As 2024 draws to a close, Usual (USUAL) is garnering significant interest from leading venture capital firms. Following its listing on Binance Launchpool, the project has secured additional funding from some of the top VCs in the industry.

This investment activity reflects strong investor confidence in Usual and the broader Real-World Asset (RWA) sector.

Top-Tier VCs Back Usual

Usual (USUAL) is a decentralized stablecoin project backed by Real-World Assets (RWA). Its flagship stablecoin, USD0, is supported by US Treasury Bills (T-Bills), which generate yield from T-Bills and distribute returns to investors via USUAL and USD0.

The project recently announced the completion of a $10 million Series A funding round led by Binance Labs and Kraken Ventures. Other prominent participants in the round included Coinbase Ventures, Wintermute, Ondo, and more.

“At Binance Labs, we seek out projects that drive meaningful innovation and expand the ecosystem, and we are excited to support Usual’s mission to push the boundaries of what stablecoins can achieve.” Alex Odagiu, Investment Director at Binance Labs, said.

Additionally, on the same day, OKX Ventures confirmed its investment in Usual, although the exact amount remains undisclosed.

“Through the organic integration of RWA and DeFi, USUAL has not only reshaped the yield structure of stablecoins but also created an economy driven by community co-creation and mutual benefit. We are excited to support USUAL in becoming the ‘new infrastructure’ that drives the long-term value creation and growth of global decentralized finance.” Dora, Founder of OKX Ventures, said.

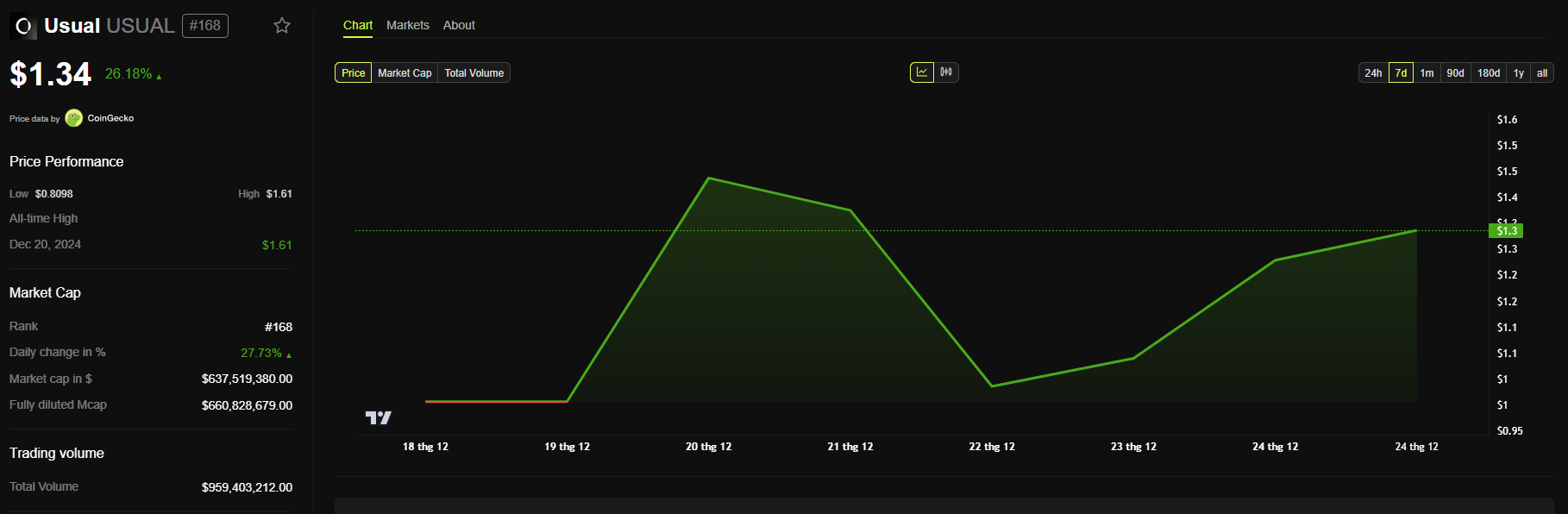

BeInCrypto data shows that the price of USUAL has increased by 26% following the news, currently trading around $1.3.

The total disclosed funding for Usual amounts to $18.5 million. According to CoinMarketCap, USUAL’s market capitalization has surpassed $600 million.

Its fully diluted valuation (FDV) exceeds $5 billion. Only 12% of the total supply, or 494 million USUAL, is in circulation. The project will unlock at least 3.2 million USUAL daily until 2028.

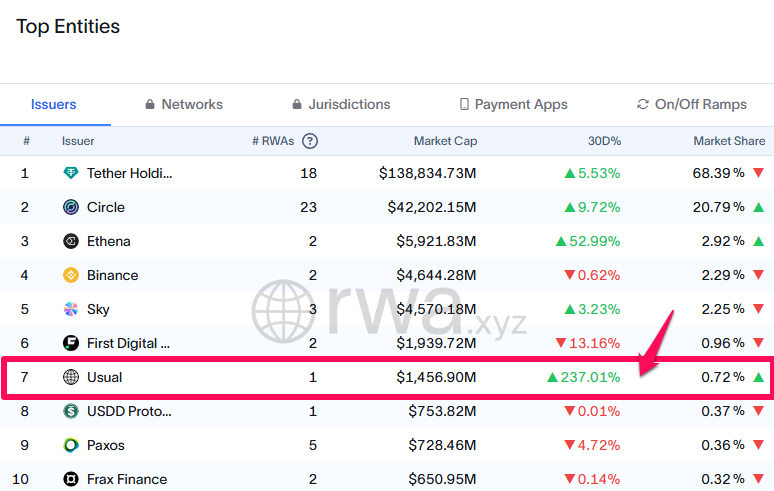

USD0 Stablecoin Growth Leads the Market

Data from RWA.xyz indicates that the market cap of USD0, Usual’s primary stablecoin, has grown from $20 million in mid-2024 to over $1.4 billion. Over the past 30 days, USD0’s market cap surged by 237%, making it the fastest-growing stablecoin of the month.

Additionally, throughout 2024, the stablecoin market has grown increasingly competitive, with several new entrants. For instance, Ethena Labs launched USDtb, a stablecoin backed by BlackRock’s BUIDL, while Ripple gained attention with the debut of RLUSD.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Nhat Hoang

https://beincrypto.com/binance-labs-and-okx-invest-in-usual/

2024-12-24 10:00:00