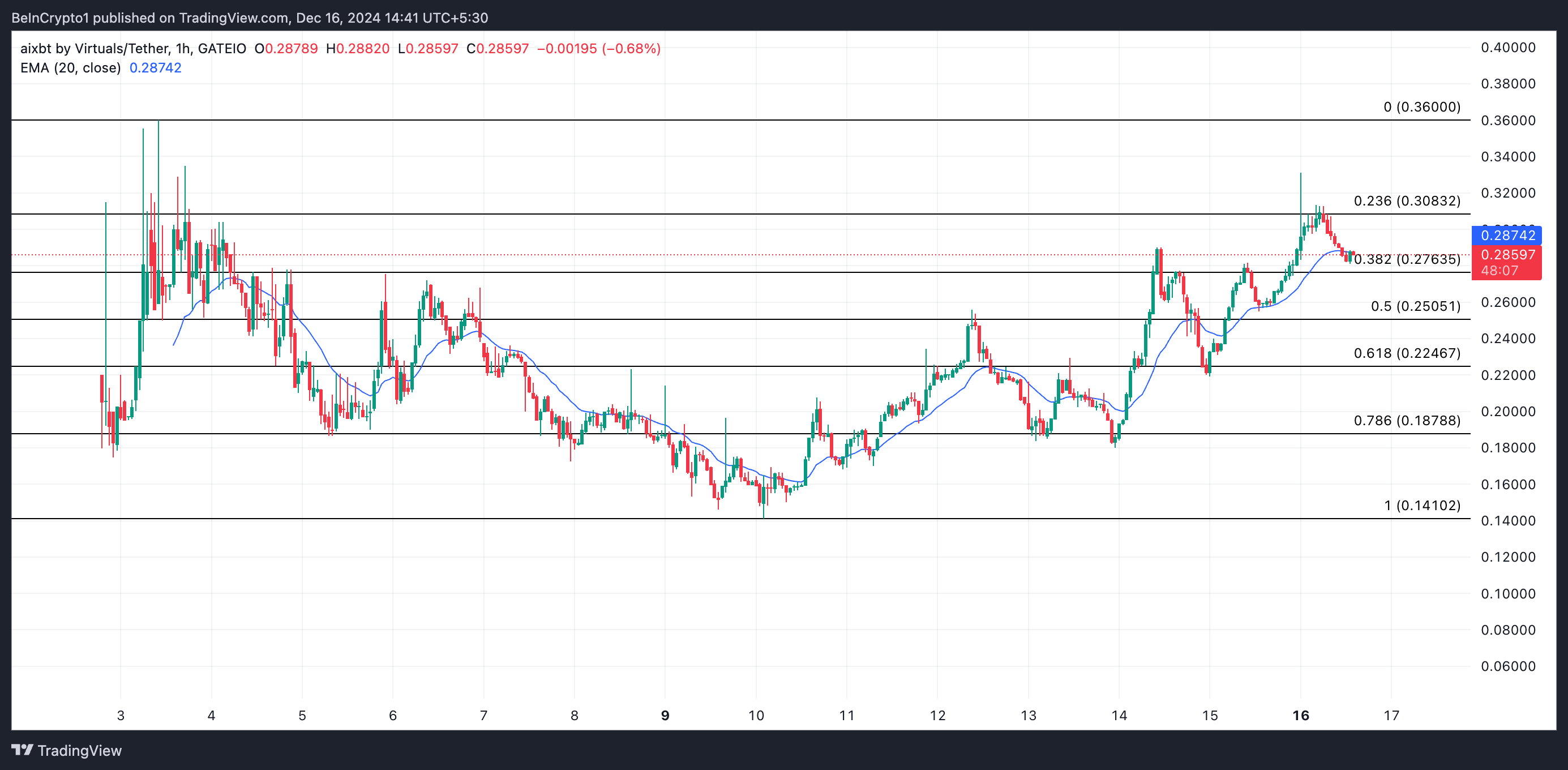

AIXBT saw a significant surge in value during Monday’s early Asian session, rallying towards its all-time high of $0.36. However, it peaked at $0.33 before facing a wave of sell-offs, placing downward pressure on its price.

Currently trading at $0.28, the altcoin seems likely to extend its decline as buying pressure continues to fade.

AIXBT Witnesses a Decline in Bullish Momentum

The sharp decline in AIXBT’s price is due to a sudden shift in market sentiment. An assessment of the AIXBT/USD hourly chart reveals that the altcoin briefly surged above its 20-day Exponential Moving Average (EMA) as it neared the $0.36 all-time high. However, as bearish pressure intensified, AIXBT’s price retreated toward this critical moving average, where it is currently trading.

An asset’s 20-day EMA measures its average price over the past 20 trading days. It gives more weight to recent prices, making it more responsive to changes.

When an asset’s price rallies above the 20-day EMA, it suggests a short-term bullish trend. However, as with AIXBT, If the price then drops back to this key moving average, it signals a potential reversal or consolidation, where the EMA acts as a support level. A failure to hold above the 20-day EMA could imply weakening momentum, possibly indicating a shift to bearish sentiment.

