In brief

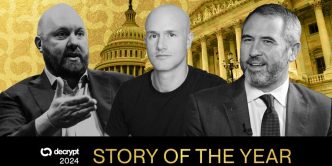

- Crypto lobbying efforts led by Coinbase, Ripple, and Andreessen Horowitz changed the political landscape in 2024.

- The plan worked, but it also set a risky precedent.

- The story of how it happened, and what it means for crypto and beyond, is Decrypt’s 2024 Story of the Year.

It was December 2022, FTX had just collapsed into a $32 billion dollar cloud of vapor, Sam Bankman-Fried was adjusting to life in the sick bay of a Bahamian prison, and Coinbase Chief Policy Officer Faryar Shirzad was feeling cautiously optimistic.

Shirzad was a battle-tested D.C. insider with decades of experience navigating the inner sanctums of Congress and the White House. As the steward of Coinbase’s reputation on Capitol Hill, there was certainly plenty about the implosion of fellow crypto exchange FTX to cause him concern—but at the time, Shirzad’s instincts led him to believe the scandal could be productive.

“It seemed like, for all the terrible aspects of the FTX debacle, it would have engendered something we thought was long overdue: a clear federal framework around the trading of crypto assets,” Shirzad told Decrypt.

Misconduct in other industries had been known to bring about legislative reform in Washington. Companies like Coinbase were itching for a crypto regulatory framework, and would have welcomed new laws designed to root out future FTXs and reward their compliant competitors.

We were dealing with a political problem. And to deal with that political problem, we needed a political solution.

But such laws never came. Over the next six months, instead, most politicians distanced themselves from the industry, considering it politically toxic. Meanwhile, a select number of progressive lawmakers seized on FTX’s demise as proof of crypto’s inherently criminal nature.

Votes on digital assets legislation, just months ago on the precipice, were now non-starters.

It took until mid-2023 for crypto policy leaders like Shirzad to realize just how drastically the ground had shifted under their feet. Persistent efforts to sway lawmakers kept hitting walls. Crypto’s existing lobbying tactics were now impotent.

“We began to realize that for all of our efforts, it didn’t matter,” Shirzad said.

“We were dealing with a political problem,” he said. “And to deal with that political problem, we needed a political solution.”

That solution would turn out to be the implementation of a corporate political spending strategy never before seen in American history—one that would cost some $300 million; that would, within barely more than a year, reverse the crypto industry’s fortunes entirely; and that some experts believe has paved the way for already-influential corporations to wield unprecedented control over the American political process.

“Go big or go home”

By the fall of 2023, the leaders of America’s wealthiest crypto companies had decided that, despite differing political views, they had no choice but to band together and do something bold to protect their young industry from extinction. Policy experts at these companies led the charge, convincing their bosses that a crypto super PAC could be the path forward—despite the many risks posed by such a strategy.

Super PACs were still a relatively new political instrument. Birthed by a 2010 U.S. Supreme Court ruling, they allowed individuals and corporations to donate unlimited sums of money to aid political candidates—so long as that money wasn’t touched by campaigns directly.

The innovation upended American campaign finance the moment it was legalized. Political organizations like AIPAC, the pro-Israel lobbying group, seized on super PACs as a means to reshape congressional races with unparalleled sums of cash.

Ideologically driven billionaires also became particularly infatuated with super PACs. Hye Young You, a Princeton professor specializing in the history of campaign finance in the United States, told Decrypt that sponsoring general pro-Democrat or pro-Republican super PACs emerged “almost as a political hobby” among America’s wealthiest elite between 2010 and 2022.

During that entire period, however, super PACs were all-but avoided by corporations.

Why? PACs carried an anti-democratic stigma and were associated with partisanship—an alienating force that could turn off some portion of a corporation’s customer base. So America’s top industries largely wrote them off, You said, as more trouble than they were worth.

“It’s quite remarkable how little corporations and industry sponsored particular super PACs,” she said. “Until this election.”

That such a strategy was not only untested but also risky wasn’t lost on the leaders of the three major corporations who debated supporting a crypto super PAC in the fall of 2023: America’s leading crypto exchange Coinbase, crypto payments company Ripple, and the Silicon Valley venture capital giant Andreessen Horowitz.

What if the crypto industry took shots at major political players and missed? What if getting overtly political turned out to be brand suicide?

Those concerns were mitigated by the digital asset industry’s increasingly perilous position in late 2023. The SEC was coming at all manner of crypto projects with full force. Any shot at change seemed less risky than doing nothing.

“We’d invested $150 million in defending against litigation from the SEC,” Stuart Alderoty, Ripple’s chief legal officer, told Decrypt. “So we certainly knew that not getting policy right was an expensive endeavor.”

“It was go big or go home,” he said.

So the leaders of Ripple, Coinbase, and Andreessen Horowitz decided to go big. Unprecedentedly big.

It was certainly a lot of money by anyone’s measure. But given the alternative, it seemed like a rational decision to make.

