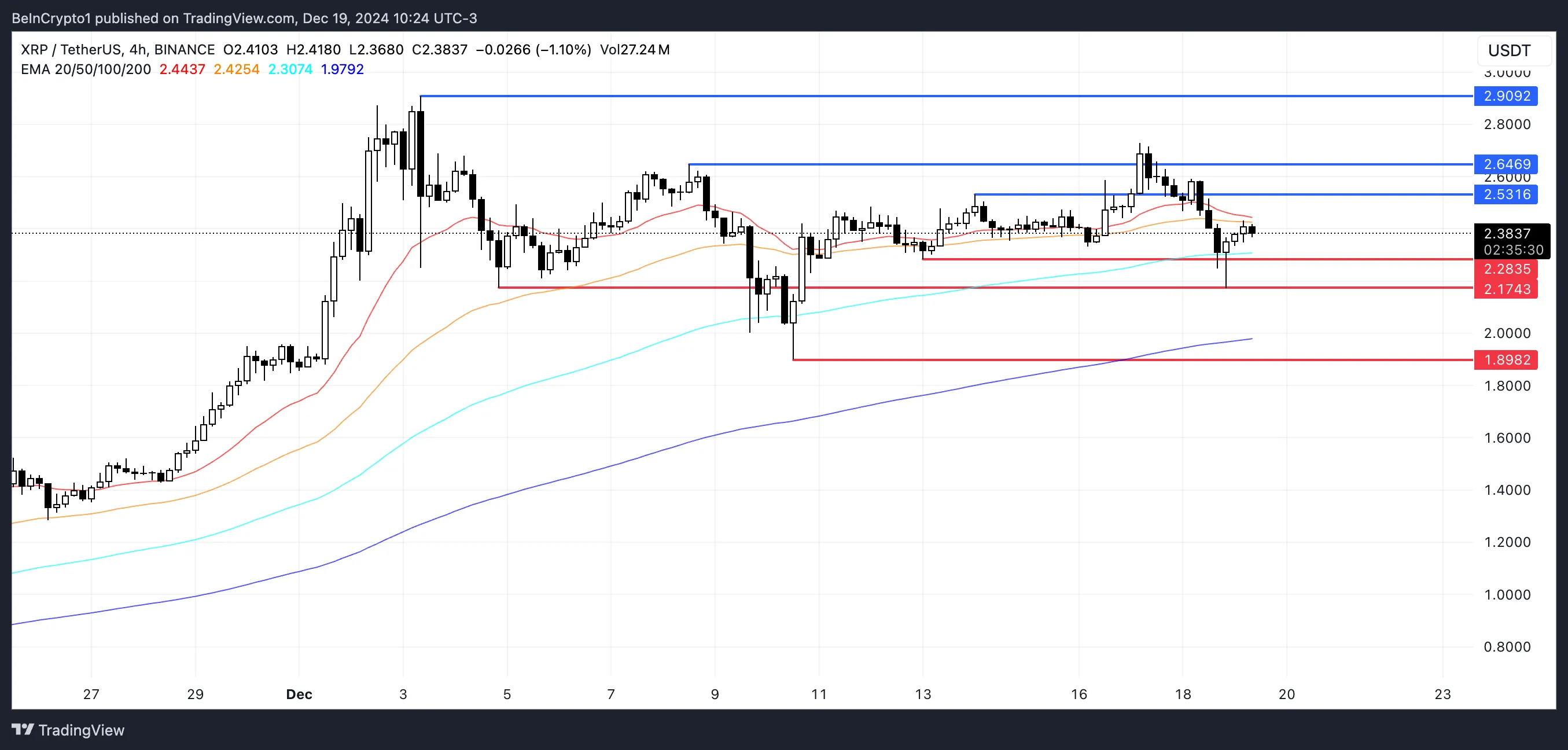

XRP price is down nearly 6% in the last 24 hours, following a historic surge earlier this December that solidified its position as the 4th largest cryptocurrency by market cap. Momentum indicators like RSI and CMF show a mixed outlook, with RSI at 45 indicating neutral conditions and CMF at 0.01 signaling slight positive capital flow.

