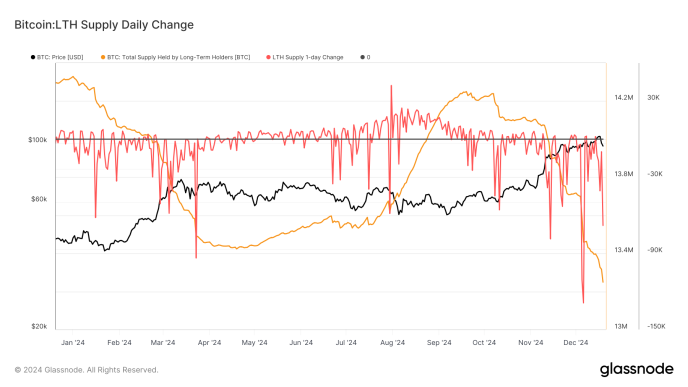

Since Donald Trump’s election victory on November 5, Bitcoin (BTC) has experienced a substantial rally, reaching record highs above $108,000. However, this momentum has recently faltered, with the cryptocurrency dropping below the critical $100,000 mark,

This has prompted analysts to speculate on a potential deeper correction with some experts believing Bitcoin could dip to levels around $85,000 or even $75,000 before resuming its upward trajectory.

Is It A Temporary Setback Or The Calm Before A Final Surge?

Analyst Morecryptoonl highlights that the current market dynamics suggest a substantial likelihood of Bitcoin moving toward $85,000. This projection stems from the observation that the recent wave of price action lacked the strength typically seen in bullish trends, failing to reach key extension levels.

The “overlapping and corrective nature” of the rally highlighted by the analyst further supports the idea that a significant pullback may be imminent. Should this scenario unfold, it could represent the last major correction of the current bull market, setting the stage for a final surge in prices.

Related Reading

Technical analyst Rekt Capital offers a contrasting perspective, asserting that the perception of Bitcoin at $75,000 as a favorable entry point is relative to its current price of approximately $97,000.

Rekt Capital further suggests that what seems like a bargain now may not have appeared as attractive when Bitcoin was previously at that level.

Despite the bearish sentiment from some experts, others see the recent price correction as a significant buying opportunity. Analyst VirtualBacon argues that the market’s reaction to Bitcoin’s drop from $108,000 to $96,000 has been “exaggerated.”

Is Bitcoin Preparing For New Record Highs?

VirtualBacon asserts that this decline is not indicative of a market collapse but rather a healthy consolidation phase within an ongoing bull market.

Historical data supports this view, as corrections of this nature often precede new highs. Key support levels, such as the weekly 21 exponential moving average (EMA) around $79,000 and the daily 200 EMA near $73,000, remain intact, suggesting that even a brief dip to these levels would not destabilize the overall bullish structure.

Related Reading

The underlying economic conditions also play a crucial role in shaping Bitcoin’s future, according to VirtualBacon. The recent Federal Reserve (Fed) actions, including a modest rate cut and a cautious approach to monetary policy, suggest a stable economic environment.

While the Fed continues its policy of quantitative tightening (QT), the expectation is that this will not persist indefinitely. The rising US debt crisis is likely to necessitate a return to quantitative easing (QE), which has historically fueled bullish trends in crypto markets.

In summary, the recent dip in Bitcoin’s price is viewed by many as a temporary setback rather than the end of the bull market. As long as Bitcoin maintains its position above critical support levels, the bullish trend remains intact.

At the time of writing, BTC is trading at $97,720, down 3% for the 24-hour period and over 2% for the week.

Featured image from DALL-E, chart from TradingView.com

Source link

Ronaldo Marquez

https://www.newsbtc.com/bitcoin-news/bitcoin-rally-loses-momentum-could-a-drop-to-75000-signal-the-final-correction/

2024-12-20 11:00:41