Cardano (ADA) has struggled to regain bullish momentum after a sharp decline, keeping its price below the critical $1 level.

The altcoin’s inability to recover recent losses reflects a bleak outlook as it continues to consolidate in a narrow range. Weak investor sentiment and a lack of significant price movement exacerbate ADA’s struggles.

Cardano Investors Lose Interest

Cardano’s price DAA (Daily Active Addresses) divergence is currently flashing a sell signal, highlighting diminishing bullish potential. The metric indicates that the number of active participants interacting with the blockchain is declining, further reducing buying pressure. This trend signals a bearish outcome for the altcoin if market conditions fail to shift.

Adding to the concerns is the lack of price growth. A dwindling investor base is visible as trading volume for ADA stagnates. Without increased market participation, the possibility of Cardano achieving a significant rebound diminishes, leaving the altcoin vulnerable to further price depreciation.

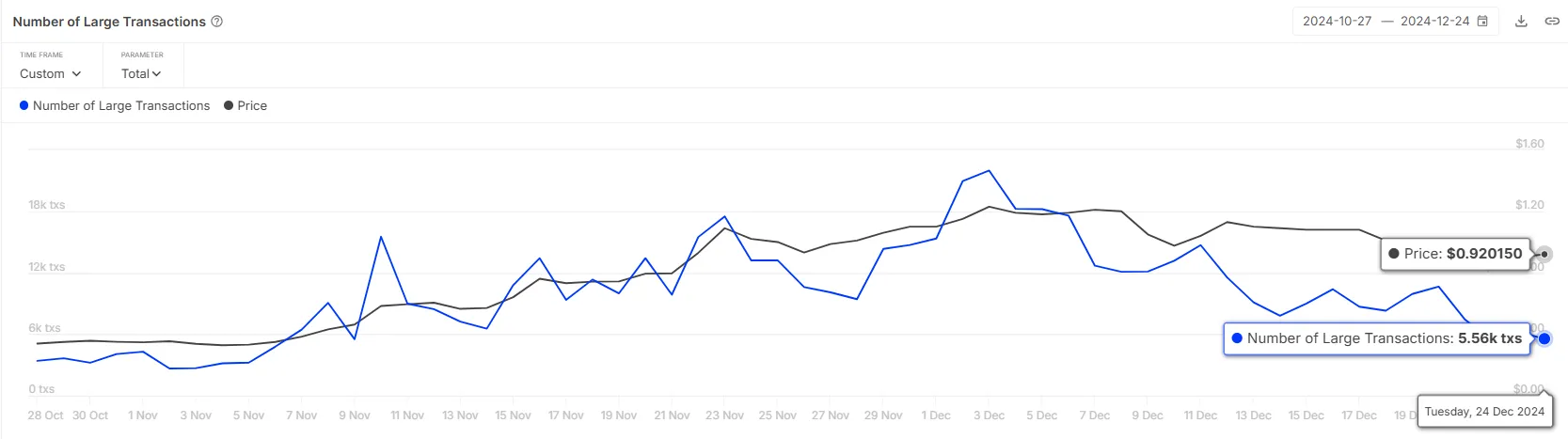

Cardano’s macro momentum also points to bearish challenges. Whale activity has seen a noticeable decline, with the number of transactions exceeding $100,000 dropping to a six-week low. This decrease reflects hesitancy among large investors who often influence market movements.

The drop in high-value transactions to 5,560 transactions over the last 24 hours aligns with ADA’s lack of growth in recent days. Large investors appear to be waiting for stronger signals of recovery before re-entering the market, further dampening Cardano’s prospects for a near-term rally.

ADA Price Prediction: Escaping Consolidation

Cardano’s price is currently consolidating around $0.92, trading within a tight range of $0.87 to $1.00. This sideways movement over the past week highlights fading recovery chances as the broader market remains stagnant. The lack of a decisive breakout further solidifies its bearish rut.

If current bearish indicators persist, ADA is likely to continue consolidating or drop below $0.87. A further decline could push the price toward $0.77, representing a significant loss for investors. Such a scenario would solidify the bearish outlook unless market conditions improve.

On the flip side, if investors regain confidence and market cues shift, ADA could break past the $1.00 mark. Achieving this level would invalidate the bearish thesis, potentially triggering a rally to higher price targets. However, such a recovery would require significant buying pressure and broader market support.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Aaryamann Shrivastava

https://beincrypto.com/cardano-price-stalls-as-whale-activity-declines/

2024-12-25 08:00:00