In a recent report, BlackRock analysts suggested that Bitcoin should comprise 1% to 2% of traditional 60/40 investment portfolios.

This marks a shift from mainstream investors’ previous exclusion of the cryptocurrency.

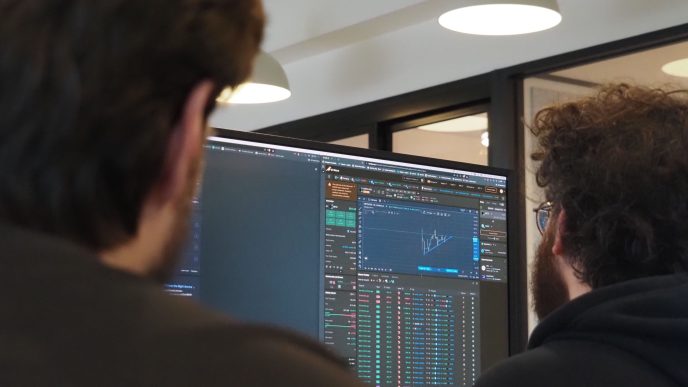

BlackRock’s Bitcoin ETF is Driving Institutional Adoption

BlackRock’s latest report offers guidance for investors willing to accept Bitcoin’s risks, outlining strategies for allocating to the cryptocurrency amidst its continued rise.

Factors such as President-elect Donald Trump’s supportive stance on crypto and his pro-crypto nominations for key government roles have fueled this year’s rally. Bitcoin’s recent $100,000 milestone was a psychological trigger for more institutional investors to engage with the largest cryptocurrency.

This was reflected in the ETF market, as Bitcoin ETFs, including BlackRock’s iShares Bitcoin Trust (IBIT), have attracted billions in investments during this surge.

“New report from BlackRock today that recommends 1-2% exposure to Bitcoin ETF, first time they gave specific number. They put this out because they had so much incoming on this question of how much?,” ETF analyst Eric Balchunas wrote on X (formerly Twitter)

Despite the gains, Bitcoin’s history of volatility remains a concern. BlackRock’s paper emphasizes a “risk budgeting” approach, urging investors to weigh potential rewards against inherent risks.

Bitcoin’s infamous price swings have led to drawdowns of up to 80% since its inception in 2009, even as it has surged 140% this year.

The cryptocurrency’s recent decoupling from traditional asset classes, such as technology stocks, is notable. BlackRock attributes this divergence to factors like increasing geopolitical tensions, global financial fragmentation, and eroding trust in banks.

The introduction of US spot Bitcoin ETFs in January was a major catalyst for Bitcoin’s recent climb. Assets under management in these funds have surpassed $113 billion, with nearly $10 billion invested since Trump’s election win in November.

Also, Weekly inflows remain extremely positive, with over $2.7 billion in the first week of December alone. BlackRock’s IBIT leads these inflows, significantly outpacing competitors.

Combined, the 12 U.S. Bitcoin ETFs now hold more than 1.1 million BTC, exceeding the estimated holdings of Bitcoin’s creator, Satoshi Nakamoto. BlackRock’s IBIT also holds higher assets under management than all regional European ETFs combined.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Mohammad Shahid

https://beincrypto.com/blackrock-bitcoin-portfolio-allocation/

2024-12-12 22:06:34