NEAR, the native cryptocurrency of Near Protocol, has surged by 57% from its September 6, 2024, low of $3.41.

At present NEAR is trading at $5.22 NEAR/USDT at Gate.io, after losing by 0.5% within the last 24 hours.

On September 24, it reached an eight-week high of $5.36 before retracing towards $5.20 a strong support flow.

Several factors that include increasing open interest, TVL (total value locked) and the protocol’s implementation of blockchain sharding have contributed to its current bullish momentum.

Near Blockchain implements sharding

Near protocol, a cloud computing platform, has introduced sharding on its network to increase scalability and security without negatively affecting decentralization.

As the image shows, on X, Justin Bons announced the implementation of sharding on the NEAR Protocol.

The protocol completed the NEAR 2.0 update on August 12, thereby launching its sharding.

As of right now, Near protocol has become the second blockchain after Elrond to introduce sharding.

Basically, sharding enables the network to split its workload across many node groups. That process helps it to achieve scalability and enhances its security.

The implementation of sharding has made Near protocol an alternative to the Ethereum blockchain for DApps (decentralized applications). This is because it is now faster and more cost-effective than before.

Therefore, as the demand for DApps increases, Near Protocol will grow accordingly.

Partnership between Nvidia and Alibaba Cloud

The partnership between Nvidia and Alibaba Cloud resulted in a bullish momentum for AI-themed crypto tokens such as NEAR.

Data on CoinGecko shows that the AI tokens increased by about 5.9% after the partnership of the two giants in the sector. The cumulative market capitalization of AI tokens is around $28.9 billion.

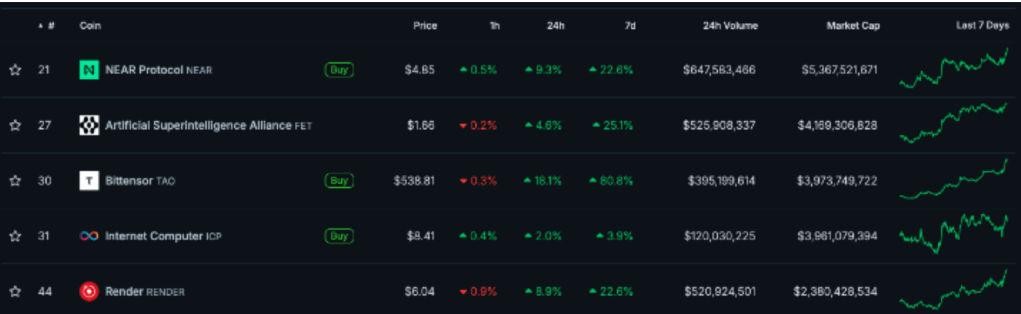

The following table shows the performance of the top five AI tokens in the cited period according to CoinGecko.

As you observe in the table, NEAR was one of the biggest gainers following the Nvidia and Alibaba Cloud alliance.

The NEAR price rose by 9.3% within the 24-hour period following the announcement of the partnership.

Artificial Superintelligence Alliance (FET) gained by 5% while Bittensor (TAO) rallied by 18%.

At the moment FET is trading at $1.67 FET/USDT. However, its value has fallen by 1.3% within the last 24 hours.

Kamala Harris’s promise to promote AI and digital asset in the United States

The United States presidential candidate Kamala Harris’s promise to promote “an opportunity economy” focused on AI and digital assets in the country might have contributed to the recent NEAR price surge.

She said that as her first time to publicly show her support for digital assets and the AI sector.

Growing network activity and TVL (total value locked)

On-chain data indicates that the NEAR Protocol network grew over the past few weeks. There was a rise in its daily transaction as well as TVL.

For instance, daily transactions rose by 42% between August 25 and September 24.

On the other hand, its new wallet addresses increased by about 30.8%. These changes led to the rise in NEAR’s TVL.

