Michael Saylor, co-founder of MicroStrategy, has sparked speculation about another major Bitcoin acquisition.

This follows the company’s recent inclusion in the Nasdaq-100 Index, a significant milestone that highlights its growing influence in the tech and financial sectors.

MicroStrategy Eyes Bitcoin Acquisition

On December 15, Saylor cryptically questioned whether the SaylorTracker, a portfolio tracker highlighting each Bitcoin acquisition by the company, was missing a green marker. These markers have traditionally signified new Bitcoin purchases, prompting speculation in the crypto community about an imminent acquisition.

Over the past five weeks, Saylor has dropped subtle hints on social media about Bitcoin purchases, followed by official announcements of large-scale acquisitions by the subsequent Monday. During this period, MicroStrategy expanded its Bitcoin holdings to over 171,000 BTC, investing over $15 billion.

If a new acquisition is confirmed, it would mark MicroStrategy’s first Bitcoin purchase since its inclusion in the Nasdaq-100 Index on December 13. Analysts view this inclusion as a potential precursor to the company’s entry into the S&P 500, which tracks the performance of the 500 largest companies in the U.S.

James Van Straten of CoinDesk noted that the only remaining criterion for MicroStrategy’s S&P 500 entry is achieving positive earnings over the past four quarters.

“On a theoretical basis, once FASB is implemented in Q1 2025 and with a BTC price of $120,000 and no increase to their BTC holdings, MSTR will have $25 billion of net income. MSTR could be included as early as Q2 2025,” Van Straten predicted.

Marathon Digital Targets Nasdaq-100 Entry

While MicroStrategy cements its position, Marathon Digital Holdings is working to follow suit. Saylor has tipped Marathon as the next likely Bitcoin-focused firm to secure a Nasdaq-100 spot. In a December 14 post, he responded to Marathon CEO Fred Thiel’s congratulatory message, expressing confidence in the company’s upward trajectory.

“Thanks Fred. I expect MARA will be the next,” Saylor stated.

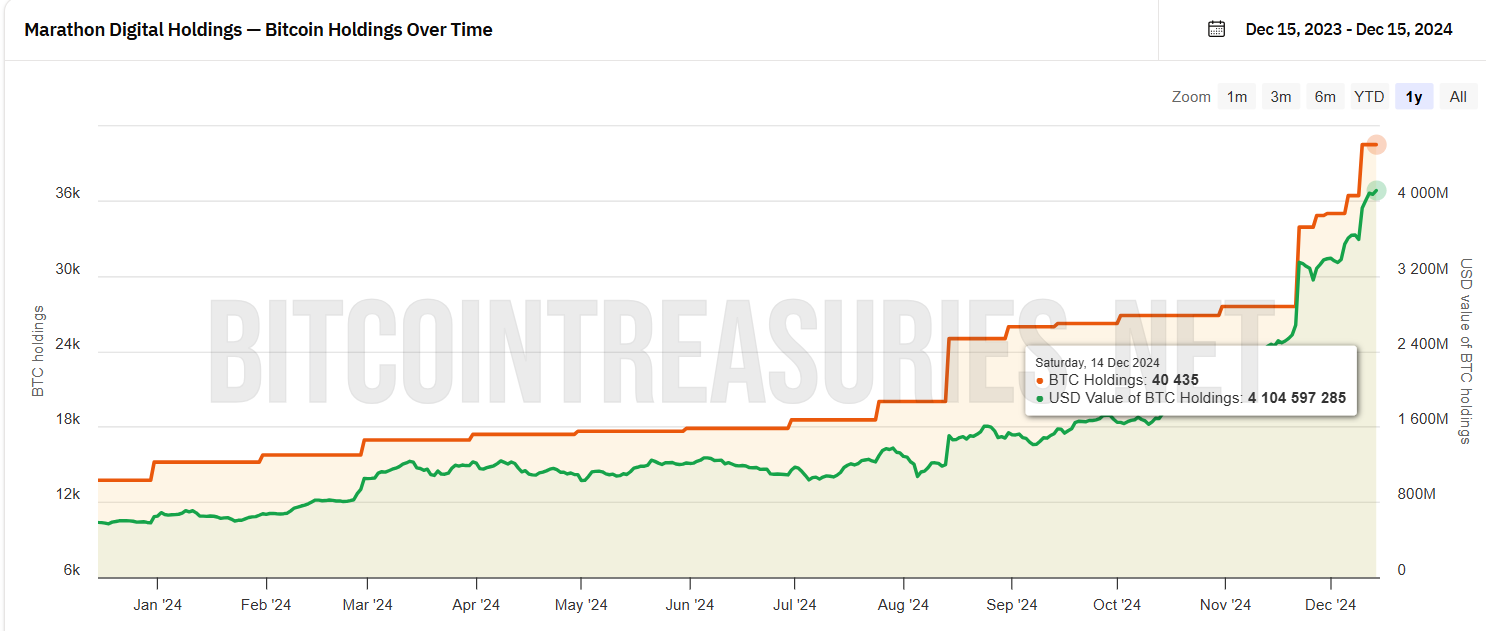

Marathon still faces a challenging road ahead, with a current market capitalization below $10 billion — far short of the figures MicroStrategy achieved prior to its inclusion. However, Marathon has aggressively expanded its Bitcoin strategy, spending over $1 billion this month to increase its reserves to 40,435 BTC, now valued at nearly $3.9 billion.

Meanwhile, this acquisition solidifies Marathon’s position as the second-largest corporate Bitcoin holder, trailing only MicroStrategy. As the company continues to grow its Bitcoin portfolio, it is becoming a key contender in the evolving landscape of institutional crypto investment.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Oluwapelumi Adejumo

https://beincrypto.com/saylor-hints-at-microstrategy-bitcoin-investment/

2024-12-15 18:45:00