Bitcoin (BTC) has experienced a 5% dip over the past week. As of this writing, the leading coin trades at $96,905, below the key $100,000 price level.

Interestingly, the recent decline has not sparked a wave of sell-offs. This suggests that the bullish sentiment remains strong, and market participants expect the coin’s price to rise back above $100,000 in the near term.

Bitcoin Sees Decline in Selloffs

According to CryptoQuant’s data, BTC net outflows from cryptocurrency exchanges over the past week have exceeded $2.5 billion. Net outflows from exchanges track the amount of coins or tokens withdrawn from exchange wallets.

When an asset’s exchange outflow spikes, it indicates a shift towards holding assets in private wallets rather than trading or selling. This often signals a bullish sentiment, as investors may expect prices to rise.

Commenting on its implications for Bitcoin, pseudonymous CryptoQuant analyst KriptoBaykusV2 noted in a recent report:

“If the trend of Bitcoin outflows continues, this could reduce selling pressure in the market. With fewer Bitcoin available on exchanges and demand staying the same or increasing, prices could see upward momentum.”

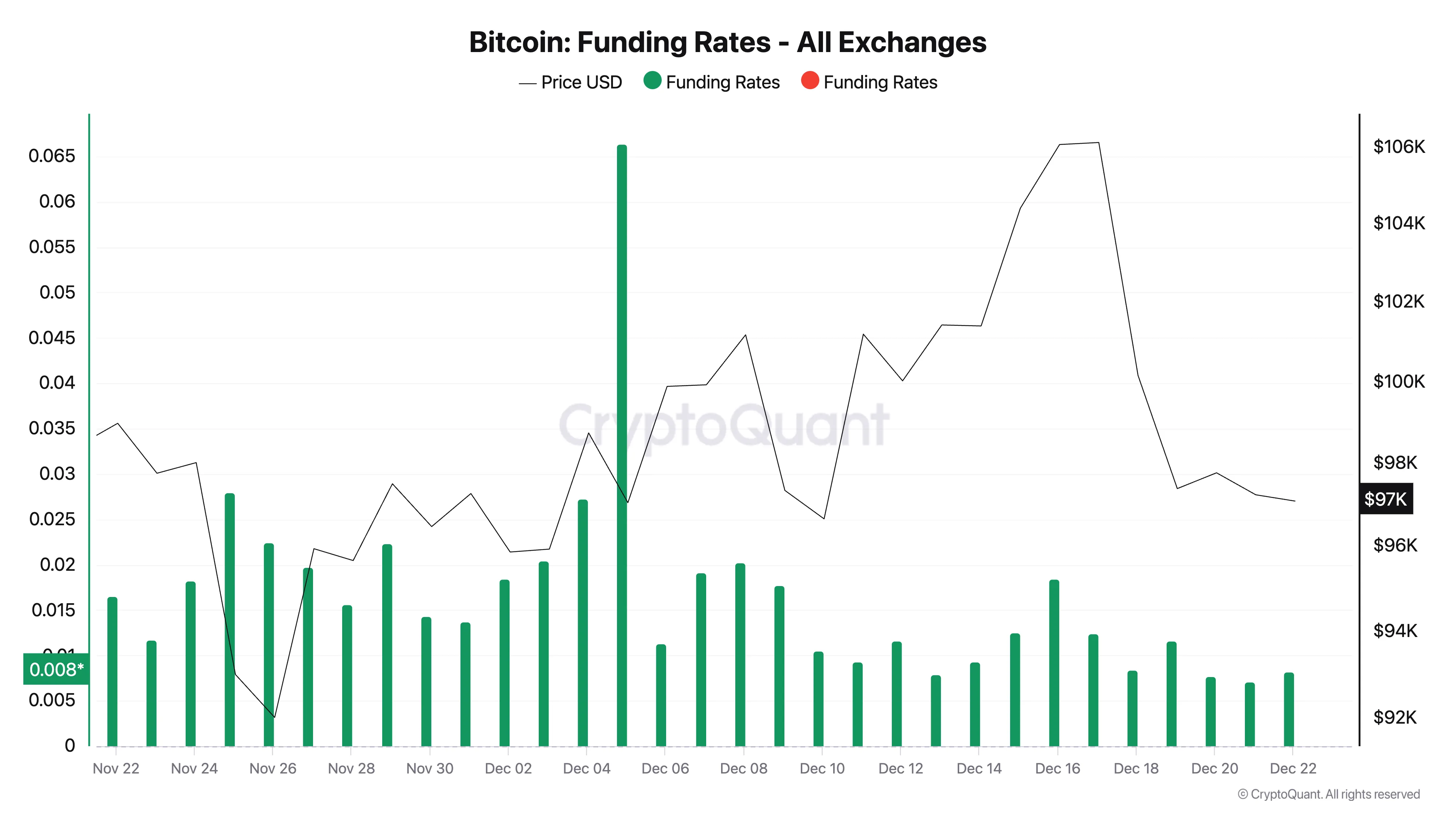

Additionally, the coin’s positive funding rate supports the likelihood of this upward projection in the near term. Currently, the funding rate in perpetual futures markets stands at 0.0081.

When an asset’s funding rate is positive, it means long positions are paying short positions. This indicates that the market sentiment is bullish, with traders expecting prices to rise.

Bitcoin Price Prediction: Coin Battles Dynamic Resistance at $100,000

The broader market drawdown has caused BTC’s price to fall below the Leading Span A of its Ichimoku Cloud, which forms a dynamic resistance at $100,160. This indicator tracks the momentum of an asset’s market trends and identifies potential support/resistance levels.

When an asset’s price trades below the Leading Span A of the Ichimoku Cloud, it indicates a bearish trend as selling pressure is strong and buyers are struggling to push the price higher. This scenario often signals further downside potential unless the price breaks back above the cloud.

Bitcoin’s price successful break above this level will propel it toward its all-time high of $108,388. On the other hand, a failed attempt to break above this resistance could cause Bitcoin’s price to decline to $95,690.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Abiodun Oladokun

https://beincrypto.com/bitcoins-exchanges-outflow-increase/

2024-12-22 16:45:00