum has cooled, and the market sentiment is now neutral or slightly bearish. As a result, XRP could face a period of consolidation or mild downward pressure before any potential recovery.

XRP RSI Is Neutral After Consecutive Days Above 70

XRP RSI is currently at 46, a significant drop from the overbought level above 70 between November 29 and December 3, when its price peaked around $2.9, the highest since 2018.

The decline in RSI suggests that the recent bullish momentum has cooled off, and the market may now be in a neutral or slightly bearish phase.

RSI, or Relative Strength Index, is a momentum oscillator that measures the speed and change of price movements. It ranges from 0 to 100, with values above 70 typically indicating an overbought condition, while values below 30 suggest oversold conditions.

With XRP’s RSI at 46, it indicates that the asset is neither overbought nor oversold, suggesting a neutral market sentiment. If this trend continues, Ripple price may experience a period of consolidation or mild downward pressure before a potential recovery.

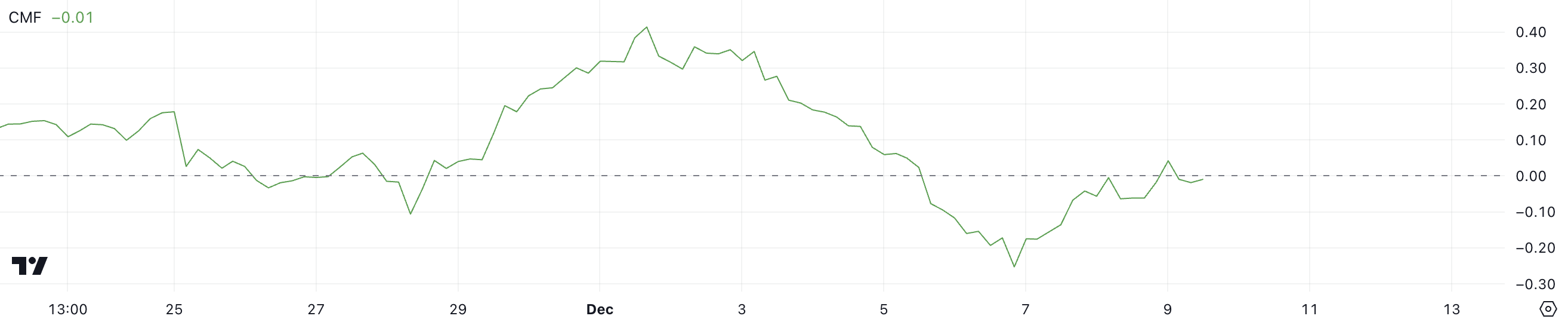

Ripple CMF Is Now Around 0

XRP’s CMF is currently at -0.01, following a brief positive reading of 0.04 just a few hours ago. The indicator reached a negative peak of -0.25 on December 6, after remaining positive between November 29 and December 5.

This shift in the CMF suggests that XRP next movements are still uncertain, and the asset is struggling to maintain upward momentum.

CMF, or Chaikin Money Flow, measures the accumulation and distribution of an asset over a specific period, taking into account both price and volume. It ranges from -1 to +1, with values above 0 indicating accumulation (buying pressure) and values below 0 indicating distribution (selling pressure).

The current CMF of -0.01 indicates a weak selling pressure, suggesting that while there was an attempt to reverse the downtrend, it was not strong enough to sustain the positive momentum. If this trend continues, it could indicate further downward pressure for XRP price in the near term.

XRP Price Prediction: Can Ripple Go Below $2?

Ripple EMA lines remain bullish, with short-term lines positioned above the long-term ones, suggesting an overall upward trend.

However, the current price is below the shortest line, indicating that the trend may be shifting and the bullish momentum could be weakening.

If a strong downtrend develops, XRP price could test the support at $2.16, and if that level fails to hold, it could fall as low as $1.63, potentially marking a 32% correction.

On the other hand, if Ripple price regains its upward momentum, following the more than 330% surge in the last 30 days, it could rise to retest $2.90 and potentially push toward $3, a level not seen since January 7, 2018.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Tiago Amaral

https://beincrypto.com/ripple-xrp-price-faces-uncertain-after-6-year-highs/

2024-12-09 21:00:00