Ethereum spot exchange-traded funds (ETFs) have logged 16 consecutive days of positive daily inflows, renewing optimism for ETH’s potential new all-time high (ATH) in the coming weeks. However, for ETH to reach this milestone, it must surpass the critical resistance level of $4,000.

Ethereum Spot ETFs Attracting Consistent Inflows

According to data from SoSoValue, Ethereum spot ETF inflows have remained consistently positive since November 22. The cumulative net inflows total $2.32 billion, with a significant $1.5 billion added between November 22 and December 16 alone.

Related Reading

Breaking it down by weekly inflows, the week ending December 13 saw net inflows of $854.85 million, closely followed by $836.69 million during the week ending December 6. Moreover, the total net assets held by Ethereum ETFs have climbed to $14.28 billion, which represents approximately 2.93% of ETH’s total circulating supply.

Grayscale’s Ethereum Trust (ETHE) ranks as the largest holder with $5.87 billion in net assets, followed by Blackrock’s iShares Ethereum Trust (ETHA) with $4.02 billion. These strong inflows into Ethereum ETFs have bolstered bullish sentiment, with Ethereum bulls anticipating a possible rally to a new ATH for the second-largest cryptocurrency by market cap.

Crypto analyst Momin Saqib took X to share his thoughts on ETH price action. The analyst noted that ETH looks poised to break through the local highs of the $4,000 range and is eyeing the $4,500 price level. He added:

Ethereum inflows have been coming in non-stop for the last few weeks! After seeing $BTC at $107K…. I think institutions don’t have much options left to bet on higher upside of crypto industry! Higher!

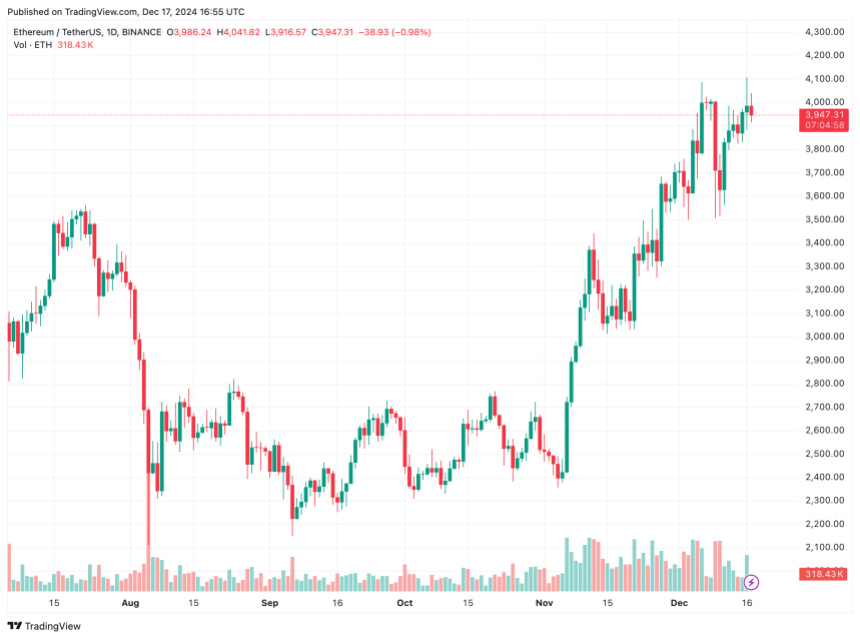

Looking at Ethereum’s weekly chart, the digital asset has made four significant attempts to break through the $4,000 resistance level. While it briefly surpassed this level during its second attempt, creating its current ATH of $4,878, it ultimately proved to be a false breakout, followed by a prolonged bear market over the next two years.

Analyst Rekt Capital noted that ETH’s post-breakout retest of the $3,100 price level was successful, propelling the cryptocurrency back into the $4,000 zone. They highlighted that ETH has held above the $4,000 zone as support for the second consecutive week, a key development that could pave the way for further upward momentum.

Despite The Potential Upside, ETH Traders Remain Cautious

While strengthening fundamentals, bullish technical indicators, and persistent ETF inflows paint a positive picture for Ethereum, some analysts remain cautiously optimistic about ETH’s short-term price action.

Related Reading

For instance, analyst CryptoBullet emphasized that ETH may see a quick wick to $3,700 before rebounding. The analyst added that ETH’s ability to hold above key resistance levels indicates its strong bullish momentum.

Another factor potentially dampening short-term optimism is Justin Sun, founder of Tron (TRX), who recently unstaked $208 million worth of ETH from Lido Finance. This move has raised concerns about potential selling pressure. ETH trades at $3,947 at press time, down 0.2% in the past 24 hours.

Featured image from Unsplash, Charts from SoSoValue, X and TradingView.com

Source link

Ash Tiwari

https://www.newsbtc.com/ethereum-news/ethereum-spot-etfs-witness-unbroken-16-day-inflow-streak-new-eth-ath-soon/

2024-12-18 07:30:19