The U.S. Federal Reserve lowered its benchmark fed funds rate by 25 basis points to the 4.25%- 4.50% range, its third consecutive easing move this year and now marking a total of 100 basis points of rate cuts since September.

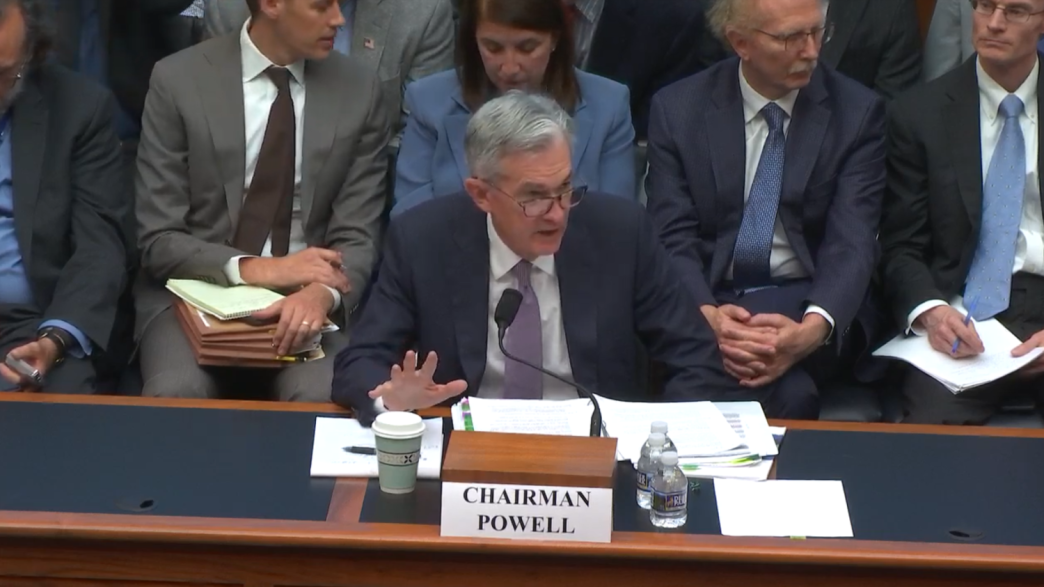

Market participants had fully expected Wednesday’s move by the central bank, but recent data had shown continued solid economic growth and perky inflation. This turned the focus today to the policy statement, updated economic projections and the upcoming press conference with Chairman Jerome Powell for clues about the Fed’s thinking on future policy actions.

The Fed’s quarterly economic projections — which include the “dot plot” indicating where the central bank expects the Fed funds rate to land over time — reveal that policymakers expect the Fed funds rate to decline to 3.9% by year-end 2025 or another 50 basis points in rate cuts next year. That’s higher than the 3.4% projected in September, signaling a less dovish monetary policy in 2025.

Already lower in the session, the price of bitcoin (BTC) traded slightly above $104,000 in the minutes following the announcement. The S&P 500 index also fell to a session low on Wednesday.

“I think the biggest headache for the Fed right now is the fact that financial conditions have still tightened despite the Fed cutting rates,” Andre Dragosch, European Head of Research at Bitwise, told CoinDesk prior to today’s action. “Long bond yields and mortgage rates have increased since September and the dollar has appreciated which also implies a tightening in financial conditions.”

“A continued appreciation of the US dollar also poses a macro risk for bitcoin since dollar appreciation is associated with global money supply contraction as well which tends to be bad for bitcoin and other crypto assets,” Dragosch continued. “In fact, Fed net liquidity continues to decrease. Tightening liquidity and strong dollar is also the biggest risk for BTC in my view … On the other hand, on-chain factors for BTC continue to be very supportive, in particular the ongoing decline in exchange balances which supports the hypothesis that the BTC supply deficit continues to intensify.”

Fed Chairman Jerome Powell will hold a post-meeting press conference at 2:30 pm ET, which will provide further signals about the U.S. central bank’s intentions.

Source link

James Van Straten, Krisztian Sandor

https://www.coindesk.com/markets/2024/12/18/fed-cuts-interest-rates-by-25-basis-points-bitcoin-slips-below-104-k-on-hawkish-tone

2024-12-18 19:14:46