Cardano’s (ADA) price has been experiencing a downtrend recently, raising concerns about a potential drop below the $1 support level.

A major contributing factor to this decline is the selling activity by large ADA holders, often referred to as whales. These Cardano investors have been unloading their coin holdings, likely taking advantage of recent gains to secure profits.

Cardano Whales Trigger Selloffs

BeInCrypto’s assessment of Cardano’s on-chain performance has revealed that its whales have sold a significant portion of their holdings over the past week. According to Santiment, large holders that hold between 100,000,000 and 1,000,000,000 ADA have distributed coins worth $200 million in the past seven days.

When large holders of a cryptocurrency sell their coins, it signals reduced confidence in the asset and introduces significant selling pressure to the market. This can lower prices, especially if the market lacks sufficient demand to absorb the large sell-off. This trend may also trigger further panic selling by smaller investors, putting more pressure on the asset’s price.

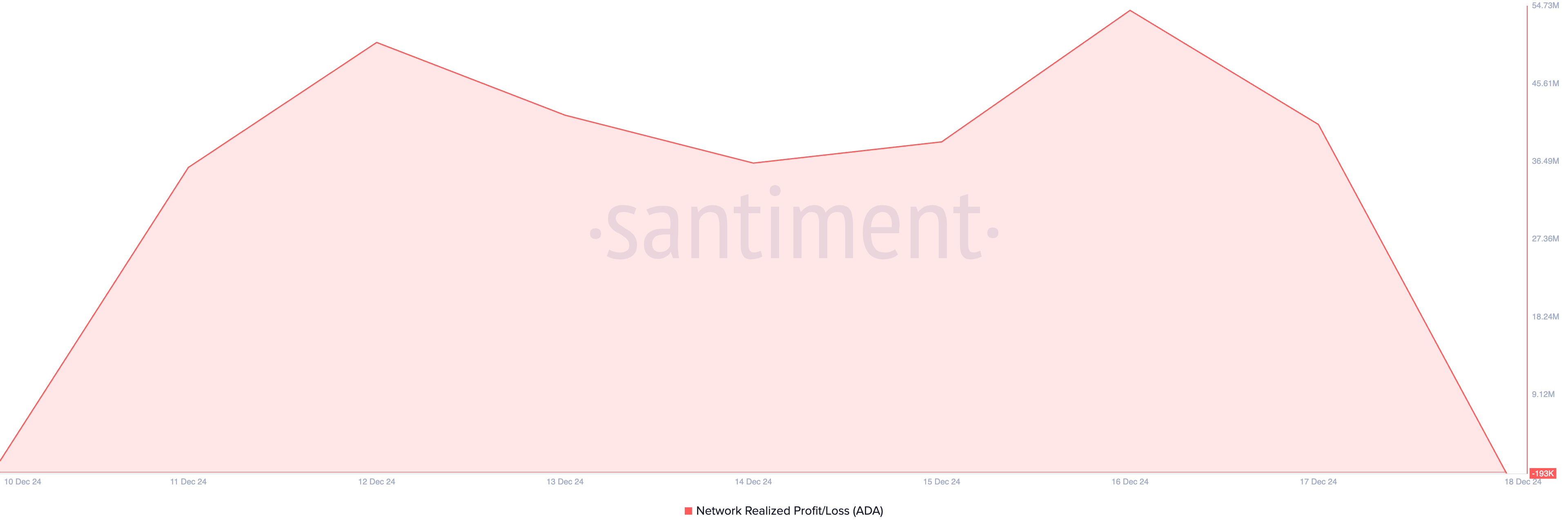

Moreover, the profitability of ADA transactions in the past few days has contributed to increased selloffs. Data from Santiment shows that the coin’s Network Realized Profit/Loss has been consistently positive in the past seven days, indicating that traders have been selling for profit.

This may have prompted other investors to sell their ADA coins to lock in their gains, contributing to its price decline over the past few days.

ADA Price Prediction: The $1.07 Price Level Is Key

As of this writing, ADA trades at $1.02, slightly below the resistance formed at $1.07. Any attempt to breach this resistance level will fail if selloffs persist. This may trigger a decline below the $1 price zone to $0.92.

On the other hand, a succesful breach of this resistance will propel ADA’s price to its two-year high of $1.34, last reached on December 3.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Abiodun Oladokun

https://beincrypto.com/cardano-whales-spark-fear/

2024-12-18 12:00:00