XRP price is currently the fourth largest cryptocurrency by market cap, with a valuation of $130 billion. Despite its strong position, XRP has faced a 10.4% decline over the past seven days, reflecting a period of consolidation following its historic rally in November and December.

Key technical indicators, including a neutral RSI and closely clustered EMA lines, suggest a lack of clear momentum, pointing to a market awaiting decisive action.

XRP RSI Has Been Neutral For 3 Days

XRP Relative Strength Index (RSI) is currently at 50.88, reflecting a neutral position since December 20. This level indicates that the market is balanced, with neither buyers nor sellers showing a decisive advantage.

Following a historic rally during November and December, XRP price has entered a consolidation phase. Its RSI has hovered between 40 and 55 over the past three days. This tight range suggests that the coin is experiencing a period of reduced volatility, with traders awaiting a clearer directional signal.

RSI is a momentum oscillator that measures the speed and magnitude of price movements on a scale from 0 to 100. Values above 70 typically indicate overbought conditions that could lead to a correction, while values below 30 suggest an oversold state, often preceding a rebound.

With XRP’s RSI at 50.88, the coin is firmly in the neutral zone, signaling neither excessive buying nor selling pressure. In the short term, this range-bound RSI behavior suggests that XRP price may continue to consolidate unless a strong catalyst emerges to break the current equilibrium.

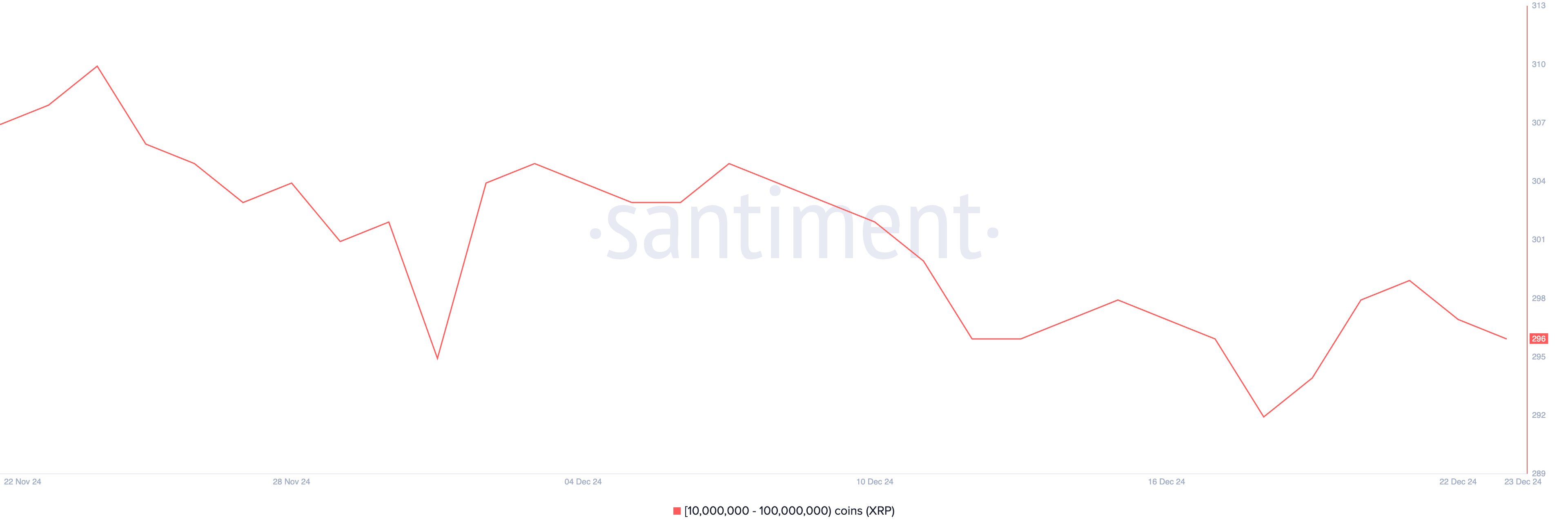

XRP Whales Stopped the Accumulation

On November 24, XRP whale addresses holding between 10 million and 100 million XRP reached a monthly high of 310, signaling significant accumulation among large holders. Since then, the number of whale addresses has gradually declined, reflecting a potential reduction in large-scale interest or distribution activity.

Notably, between December 18 and December 21, the whale count surged from 292 to 299, suggesting renewed interest during that period. However, the count has since declined slightly, now sitting at 296, indicating potential hesitation or profit-taking among major holders.

Tracking whale activity is crucial because these large addresses can significantly influence market trends due to the size of their holdings and potential trading activity.

The recent decline in whale addresses, following a brief surge, suggests mixed sentiment among major holders. In the short term, this could indicate that while some whales remain invested, others may be reducing their positions, potentially leading to XRP price consolidation or mild bearish pressure.

XRP Price Prediction: Can XRP Fall Below $2 In December?

XRP price is currently trading within a narrow range, with resistance at $2.33 and support at $2.17 defining its immediate boundaries.

If the support at $2.17 fails, XRP price could face a more substantial pullback, potentially dropping to $1.89.

Conversely, if XRP can break above the $2.33 resistance, it could pave the way for further gains, with potential targets at $2.53 and $2.64.

However, the EMA lines currently show no definitive trend, as they are closely clustered, indicating a period of consolidation. This lack of clear directional momentum suggests that XRP’s price movement will largely depend on whether it breaks out of this range, making these levels crucial to watch in the short term.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Tiago Amaral

https://beincrypto.com/xrp-price-consolidates-after-recent-decline-as-whales-wait-next-movements/

2024-12-25 15:00:00