Solana’s price has faced significant volatility recently, dipping to a multi-week low as investor sentiment continues to falter.

Despite the initial bullish momentum earlier in the year, Solana (SOL) now faces a decline in market confidence, with recent data highlighting a notable decrease in user activity and funding rates.

Solana Enthusiasts Are Concerned

The funding rate for Solana has dropped by 81% over the last 48 hours, a sign of deteriorating bullish sentiment. A positive funding rate typically indicates that long positions dominate the market, signaling optimism among traders. However, as the rate continues to decline, it reflects growing concerns, with short contracts gaining traction as traders anticipate further price declines.

Though the funding rate for SOL remains positive, the rapid decline is noteworthy. Traders are increasingly hedging against potential downside risk, which suggests that the market’s short-term outlook is bearish. This shift toward shorting could signal a weakening of confidence in Solana’s ability to maintain its price levels, creating uncertainty for its future price trajectory.

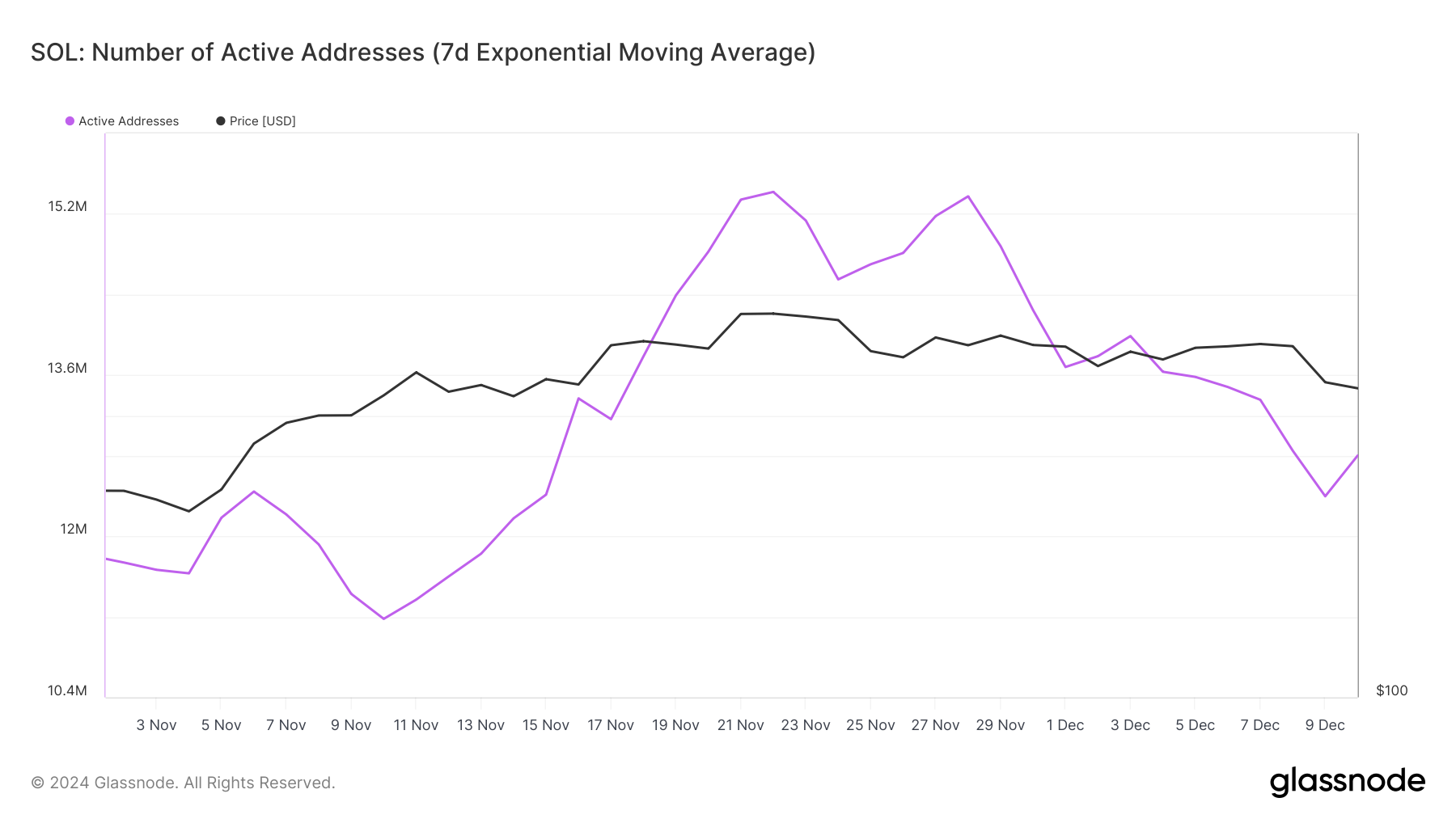

Solana’s active addresses, a key indicator of user engagement, have dropped to the lowest point in December, further reinforcing concerns about waning interest. Lower activity levels often correlate with reduced liquidity, which can exacerbate price volatility and hinder further adoption. This decline in active addresses raises red flags for traders and investors, signaling that Solana may struggle to attract the level of demand it once had.

