Unlike previous weeks, the price of Hedera (HBAR) has decreased by nearly 17% in the last seven days. While many holders hope that this HBAR price decline is temporary, several indicators suggest that the altcoin may still drop lower.

As of this writing, HBAR trades at $0.29. But how low can the cryptocurrency’s value go?

Hedera Trend Switches from Bullish to Bearish

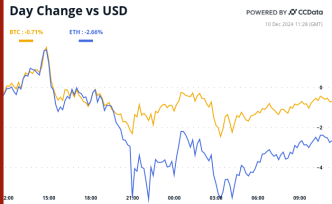

One indicator suggesting that HBAR’s price could slide lower is the Exponential Moving Average (EMA). The EMA is a technical indicator that helps traders identify trend directions and potential support and resistance levels.

During an uptrend, the EMA may serve as a support level, with prices bouncing off it before continuing upward. On the other hand, the EMA can function as a resistance level, with prices retreating after a downtrend

According to the 4-hour HBAR/USD chart, the altcoin has dropped below the 20-period EMA, indicating a bearish trend. Historically, whenever this happens, the asset’s value falls much lower than it has. Therefore, there is a high chance that HBAR’s value could sink below $0.29 in the short term.

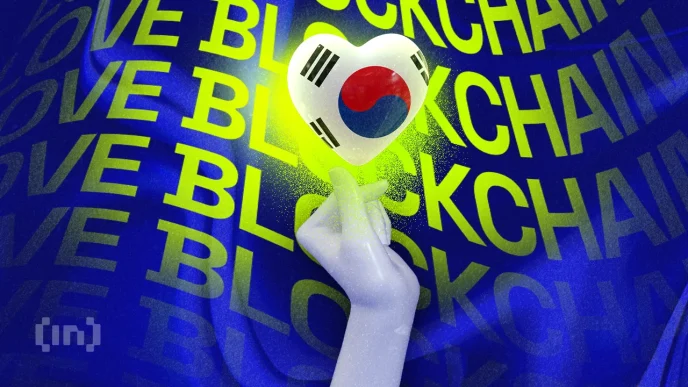

From an on-chain perspective, Hedera’s social dominance is one metric supporting the extended drawdown. Social dominance measures the level of discussions the market has about a cryptocurrency.

An increase in social dominance indicates that discussions about the asset are rising compared to other top 100 cryptocurrencies, often signaling bullish sentiment. Conversely, a decline suggests waning interest and reduced attention amid the HBAR price decline.

On December 3, HBAR’s social dominance spiked to 3.50%. However, it has since dropped to 1.12%, reflecting a sharp decline in the altcoin’s buzz. If this trend persists, it could lead to further price declines.

HBAR Price Prediction: Eyes on $0.17

Meanwhile, on the daily chart, the Chaikin Money Flow (CMF) has dropped from its peak on December 2. As the name implies, the CMF measures the flow of liquidity in and out of a cryptocurrency.

When the CMF increases, it indicates a rise in buying pressure, and the price can increase. However, in HBAR’s case, the drop in the indicator’s rating suggests rising selling pressure.

If this remains the same, then HBAR’s price could drop to $0.17. On the other hand, if the altcoin rises above the 20 EMA and buying pressure increases, this trend might change. In that scenario, the token might climb to $0.39.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Victor Olanrewaju

https://beincrypto.com/hedera-hbar-price-slips-below-key-moving-average/

2024-12-10 11:30:00