Leading meme coin Shiba Inu (SHIB) has seen a 4% price increase in the past 24 hours, reflecting the uptick in the broader crypto market. However, this price rally may be shortlived as bearish sentiment continues to overshadow the meme coin.

On-chain and technical indicators suggest that the Shiba Inu price rally could reverse its trend once the general market’s bullish pressure weakens.

Shiba Inu Records Outflow as Selling Pressure Mounts

Net outflows from SHIB’s spot market have been observed, indicating that investors are increasingly opting to sell their holdings. Today alone, $3.2 million has exited the meme coin’s spot market as its holders dump their coins. This marks the fourth consecutive day of outflows from the SHIB spot market, with a total of $13 million withdrawn.

When an asset witnesses net outflows from its spot market, it means more of the asset is being sold or withdrawn than bought or deposited. This signals reduced demand or a lack of confidence among investors, which can lead to downward price pressure. As with SHIB, persistent outflows indicate a bearish sentiment as investors prefer to lock in profits rather than hold their coins.

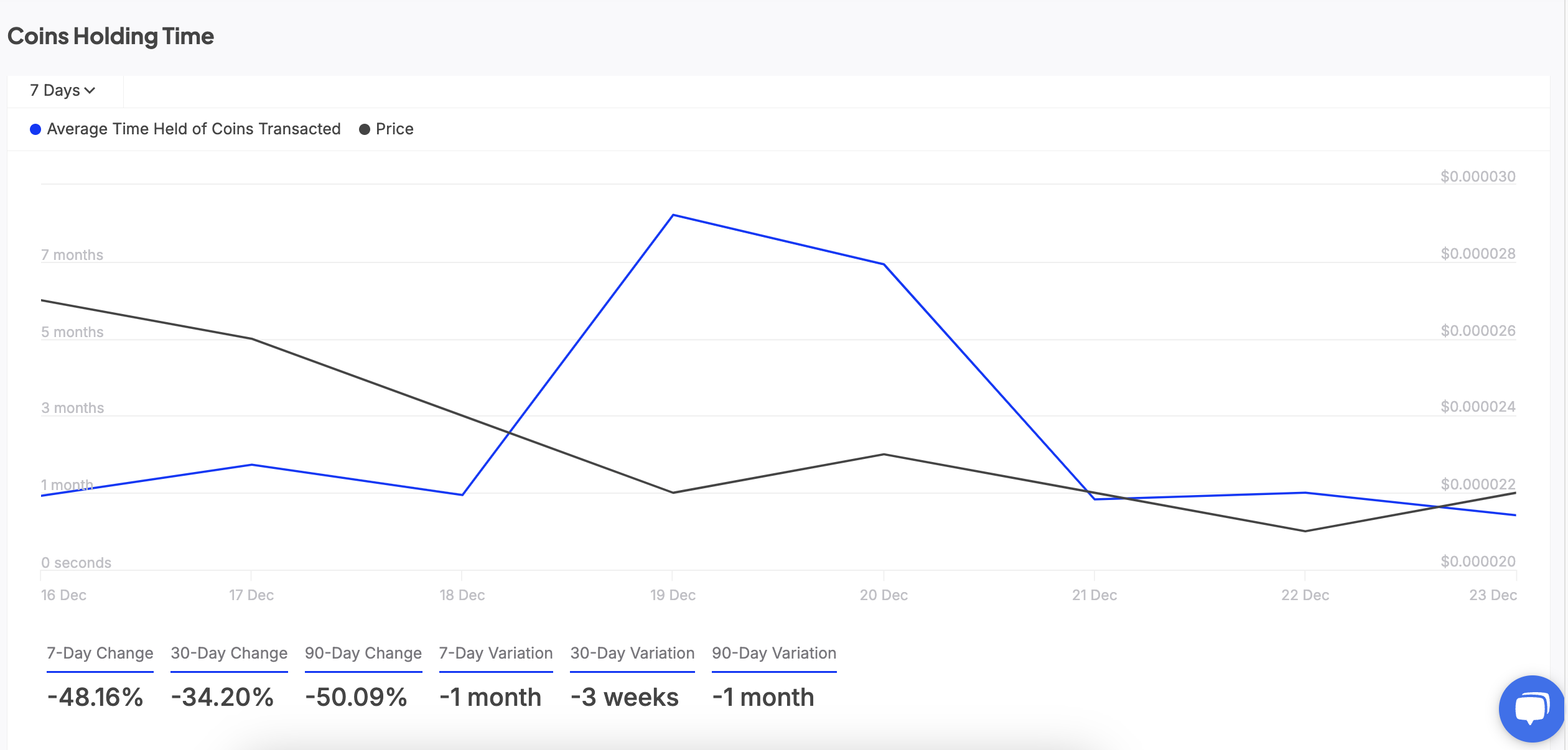

Notably, BeInCrypto’s assessment of SHIB’s on-chain performance has confirmed the decline in its holding time over the past week. According to IntoTheBlock, this has dropped by 48% in the past seven days.

An asset’s holding time measures the average length of time its tokens are held in wallets before being sold or transferred. When this metric dips, it indicates increased selling pressure among market participants. This scenario reflects the bearish sentiment toward the asset and contributes to its price decline.

SHIB Price Prediction: Can Bulls Defend the $0.000021 Mark?

SHIB is currently trading at $0.000022, holding above support at $0.000021. However, as bearish pressure intensifies, SHIB could witness a drawdown to this support level. If the bulls fail to defend it, the downtrend could gain momentum, driving SHIB’s price down to $0.000019.

Conversely, if market sentiment turns positive, the Shiba Inu price rally could continue toward $0.000026.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Abiodun Oladokun

https://beincrypto.com/the-shiba-inu-price-rally-3-2-million-market-outflows/

2024-12-24 13:00:00