This drop in user activity could further undermine Solana’s position in the market. When fewer addresses engage with the network, it weakens the overall market perception and diminishes the asset’s appeal to potential investors. Without a revival in user activity, Solana could see continued pressure on its price.

SOL Price Prediction: Breaching Resistance

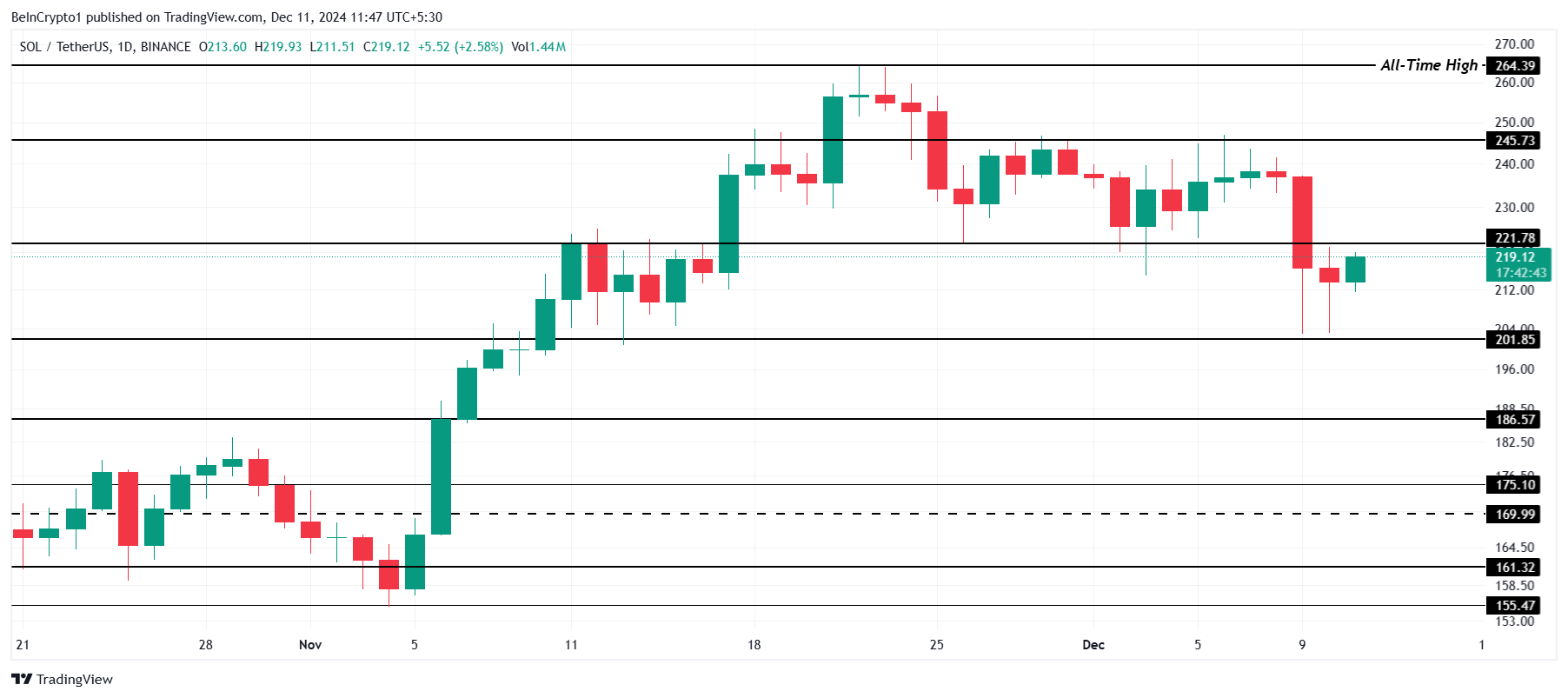

Solana’s price is currently trading at $219, and it is attempting to flip the resistance of $221 into support.

If Solana fails to secure $221, the price could experience a setback, slipping toward consolidation above $201. The failure to maintain this critical support level could signal a broader market weakness and cause further hesitation among investors, ultimately limiting SOL’s potential for a near-term breakout.

A successful breach of $221 could propel Solana’s price toward $245. This would invalidate the bearish outlook, suggesting a stronger market sentiment and driving the asset closer to its all-time high of $264. A sustained move above $221 is crucial for SOL to regain upward momentum and challenge previous price records.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Aaryamann Shrivastava

https://beincrypto.com/solana-funding-rate-falls-with-price/

2024-12-11 08:00:06