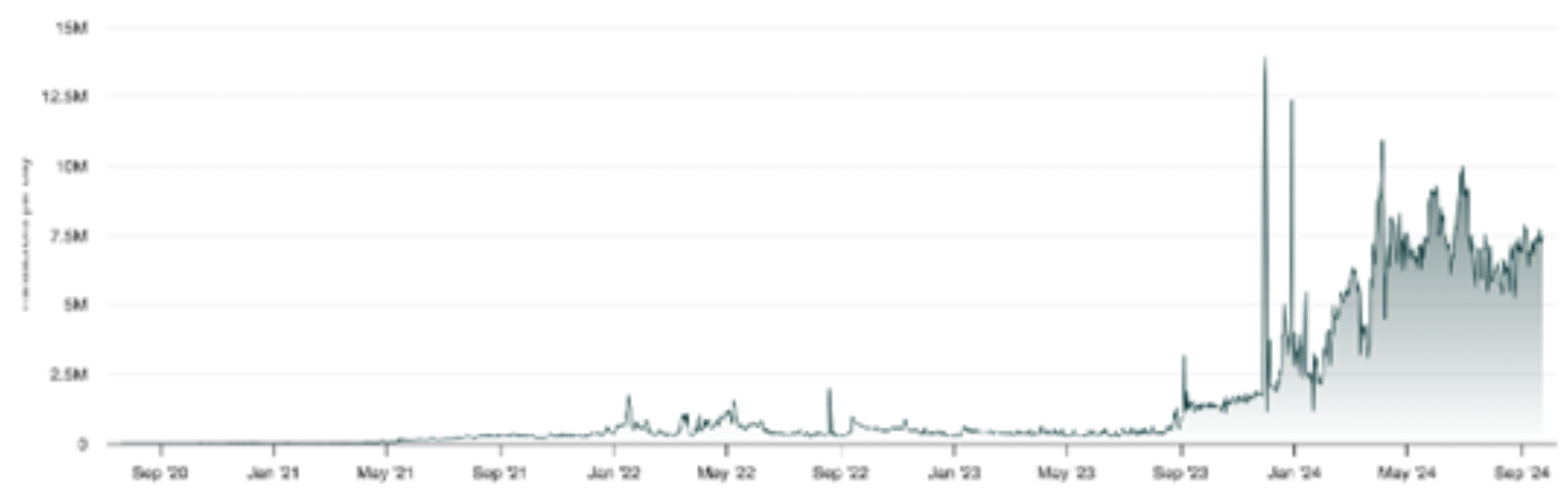

The following graph shows the rise in its daily transactions, according to NearBlocks.io.

One of the factors that resulted in the increase in its daily transactions was the rising adoption of projects on the network.

