HBAR, the native cryptocurrency of the Hedera Hashgraph network, has surged by 8% in the past 24 hours. This rebound follows a few days of decline after the altcoin reached a three-year high of $0.39 on December 3.

However, HBAR’s 8% surge over the past 24 hours merely mirrors the broader market rally. The bearish bias against it remains significant, putting it at risk of resuming its downward trend. This analysis explores the reasons behind it.

Hedera Bears Take Control

The Hedera token price price has noted an 8% uptick in the past 24 hours, while its trading volume has plummeted by 21%. Rising prices with declining volume are generally interpreted as bearish divergence — a potential sign to be cautious about the continuation of the uptrend.

This pattern indicates that speculative buying, rather than genuine demand, is driving the price increase, making it less likely to hold.

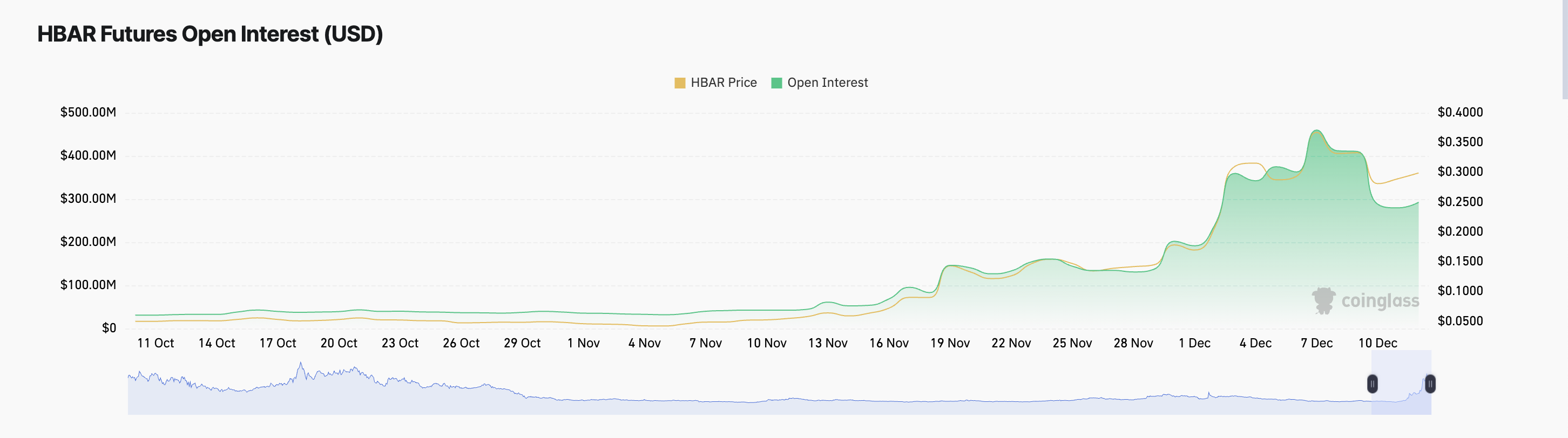

The low activity around HBAR is evidenced by the plummeting open interest in its derivatives market. At press time, this stands at $292 million, having dropped 38% over the past five days. A decline in open interest indicates that fewer contracts are being traded or held, often suggesting reduced market participation or waning investor confidence in the asset.

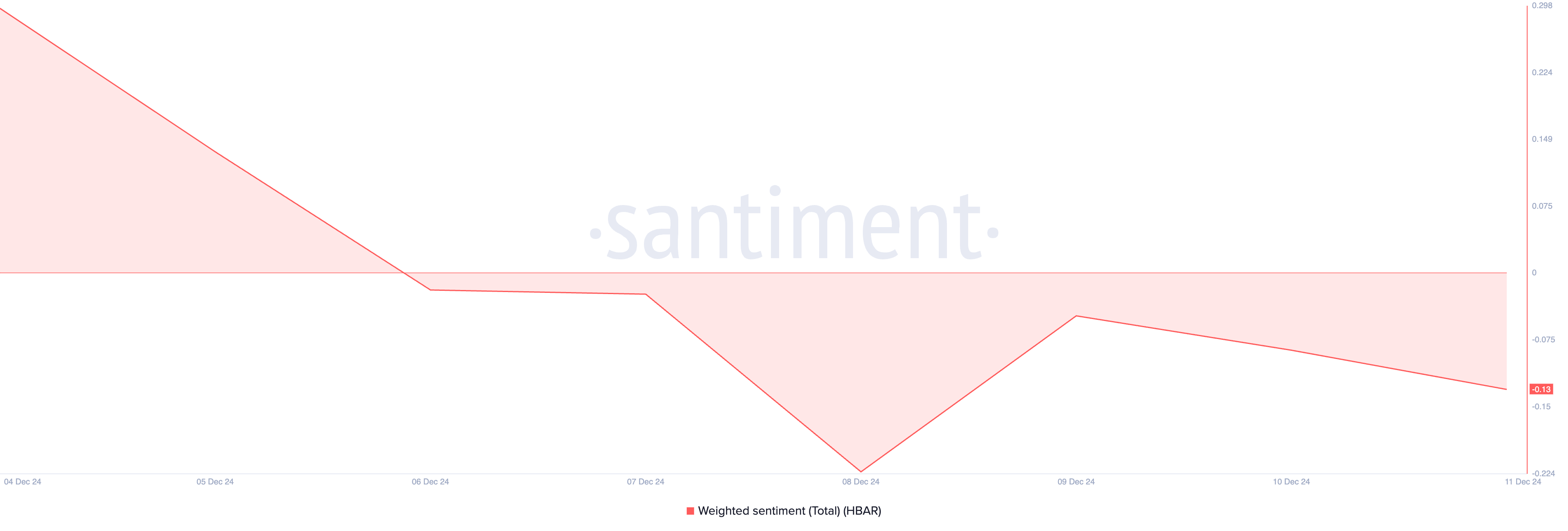

Moreover, the general market’s sentiment toward HBAR remains bearish, as reflected by its negative weighted sentiment metric. According to Santiment, the metric has shown only negative values since HBAR’s decline from its three-year high on December 4. As of this writing, it stands at -0.13.

This on-chain metric measures the overall sentiment of social media mentions about an asset, considering both the volume and polarity of the comments. A negative weighted sentiment indicates that most social media mentions are negative, suggesting a bearish sentiment towards the asset.

HBAR Price Prediction: Key Resistance to Breach

On the HBAR/USD one-day chart, the Awesome Oscillator supports a bearish outlook, with the past five days showing only red histogram bars. This indicator assesses market momentum, and red bars signal declining momentum, pointing to weakening bullish trends or increasing bearish pressure.

Currently trading at $0.30, HBAR could drop to $0.25 if bearish pressure intensifies.

On the other hand, if market sentiment shifts from bearish to bullish, the Hedera token price may breach the resistance at $0.31 and attempt to reclaim its three-year high of $0.39.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Abiodun Oladokun

https://beincrypto.com/hedera-price-stumbles/

2024-12-12 09:17:40