Aave (AAVE) price has surged to its highest level since September 2021, following a 30% increase in the last 24 hours. The decentralized finance (DeFi) token has seen a sharp spike in activity, with AAVE whale accumulation injecting fresh liquidity into the cryptocurrency.

Can AAVE sustain this momentum as the DeFi market regains traction? This on-chain analysis examines the possibility.

Aave Stakeholders Bring Dormant Tokens Back to Life

At the start of the year, AAVE traded below $100. However, with a nearly 300% surge, the token has skyrocketed to $350, marking its highest level in over three years. This impressive rally has rekindled interest in DeFi tokens, with Curve (CRV) notably outperforming other altcoins recently.

According to Santiment, the Mean Dollar Invested Age (MDIA) is one reason AAVE’s price has increased. The MDIA measures the average age of all tokens on a blockchain, which is weighted by the average purchase price.

When MDIA rises, it indicates that the majority of cryptocurrency holders are keeping their assets dormant in their wallets, which can hinder price growth. Conversely, a declining MDIA signals that previously stagnant tokens are re-entering circulation, often pointing to increased market activity and potential price acceleration.

As seen above, on-chain data shows that AAVE’s MDIA has significantly fallen. If sustained, this could take the altcoin’s price well above $400 if key stakeholders like crypto whales continue to move from lingering dormancy to active trading.

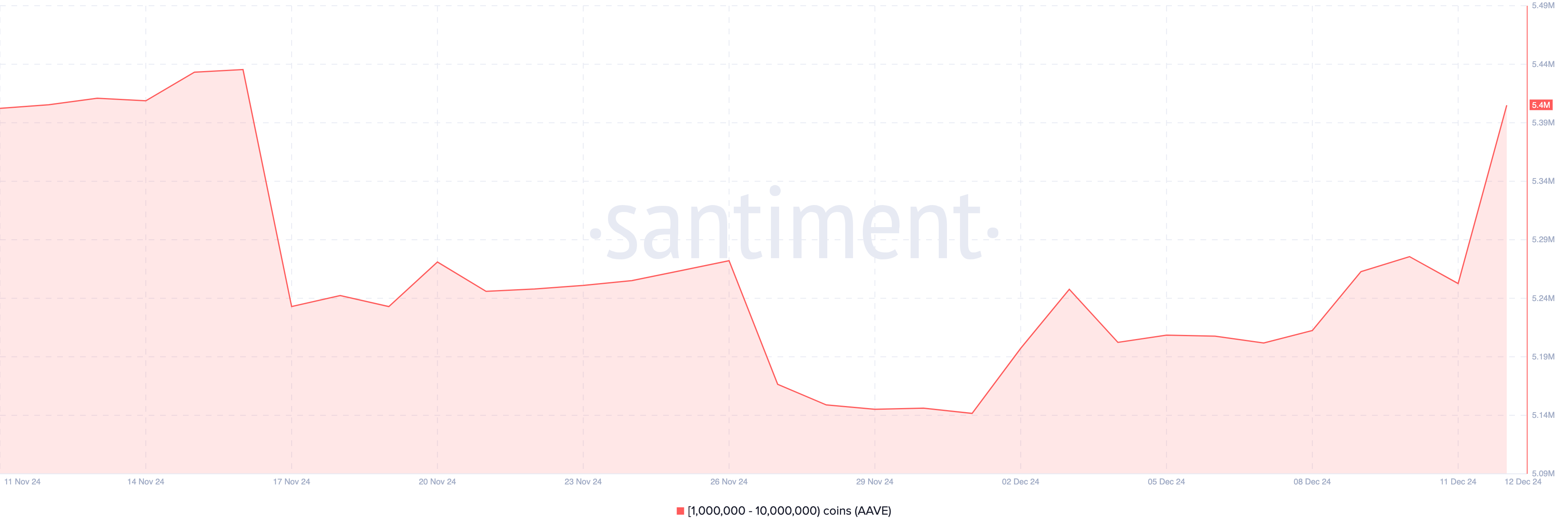

Furthermore, a look at the AAVE balance of addresses shows that crypto whales have not stopped buying the altcoin. On December 1, the balance held in the wallet of AAVE addresses who own between 1 million and 10 million tokens and $5.14 million.

Today, the figure has increased to 5.40 million, indicating that crypto whales purchased a total of 260,000 tokens within the last 11 days.

At its current price, the token is worth $92.30 million, indicating significant buying pressure. Should this AAVE whale accumulation, the notion mentioned above that the AAVE’s value could surpass $400 might come to pass.

AAVE Price Prediction: It’s the Season to Hit $420

On the daily chart, AAVE’s price is trading higher than the Ichimoku Cloud position. The Ichimoku Cloud is a versatile technical indicator that offers traders a clear visualization of support and resistance levels.

Typically, When a cryptocurrency’s price is above the cloud, it signals strong support for an uptrend. Conversely, if the cloud is above the price, it indicates resistance that could push the price lower.

Since it is the former, it means that the value of AAVE could continue climbing with possible targets at $420. However, if whale accumulation slows, this bullish momentum might falter, potentially causing the DeFi token to decline to $260.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Victor Olanrewaju

https://beincrypto.com/aave-whale-accumulation-leads-revival/

2024-12-12 19:30:00