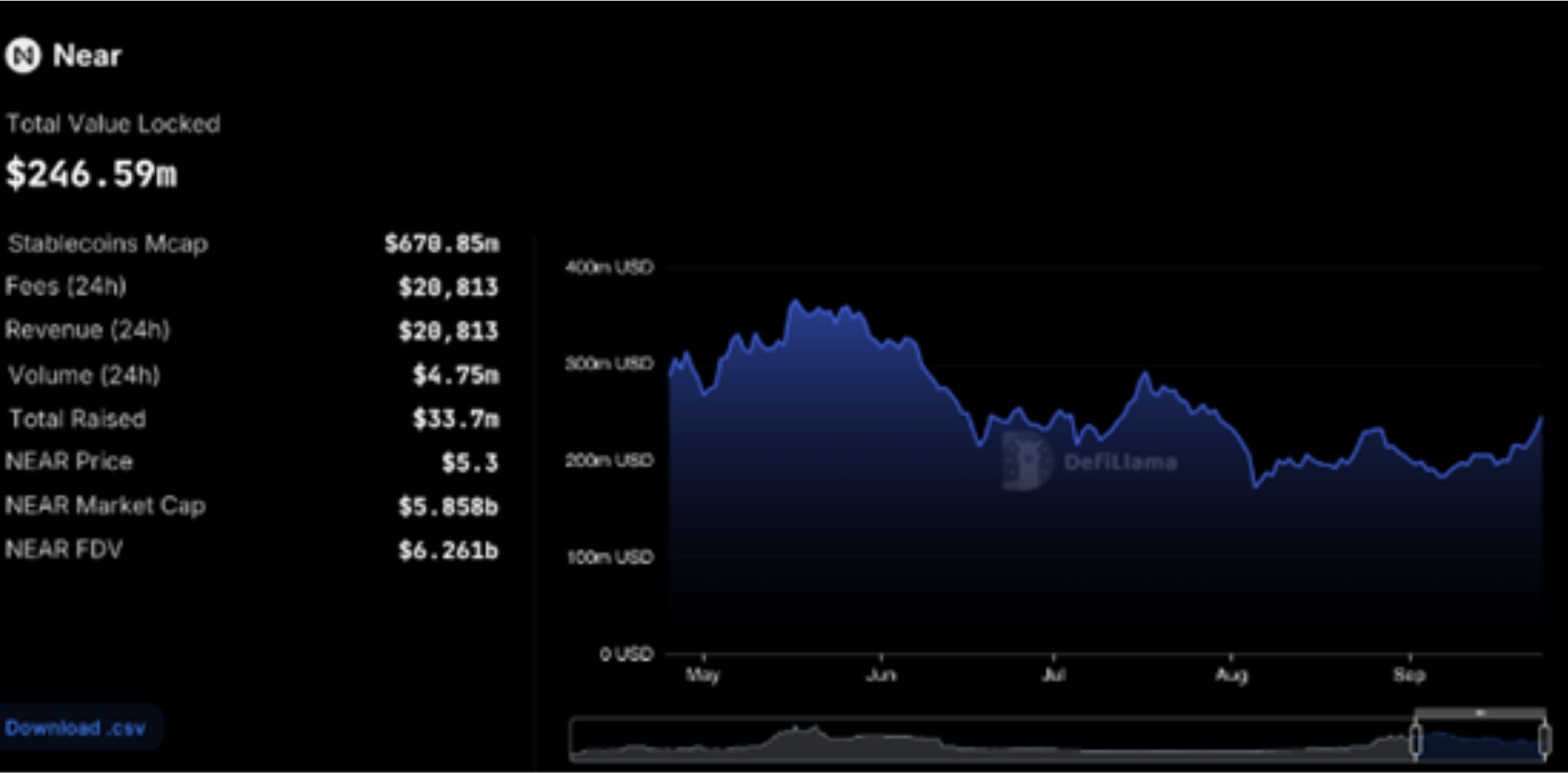

The next graph shows the increase in NEAR’s TVL, according to DefiLlama.

The rise in TVL shows growing interest and activity in the network. Thus, more users are utilizing the assets within the NEAR ecosystem than before.

Rising futures open interest

Data on Coinglass shows that there has been an increase in traders’ interest in NEAR futures.

For instance, open interest in NEAR futures contracts has risen from $114.9 million on September 6 to $279.2 million on September 24.

Incidentally, that was the highest OI rise since June 7. Such a development shows a rise in buying activity and a surge in capital entering the market.

NEAR price analysis

The NEAR price action is showing a strong market position. First, on September 23, the NEAR price broke above a descending trendline.

In addition, the token value has also risen above several key moving averages such as the 200-day EMA (exponential moving average) at $4.87, the 100-day EMA at $4.75 and the 50-day EMA at $4.40.

For a long time, the above EMAs were acting as strong dynamic resistance levels.

In addition, NEAR’s RSI (relative strength index) also shows that the cryptocurrency is bullish. This is because it has a reading of 70.

As a fact, if the RSI is above 50 and it is rising, it is a bullish indication. On the other hand, when an RSI reading is below 50 and is falling, it is a bearish signal.

Also, the current NEAR price prediction shows that its value may rise during the rest of September.

In fact, according to Changelly, the price of NEAR is likely to keep increasing until October. For example, its value may reach $7.74 by October 1.

This content is sponsored and should be regarded as promotional material. Opinions and statements expressed herein are those of the author and do not reflect the opinions of The Daily Hodl. The Daily Hodl is not a subsidiary of or owned by any ICOs, blockchain startups or companies that advertise on our platform. Investors should do their due diligence before making any high-risk investments in any ICOs, blockchain startups or cryptocurrencies. Please be advised that your investments are at your own risk, and any losses you may incur are your responsibility.

Follow Us on Twitter Facebook Telegram

Source link

Press Release

https://dailyhodl.com/2024/12/10/near-price-analysis-factors-behind-its-57-rally/

2024-12-10 18:55:55