The Ethereum (ETH) price outlook has been on investors’ radars for a while. Amid this sentiment, the cryptocurrency has rallied above $4,000 and, at one point, decreased below $3,200.

However, in the last 24 hours, Ethereum’s price has increased by 10%, with large transactions climbing to levels not seen in almost one week.

Ethereum Sees Notable Institutional Interest

Ethereum’s 10% surge has pushed the altcoin to $3,422. On-chain data reveals that increasing institutional interest is a key factor influencing Ethereum’s price outlook.

IntoTheBlock reports that Ethereum’s large transactions have climbed to 2.83 million ETH. This increase suggests heightened trading activity among whales and key stakeholders.

On the other hand, a decline in this metric indicates dwindling interest. At the time of writing, these transactions are worth approximately $11 billion. Historically, when this metric rises alongside the price, it is a bullish sign. As such, the ETH price could rise above $4,500 in the short term.

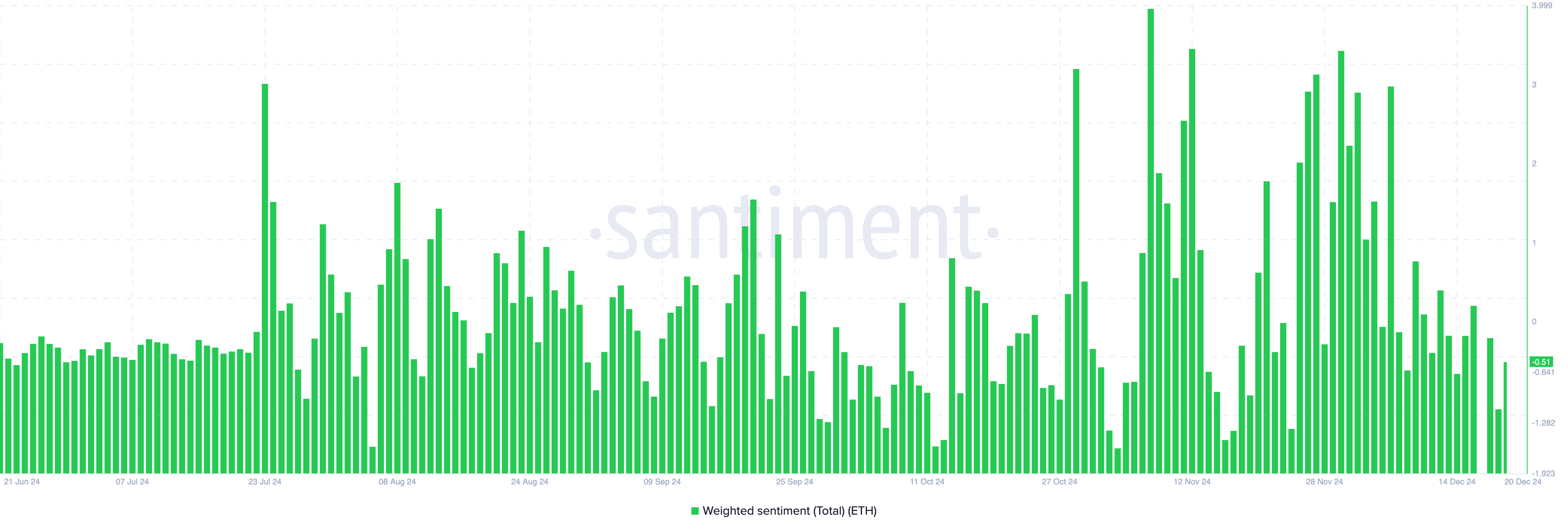

The Weighted Sentiment indicator suggests Ethereum’s price could keep rising. This metric measures overall market perception of a cryptocurrency, with positive readings reflecting bullish sentiment and negative readings indicating bearish sentiment.

Santiment data shows Ethereum’s Weighted Sentiment is nearing the positive zone. If it remains in this territory, ETH’s value could continue to increase.

ETH Price Prediction: Breakout Beyond $4,000 Still On the Cards

According to the 3-day ETH/USD chart, the Accumulation/Distribution (A/D) line has continued to climb. A rising A/D line indicates that investors are buying, which could drive the price higher. When the indicator’s reading drops, it indicates that investors are distributing, which is a bearish sign.

Since it is the former for ETH, it suggests that the cryptocurrency’s price might break the $3,982 resistance. If validated, the value could hit $4,110. However, if the broader market conditions become extremely bullish, Ethereum’s price could rally above $4,500.

But if the cryptocurrency fails to break above the resistance, the value might not experience such an upswing. Instead, the price might decline to $3,178.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Victor Olanrewaju

https://beincrypto.com/ethereum-price-amid-large-transaction/

2024-12-21 16:00:00