A widely followed crypto analyst says Ethereum (ETH) looks primed to move higher after exhibiting price stability during the last two weeks.

In a new strategy session, pseudonymous crypto trader Rekt Capital tells his 519,700 followers on the social media platform X that ETH may be gearing up for more rallies after maintaining $4,000 as support on the weekly chart.

“ETH: the post-breakout retest was successful. And indeed, it enabled a challenge into $4,000 (red). In fact, Ethereum has been holding the $4,000 (red) area as new support for the second week in a row. Continued price stability here [means] renewed upside.”

Looking at his chart, the trader suggests that ETH may soon rally to $4,542.

Ethereum is trading for $3,956 at time of writing, up nearly 28% in the last 30 days.

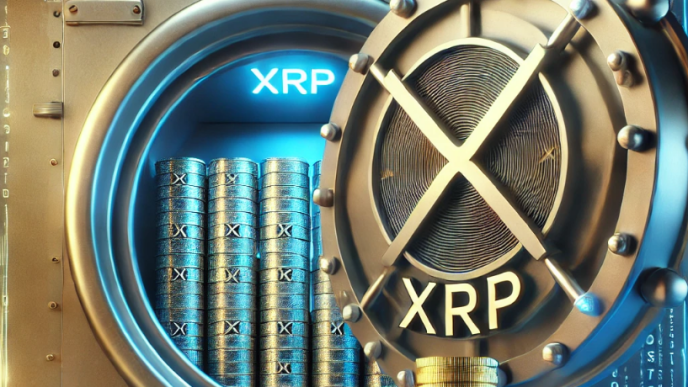

However, the analyst says that Bitcoin (BTC) may continue to outperform altcoins now that Bitcoin dominance (BTC.D) – the ratio between the market cap of BTC versus the market cap of all crypto assets combined – is rising again.

At time of writing, BTC.D is at 57.80%.

“Bitcoin dominance: sharp rebound to the upside for BTC.D. A reclaim of green 57.68% as support would allow for Bitcoin dominance to regain momentum in its macro uptrend. BTC.D is on the cusp of reclaiming this level as we speak to confirm ‘Bitcoin Season.’”

Lastly, the analyst warns that based on historic precedence Bitcoin could soon see a sudden correction before rallying again.

“It’s week seven. In 2013, Bitcoin pulled back in week seven of price discovery. In 2017, Bitcoin retraced -34% in week eight of price discovery. In 2021, Bitcoin pulled back -16% in week six. Will history repeat? Or will Bitcoin go against the grain of history?…

Price discovery corrections are a normal part of the BTC cycle. And every cycle has experienced them. Especially since Bitcoin has already experienced multiple -25% pullbacks in and around the halving.”

Bitcoin is trading for $106,972 at time of writing, up more than 18% in the last 30 days.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: DALLE3

Source link

Daily Hodl Staff

https://dailyhodl.com/2024/12/17/ethereum-eth-in-for-renewed-upside-after-continued-stability-says-crypto-analyst-heres-his-outlook/

2024-12-17 20:55:36