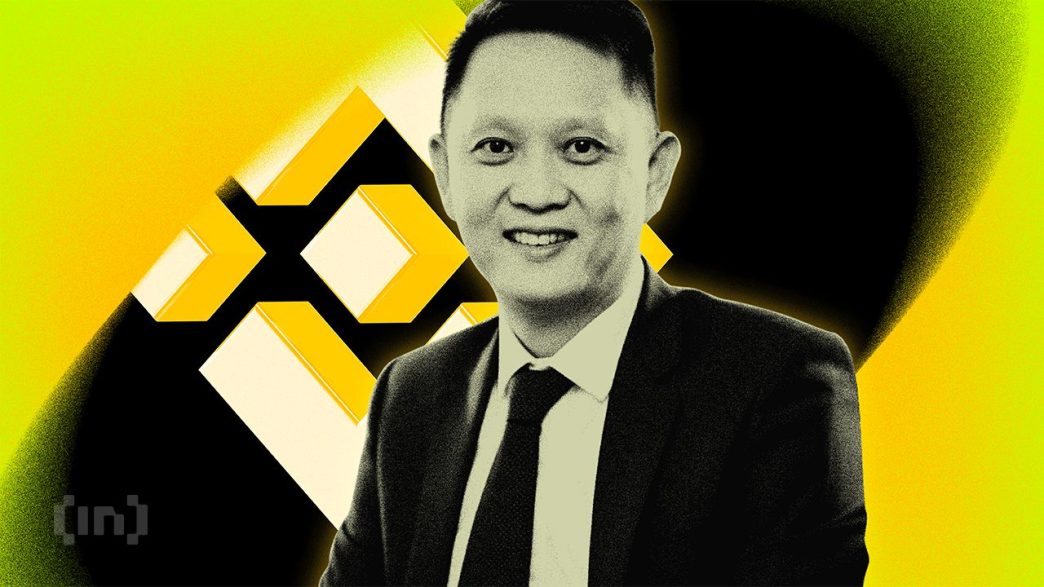

Richard Teng, CEO of Binance, has shared his outlook for 2025, offering a detailed analysis of the market’s evolution. Teng’s insights paint a promising future setting the stage for what could be another pivotal year for crypto.

Meanwhile, as 2024 draws to a close, the crypto industry is poised for a transformative year ahead. With a strong foundation laid this year, the crypto industry stands ready to capitalize on the opportunities ahead in 2025.

Richard Teng: A Historic 2024 Set the Foundation for a Strong 2025

In a statement shared with BeInCrypto, Teng lauded 2024 as a “new era” for the crypto market, citing milestones that have reshaped the ecosystem. Bitcoin and the total crypto market cap reached new all-time high, spurred by financial products like spot ETFs.

These ETFs, which accumulated over $31 billion in net inflows and surpassed $100 billion in assets under management (AUM), exceeded expectations. Recently, Bitcoin ETFs attracted up to $439 million in daily inflows despite the market downturn. They also surpassed Satoshi Nakamoto’s estimated 1.1 million BTC holdings. Taken together, these turnouts highlight the growing role of traditional finance (TradFi) in crypto adoption.

The momentum extended beyond Bitcoin, with spot Ether ETFs launching in July 2024. These products attracted $730 million in inflows and achieved $9 billion in AUM, reflecting institutional demand for broader crypto exposure.

Meanwhile, stablecoins hit unprecedented levels. According to a report by Castle Island Ventures, Brevan Howard Digital, and Visa, stablecoin supply surpassed $200 billion, and settlement volumes reached $2.6 trillion in the first half (H1) of the year.

Teng also highlighted significant regulatory progress, particularly in Europe, which paved the way for the first compliant stablecoin in the region. He also noted the pro-crypto sentiment in the US following President-elect Donald Trump’s re-election. With a history of launching NFT collections and promoting DeFi, Trump’s leadership signals a favorable environment for crypto regulation.

“The United States is poised to lead in shaping global crypto legislation next year,” Teng noted.

The possibility of a Strategic Bitcoin Reserve led by the US could also set a precedent for other nations and further accelerate BTC adoption. Japanese lawmakers are already pushing for a similar initiative.

Institutional Participation on the Rise

Teng also acknowledges that institutional interest in crypto surged in 2024. Financial heavyweights like BlackRock and Fidelity entered the market with significant commitments to asset tokenization. Teng expects this trend to gain momentum in 2025, with more institutions integrating blockchain solutions and embracing crypto products.

“We anticipate a continued wave of institutional adoption, with further spot ETFs approved in 2025, expanding access for TradFi investors,” Teng stated.

With a pro-crypto US administration taking office in January, regulatory clarity could drive new filings and approvals for additional ETFs. This, in turn, will attract greater institutional capital and solidify crypto’s role within traditional financial markets.

In parallel, DeFi’s growth has remained strong, with total value locked (TVL) surpassing $125 billion. Major advancements in real-world asset (RWA) tokenization, championed by institutions like BlackRock, signify blockchain’s increasing utility in traditional finance.

The Meme Coin Phenomenon

One of the more unconventional trends of 2024 was the resurgence of meme coins, reflecting the dynamic and novel nature of the crypto ecosystem. While meme coins like Dogecoin (DOGE) and Shiba Inu (SHIB) have demonstrated longevity, Teng cautioned against speculative risks while acknowledging the infrastructure enabling their rapid creation and trading.

“The memecoin craze highlights the robustness of on-chain token creation, allowing globally tradable assets to emerge in hours. While many meme coins will fade, a select few with real community backing and staying power could evolve into significant players within the ecosystem,” he remarked.

Nevertheless, he reiterated Binance’s commitment to educating users about the speculative nature of meme coins while emphasizing their cultural and technological significance among a young, internet-savvy demographic.

Regulation to Drive Market Evolution

Teng reiterated the importance of regulatory developments as a catalyst for growth in 2025. With the US expected to spearhead comprehensive crypto legislation, other nations are likely to follow suit. This would create a global framework for safer and more transparent crypto markets.

“Regulation brings clarity, which is essential for mainstream adoption. We are seeing a shift where governments and institutions recognize crypto’s long-term potential,” Teng explained.

Binance’s Priorities for 2025

Further, the Binance executive shared the exchange’s key priorities for 2025, indicating that they align with the market’s evolving needs.

- Compliance and Security: Binance aims to lead the industry in user protection and compliance, ensuring a safe and trusted environment for crypto participation.

- Education: With crypto adoption expanding, Binance will continue its educational initiatives to onboard new users and equip them with the tools to navigate the market responsibly.

- Product Innovation: Binance plans to advance product development, including integrating AI technologies and forming partnerships with institutions to support crypto adoption at scale.

Teng’s outlook for 2025 paints a picture of a maturing crypto industry poised for further growth and aligns with HTX Ventures’ outlook for the coming year. Institutional adoption, regulatory progress, and technological innovations will drive the market forward.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Lockridge Okoth

https://beincrypto.com/binance-ceo-predicts-2025-crypto-boom/

2024-12-18 16:00:00