XRP is trading within a key range between $2.28 and $2.53, where breaking below support could lead to a significant correction toward $1.89. However, if buyers regain control, XRP could test resistances at $2.53 and $2.90, aiming to re-establish its recent bullish momentum.

XRP RSI Stays Neutral

XRP RSI is currently at 45, a notable drop from 60 just a day ago. This decline indicates a weakening of bullish momentum and a shift closer to neutral territory, as the RSI moves away from overbought levels.

The sharp drop suggests increasing selling pressure, which could lead to continued price consolidation or further downside in the short term if buying interest does not pick up.

The RSI (Relative Strength Index) measures the speed and magnitude of price changes to assess whether an asset is overbought or oversold. RSI values above 70 indicate overbought conditions, often signaling a potential pullback, while values below 30 suggest oversold conditions, which could precede a rebound.

With XRP RSI at 45, the market is in a neutral zone, but the recent decline implies a bearish tilt, leaving the price vulnerable to further corrections unless bullish momentum returns.

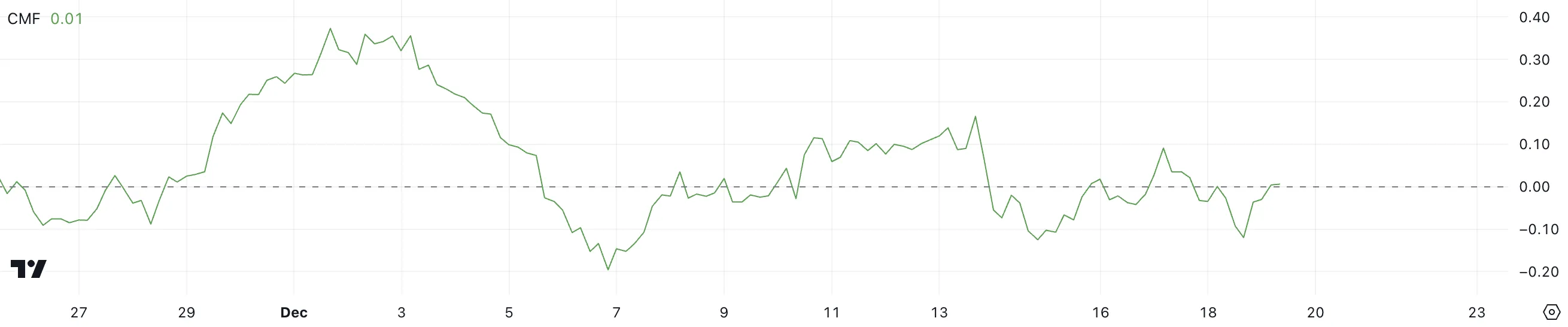

XRP CMF Is Nearing 0

XRP CMF is currently at 0.01, a significant increase from -0.12 yesterday. This indicates a shift toward more positive capital flow into the asset. While the CMF is now slightly above neutral, it does not yet reflect strong bullish momentum.

This improvement suggests that selling pressure has eased, but buying pressure remains weak, pointing to a potential stabilization in price rather than a clear uptrend.

The CMF (Chaikin Money Flow) measures the strength of capital inflows and outflows over a given period. Values above 0 indicate net positive inflows, signaling buying pressure, while values below 0 suggest net outflows and selling pressure.

With XRP CMF at 0.01, the market appears to be entering a consolidation phase, where neither buyers nor sellers are dominant. Unless a decisive shift in capital flow occurs, this could result in range-bound price action over the next few days.

XRP Price Prediction: A Death Cross Could Send the Coin Below $2

XRP is currently trading between $2.28 and $2.53, with support at $2.28 acting as a critical level. If this support fails, XRP price could decline further to test $2.17 and potentially drop to $1.89, signaling a stronger correction.

The narrowing distance between EMA lines suggests a weakening trend, and if short-term EMAs cross below long-term ones, forming a Death Cross, it could trigger increased bearish momentum.

On the other hand, if XRP price can regain positive momentum, it may first challenge the resistance at $2.53. A breakout above this level could open the door for further gains, with targets at $2.64 and potentially as high as $2.90 if the uptrend strengthens significantly.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Tiago Amaral

https://beincrypto.com/xrp-price-drops-as-buyers-remain-cautious/

2024-12-19 16:30:00