PEPE bullish momentum has taken a hit, with the price retreating to a crucial support level at $0.00001748. This setback puts the bulls under pressure to hold the line as bearish forces regain strength.

After an initial rally showed promise, the inability to sustain upward movement signals a critical moment for the meme coin’s price trajectory. PEPE now faces a decisive retest, with the $0.00001748 level emerging as a key point of contention between buyers and sellers.

If the bulls manage to defend this support, it could act as a springboard for a rebound, setting the stage for a renewed attempt to break through higher resistance levels. However, failure to hold above this threshold may result in heightened bearish activity, pushing PEPE further downward and signaling a deeper correction.

PEPE Retreat To $0.00001748: What’s Driving The Pullback?

The inability of PEPE’s bulls to maintain upward momentum has been a primary factor in the price retreat. Buying pressure has dwindled after reaching resistance levels that tested market confidence, allowing bears to regain control. Its failure to generate sufficient volume to break through higher resistance zones suggests that the rally lacked the strength for sustained upward movement.

Key technical indicators, such as the Composite Trend Oscillator, have been signaling potential drop conditions in recent trading sessions. As a result, PEPE’s price correction was anticipated as the market sought to restore balance. The indicator’s move toward the neutral levels reflects this shift, while the 100-day Simple Moving Averages (SMA) show bearish crossovers that reinforce the current downtrend.

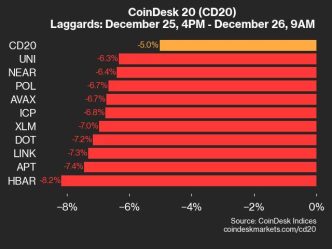

PEPE’s retracement must also be viewed in the context of the broader cryptocurrency market. Recent volatility in major assets like Bitcoin and Ethereum has created an uncertain environment, causing smaller tokens like PEPE to experience amplified price swings. Bearish sentiment across the market has likely weighed on PEPE, compounding its struggles to maintain higher levels.

Key Support Analysis: Can $0.00001748 Hold?

The $0.00001748 level has emerged as a critical support zone for PEPE as bearish pressure intensifies. This level has historically provided a strong floor, preventing deeper declines during previous downtrends. Its ability to hold hinges on several factors, including market sentiment, volume dynamics, and broader cryptocurrency market conditions.

If the $0.00001748 support holds firm, it could ignite renewed buying strength, providing bulls the capacity to regain control and drive the price higher toward its previous peak of $0.00002721. A decisive breakout above this resistance might pave the way for the formation of new highs, signaling a shift in market sentiment and stronger upward momentum.

However, a clear break below $0.00001748 may indicate more downside risk, potentially driving PEPE toward the next critical support at $0.00001313. Once this level is breached, the price could continue to decline, testing additional support zones.

Source link

Godspower Owie

https://www.newsbtc.com/analysis/pepe/bulls-falter-as-pepe-slide-to-0-00001748/

2024-12-26 13:00:00