Despite showing a glimpse of moving higher, Solana (SOL) has once again failed to climb to the $300 mark. The inability to rise to this milestone could be linked to the dominance of Solana sellers, who have outpaced the buyers.

With bears leading the way, this analysis checks if SOL could escape another downturn or not.

Solana Bearish Momentum Prevails

On the daily SOL/USD chart, BeInCrypto observed a drop in the Balance of Power (BoP) indicator into the negative zone. The BoP, a price-based technical indicator, assesses the strength and dominance of buyers versus sellers, offering traders valuable insights into market control dynamics and potential trend shifts.

A positive BoP value suggests that buyers hold the upper hand, suggesting a likely price increase. Conversely, a negative BoP reading implies that sellers are in control, increasing the risk of a price decline.

At press time, the BoP was at -0.54, highlighting the strong dominance of Solana sellers and indicating potential bearish momentum for Solana’s price.

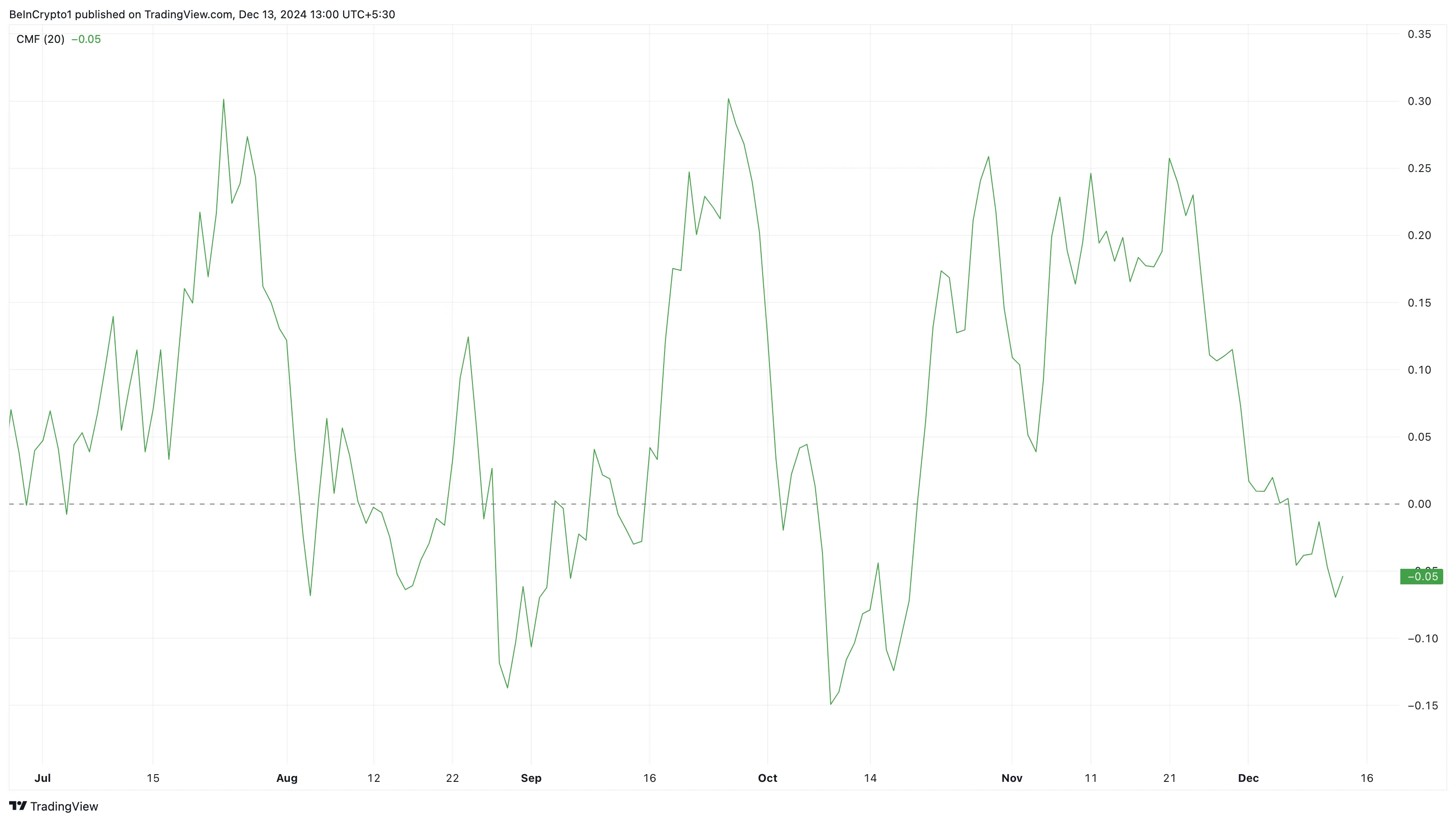

Another indicator suggesting a potential decline in SOL price is the Chaikin Money Flow (CMF). The CMF is a technical indicator that measures the flow of liquidity into or out of a cryptocurrency.

By employing the price and volume data, the indicator identifies periods of accumulation (buying pressure) and distribution (selling pressure). Positive CMF values indicate strong accumulation, suggesting upward momentum, while negative values reflect distribution and potential bearish trends.

As of this writing, the CMF on the Solana daily chart has dropped to the negative region. At -0.05, the current rating reinforces the notion that Solana sellers have kept bulls at bay. If this trend continues, then SOL price might continue to decline.

SOL Price Prediction: Support Broken, Downturn Continues

Based on the daily chart, Solana’s price has been trading within a descending channel since it reached a new all-time high on November 22. Notably, the image below shows that the altcoin’s value has slipped below the support at $225.74.

The downturn below this support suggests that the SOL price risks another significant correction. If validated, the token could slide to $203.63 as long as Solana sellers continue to remain in control.

On the flip side, if buyers take over, this forecast might not come to pass. In that scenario, the cryptocurrency’s value could rise to $264.66. In a highly bullish scenario, the altcoin could eventually break out to $300.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Victor Olanrewaju

https://beincrypto.com/solana-sellers-dictate-price-movement/

2024-12-13 08:30:07