The crypto market will witness $2.62 billion in Bitcoin and Ethereum options contracts expire today. This massive expiration could affect short-term price action, especially as both assets have recently declined.

With Bitcoin (BTC) options valued at $2.02 billion and Ethereum (ETH) at $598.99 million, traders are bracing for potential volatility.

What Traders Should Watch Amid Over $2.6 Billion Options Expiry

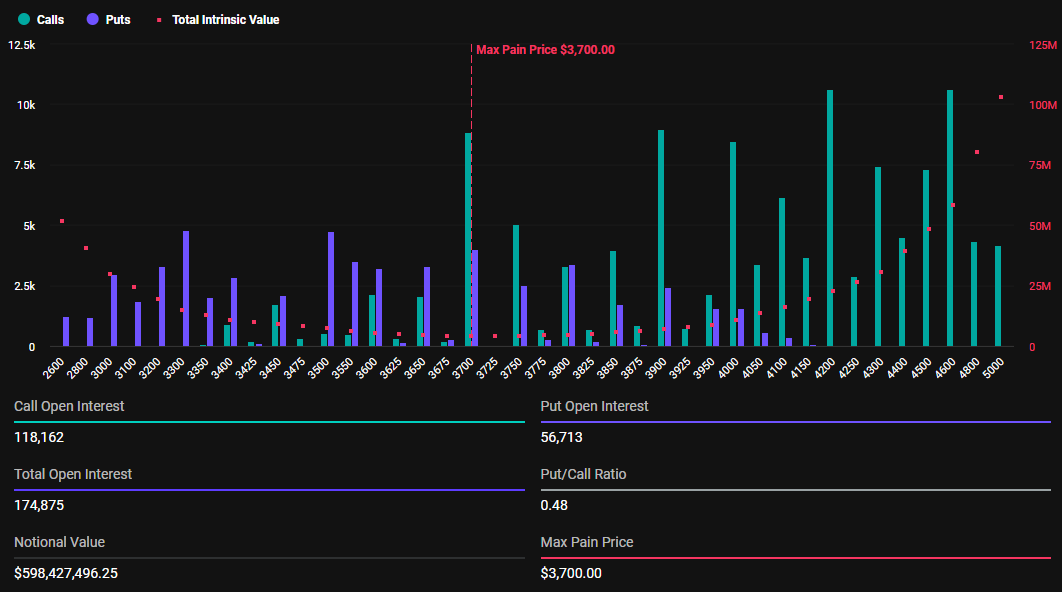

Today’s expiring options mark a slight drop from last week. According to Deribit data, Bitcoin options expiration involves 20,728 contracts, compared to 20,815 contracts last week. Similarly, Ethereum’s expiring options total 174,863 contracts, up from 164,330 contracts the previous week.

For Bitcoin, the expiring options have a maximum pain price of $110,000 and a put-to-call ratio of 0.87. This indicates a generally bullish sentiment despite the asset’s recent pullback.

In comparison, their Ethereum counterparts have a maximum pain price of $3,700 and a put-to-call ratio of 0.48, reflecting a similar market outlook.

The maximum pain point is a crucial metric that often guides market behavior. It represents the price level at which most options expire worthless.

Additionally, the put-to-call ratios below 1 for both Bitcoin and Ethereum suggest optimism in the market, with more traders betting on price increases. Nevertheless, with that volume of options expiring, traders and investors should brace for potential volatility.

“Options expiry can lead to increased volatility as traders adjust their positions. Watch for potential moves in SPX and BTC as they may react to these market dynamics,” one user on X shared.

Could Options Expiry Catalyze Market Recovery?

Of note is that these expiring options come after Bitcoin retracted to $94,235. As of this writing, the pioneer crypto was trading for $97,157, down almost 4% since the Friday session opened.

With a maximum pain point of $101,000, Bitcoin stands well below its strike price. On the other hand, Ethereum is trading for $3,392, well above its maximum pain price of $3,700. Based on the Max Pain theory, BTC and ETH prices are likely to approach their respective strike prices, hence expected volatility.

This happens because the maximum pain theory in options trading operates on the assumption that option writers are typically large institutions or professional traders. Therefore, they have the resources and market influence to drive the closing price toward the maximum pain point on expiration day.

For Bitcoin, therefore, this means a possible recovery, potentially reclaiming the $100,000 milestone.

“Overnight sessions not looking good. The saving grace could be just tons of options expiring worthless tomorrow,” one user on X quipped.

Meanwhile, it is impossible to ignore that while options expirations often cause short-term price fluctuations, markets usually stabilize soon after as traders adapt to the new price environment. With today’s high-volume expiration, traders and investors can expect a similar outcome, potentially influencing future crypto market trends, especially into the weekend.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Lockridge Okoth

https://beincrypto.com/over-2-6-billion-options-expiring-today/

2024-12-20 06:13:34