Ripple (XRP) faces the risk of falling below $2 after a 12% decline in the past week. This potential drop is highlighted by technical indicators identified in recent XRP analysis, pointing to mounting bearish pressure.

Some days back, XRP climbed to a yearly high of $2.73, sparking speculation of a return to $3. But that prediction could be delayed, and here is why.

Ripple Loses Hold on the Upside

The Relative Strength Index (RSI), which measures momentum, is one indicator suggesting that XRP’s price could decline. The RSI also shows if an asset is overbought or oversold. When the reading is above 70.00, it is overbought, and when it is below 30.00, it is oversold.

On December 2, the RSI on the XRP/USD daily chart hit 96.25, indicating that it was overbought. This also coincided with a local top for the token.

As of this writing, this XRP price analysis shows that the reading has dropped below the 50.00 neutral region, indicating that momentum around it is now bearish. With trading volume also decreasing, XRP might likely keep dropping below $2.34 in the short term.

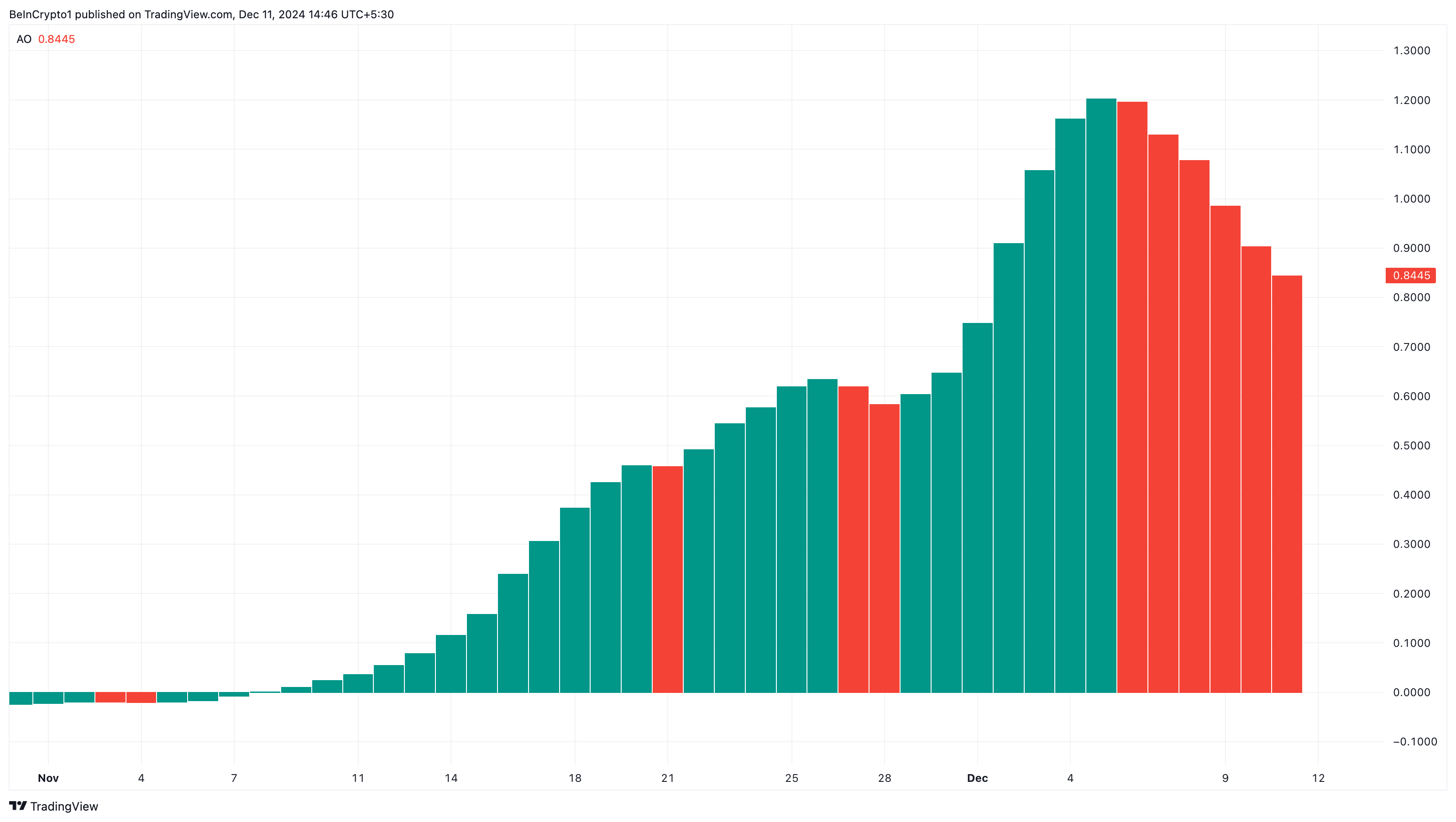

Beyond the RSI, the Awesome Oscillator (AO) is another indicator suggesting that XRP might slip below the current threshold. The AO is a momentum indicator that compares recent market movements to historical trends.

It uses a zero line at the center, with price movements plotted on either side based on comparing two different moving averages to check whether the momentum is bullish or bearish. When the AO is positive, the momentum is bullish and bearish when the indicator’s reading is negative.

At press time, the AO is positive. However, the indicator has flashed red histogram bars, suggesting that the bullish momentum around the altcoin is fading.

XRP Price Prediction: Lower Lows

On the 4-hour chart, XRP has formed a head-and-shoulders pattern. This pattern is a classic bullish-to-bearish reversal formation. It consists of three peaks: a left shoulder, followed by a higher peak (the head), and then a lower peak (the right shoulder).

A “neckline” is drawn by connecting the lowest points of the two troughs. The slope of the neckline can be either upward or downward. However, a downward slope typically indicates a more reliable reversal.

As seen below, XRP’s price has dropped below the neckline at $2.40, which indicates weak buying. Should bulls fail to reverse this trend, then the token risks declining to $1.87. However, if buying pressure increases, XRP might climb to $2.90.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Victor Olanrewaju

https://beincrypto.com/xrp-bullish-momentum-fades/

2024-12-11 12:00:00