They got in touch with the operators of Fairshake, a newly created crypto super PAC that didn’t have much in the way of funding or reputation, but already existed. After vetting Fairshake’s leadership, which was relatively inexperienced compared to that of other top super PACs, it was decided that the plan could work—so long as everyone involved agreed on several fundamental questions that would prove crucial to the road ahead.

If Ripple, Coinbase, and Andreessen Horowitz gifted Fairshake a massive war chest, would they all have the stomach to go after powerful incumbent lawmakers? The answer, after some discomfort, was yes. Could they all agree on a bipartisan slate of candidates, to ensure the durability of their coalition? Yes again. What if that meant abandoning Republicans, who had been good to the industry, in the name of supporting pro-crypto Democrats?

More discomfort ensued—but ultimately, sure. Whatever it took.

In September 2023, Coinbase CEO Brian Armstrong donated $1 million to Fairshake. The next month, Marc Andreessen and Ben Horowitz gave $2.5 million apiece. In November, Coinbase donated $5 million. By Christmas, Andreessen and Horowitz gifted another $14 million; Coinbase, another $15.5 million. Ripple matched both firms by throwing $20 million into the pot.

“It was certainly a lot of money by anyone’s measure,” Ripple’s Alderoty said. “But given the alternative, it seemed like a rational decision to make.”

By the start of 2024, Fairshake had amassed nearly $85 million, obliterating the previous record held by a corporate group for super PAC fundraising: the National Association of Realtors’ comparatively meager $18 million fundraise in 2022.

By the eve of 2024’s presidential election, Fairshake and its affiliate PACs would raise nearly $300 million.

The “crypto voter” and the “corporate money death star”

The players involved disagree on where the story goes from here. What is known for certain is that when 2024 kicked off, the vast majority of Democratic lawmakers were generally opposed to crypto’s lobbying efforts, and while some Republicans were supportive, most were ambivalent.

By May, crypto was a firmly ascendant cause across the political spectrum.

Leaders of the crypto policy movement are emphatic that this sea change was primarily thanks to a grassroots campaign, instigated by Coinbase, to activate the so-called crypto voter and show lawmakers how many millions of Americans were willing to support—or oppose—candidates based on their crypto stances.

Fairshake’s spending history tells another story. In February, the super PAC deployed over $10 million in a successful bid to defeat Rep. Katie Porter (D-CA), a candidate for California’s open U.S. Senate seat.

They unloaded on her. That struck fear into the hearts of candidates.

This initial flex of Fairshake’s financial muscle was significant for several reasons. For one, it was seismic in scale: this single spend on anti-Porter ads dwarfed the candidate’s own positive ad spend by a factor of 20:1, according to Open Secrets.

Secondly, Porter wasn’t even particularly anti-crypto; she rarely if ever spoke on the subject. She was, however, something of a protégé of Sen. Elizabeth Warren (D-MA), a staunch crypto critic. The association with Warren, apparently, was enough to trigger the crypto industry’s nuclear spending.

“Porter was not exactly crusading against crypto, and yet they unloaded on her,” Rick Claypool, a research director at Public Citizen, a consumer advocacy nonprofit, told Decrypt. “That struck fear into the hearts of candidates.”

In the spring, a handful of key crypto-related votes came before Congress: a vote in the House on FIT21, a potential crypto market regulatory framework, and a vote in both chambers on the repeal of SAB 121, an SEC rule that discouraged banks from holding crypto.

While both bills would have had a tangible impact on crypto if signed into law, their consideration in May arguably served a more important purpose: acting as a litmus test for lawmakers regarding their stances on digital assets.

Months prior, Fairshake had signaled its intention to spend heavily in the general election. Those tens of millions of dollars, crucially, had yet to be committed for or against any general election candidates when FIT21 and SAB 121 came before Congress.

During those spring votes, Fairshake’s war chest hung in the air over Capitol Hill “like a corporate money Death Star,” Public Citizen’s Claypool said.

The results were dramatic: 71 House Democrats, including Nancy Pelosi, broke with President Joe Biden to pass FIT21. Twelve Senate Democrats, including then-Senate Majority Leader Chuck Schumer, defied Biden to pass a repeal of SAB 121. (The president subsequently vetoed the resolution.)

Democrats facing battleground elections in 2024 demonstrated significant changes in tune. Rep. Elissa Slotkin (D-MI), for example, was running for a hotly contested U.S. Senate seat in Michigan at the time; she held an “F” rating on Coinbase’s “Stand With Crypto” watchdog site a month prior to the FIT21 and SAB 121 votes.

She then supported both initiatives in late May. In short order, her Stand With Crypto rating was upgraded to an “A.”

In September, Fairshake opted to throw millions of dollars behind Slotkin and against her opponent, a Republican who had vocally supported crypto for years. Slotkin ultimately won Michigan’s Senate race by a margin of less than 0.34%.

Most crypto industry leaders involved in Fairshake’s operations see the conversion of politicians like Slotkin as proof of crypto’s salience among the American public.