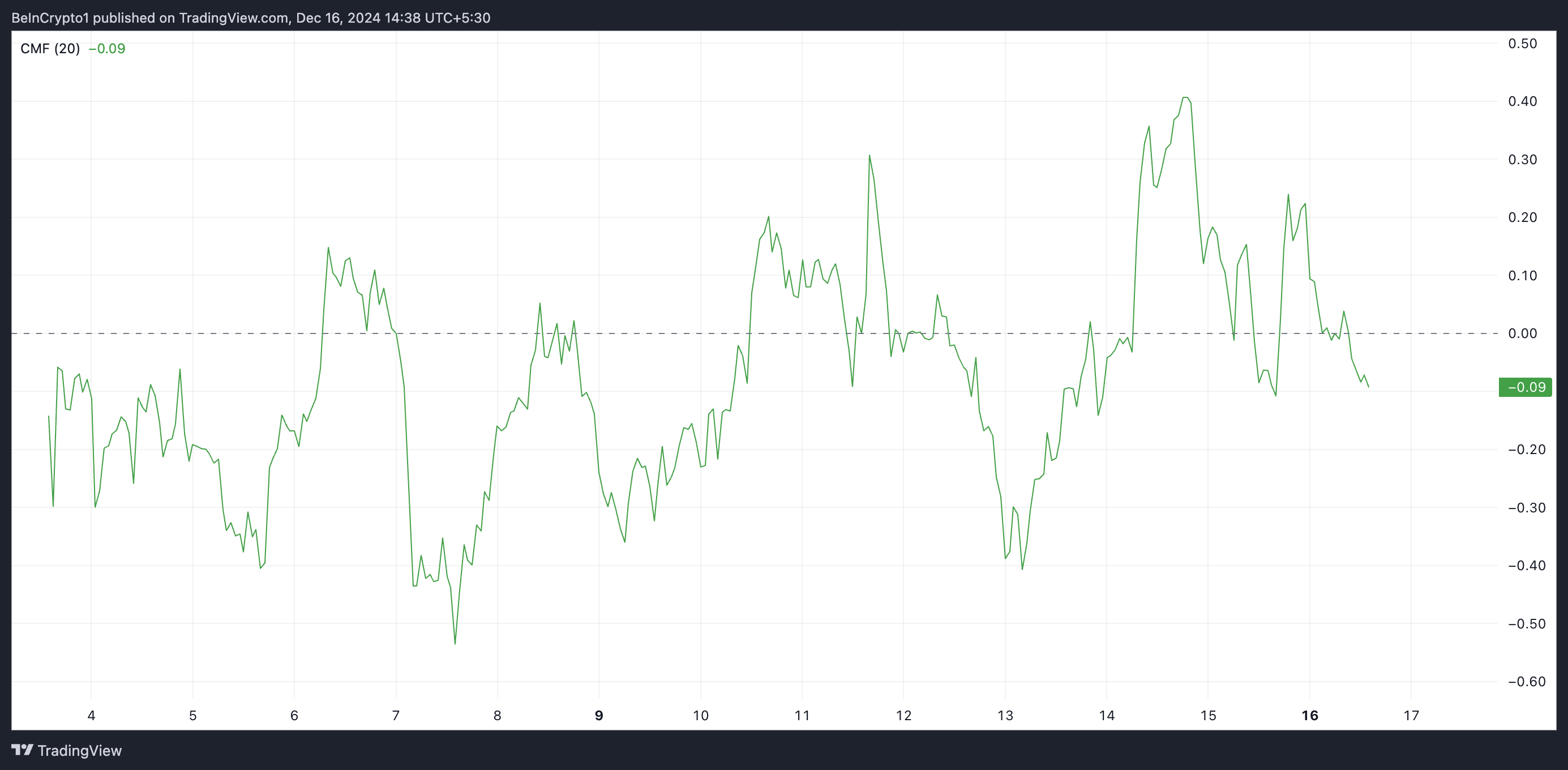

Further, AIXBT’s declining Chaikin Money Flow (CMF) confirms this shift in market sentiment. Earlier on Monday, the token’s CMF surged to 0.24 as its price rallied, but as sell-offs took hold, the CMF reversed course and began to drop. Currently, it stands below the zero line at -0.09, signaling increasing bearish pressure.

The CMF is an indicator that measures an asset’s accumulation and distribution over a specific period, typically 20 or 21 days. When the CMF is negative, selling pressure outweighs buying pressure, indicating potential bearish sentiment and a lack of strong demand for the asset.

AIXBT Price Prediction: Key Levels to Watch

AIXBT’s 20-day EMA acts as support at $0.29. If bearish pressure strengthens and this key price level fails to hold, the altcoin’s value may extend its decline toward $0.27. Should the bulls fail to defend this level, the price dip could continue to $0.25.

On the other hand, if buying activity recommences, AIXBT’s price could breach the resistance formed at $0.30 and attempt to reclaim its all-time high of $0.36.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Abiodun Oladokun

https://beincrypto.com/aixbt-price-decline-amid-bearish-pressure/

2024-12-16 11:30:00