“I think once that became crystallized for Democrats, it made it a much more clear choice,” Josh Vlasto, a spokesperson and strategic advisor for Fairshake, told Decrypt. “‘We can move and embrace the technology that our constituents clearly support and clearly engage with.’”

But in an election year defined by hot-button issues like inflation, immigration, reproductive rights, and Israel’s war in Gaza, it’s not clear that crypto ranked as a high priority for any meaningful group of voters. Mike Rogers, Slotkin’s Republican opponent, previously told Decrypt that despite his strong support of the industry, crypto almost never came up on the campaign trail in Michigan in 2024.

Some say crypto’s lack of grassroots strength was revealed by Fairshake itself in the super PAC’s ad buys. Fairshake and its affiliates spent over $133 million across 68 congressional races in 2024; of that record-shattering spend, almost none was used to purchase ads that mentioned crypto whatsoever.

Decrypt could not find proof of a single general election ad purchased by Fairshake that mentioned crypto or digital assets; the super PAC did not provide evidence of any such ads when asked multiple times.

Fairshake general election ads seen by Decrypt instead referenced issues including border security and crime, the cost of living, and infrastructure.

“It makes me wonder,” Public Citizen’s Rick Claypool said. “If they were so sure that all they had to do was mobilize the crypto masses, then why wasn’t that the story they were telling in the actual campaigns they put in front of voters?”

Fairshake’s Josh Vlasto pushed back on that conclusion. While he conceded that the overwhelming majority of ads bought by the PAC did not discuss crypto, Vlasto asserted it is common practice for special interest groups to run ads unrelated to their stated mission.

“It’s proof of effectiveness,” he said. “If you’re going to invest significant resources and support candidates that you believe in, do it in a way that helps them win the race.”

Crypto’s dream scenario

In the build-up to November, things were looking good for Fairshake—or as good as they reasonably could be in an election that was poised to come down to the thinnest of margins up and down the ballot.

For one, virtually all battleground congressional candidates appeared on board with the industry’s agenda. For another, Fairshake had endorsed a firmly bipartisan slate of Democratic and Republican candidates in the general election, and while that move certainly ruffled feathers and prompted defections, it did not cause any major rifts among the super PAC’s inner circle of megadonors.

And despite the fact that Fairshake had (likely wisely) opted to stay out of the extremely polarized presidential race, both Donald Trump, and, to a lesser extent, Kamala Harris, voiced support for crypto-related initiatives prior to Election Day.

And yet, nothing could have prepared anyone—including Fairshake’s own operators—for the super PAC’s astounding conquest on November 5.

Not only did Fairshake get its most prized “scalp” by defeating the crypto-skeptical chair of the Senate Banking Committee, Sen. Sherrod Brown (D-OH), with a pulverizing $40 million ad blitz—the PAC also saw almost every single one of its general election candidates win across the board.

Whether Democrat or Republican, rural representative or big-city senator, the clearest data-driven throughline to election night was that if you were backed by Fairshake, you probably got elected.

Add to that remarkable outcome the fact that Donald Trump won re-election after going all in on crypto—and the pledges made by incoming Republican majorities in the House and Senate to immediately pass digital assets legislation—and you get a dream scenario for the industry that would have sounded delusional even a year ago.

Gone in an instant were any theoretical regrets among Fairshake’s megadonors about political blowback or spending too lavishly on elections.

Viewed as investments, the hefty spends of Fairshake’s key donors have already reaped incredible rewards. Ripple, for example, spent $63 million on the 2024 election, according to Open Secrets. The company’s escrowed stash of XRP, a cryptocurrency its founders helped develop, has increased in value by more than $100 billion since election day.

By all accounts, the prospects for crypto’s regulatory fate in the United States appear rosier than ever. A broader view of the potential impact of Fairshake’s tactics beyond crypto, however, looks more grim.

Public Citizen’s Rick Claypool says he expects to see other corporate sectors attempt to replicate Fairshake’s strategy after the super PAC demonstrated such a substantial return on investment for donors. Those moves, he said, could easily dwarf crypto’s in size and impact—and pose a major problem for democracy.

“All things considered, crypto is not huge,” he said. “If you have other sectors or multiple sectors playing the same types of election games, pooling money to win a favorable Congress, it makes it that much harder for issues that people care about, but don’t align with a particular industry’s profit motive, to get through.”

Fairshake’s Josh Vlasto took issue with the notion that money was purely to thank for the super PAC’s successes. He maintained that his team’s thoughtful and focused strategy was just as crucial to their victories.

“It’s not just money,” Vlasto said. “It’s not.”

Princeton’s Hye Young You, meanwhile, felt conflicted about the potential implications of crypto’s historic triumph in 2024.

“On one hand, the sheer amount of money and the way it might bias policy outcomes is worrisome,” she said.

On the other hand, You monitors a lot of PACs in her job, and couldn’t help but feel particularly invested in Fairshake. After all, she owns some Bitcoin.

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Source link

Sander Lutz

https://decrypt.co/295639/2024-story-of-the-year-crypto-money-politics

2024-12-11 16:29:24