XRP has been trapped in sideways momentum, struggling to join the league of cryptocurrencies like Bitcoin that have reached new all-time highs (ATHs).

The lack of significant movement has kept the altcoin from rallying, frustrating investors hoping for a breakout. XRP’s recent performance highlights growing bearish sentiment among traders.

XRP Traders Are Unsure

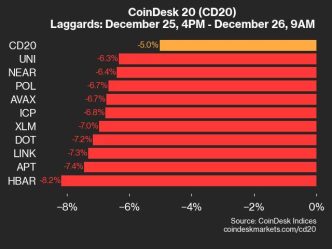

Traders are increasingly leaning toward shorting XRP rather than betting on a rally. The Long/Short ratio currently shows short contracts dominating long contracts, reflecting a monthly low. This imbalance highlights a bearish market sentiment, with investors expecting a decline rather than a surge in XRP’s price.

The dominance of short contracts suggests that most traders are preparing for XRP to lose value rather than recover. This bearish outlook reflects broader market uncertainty and could keep the altcoin’s price under pressure in the near term, especially without significant bullish catalysts.

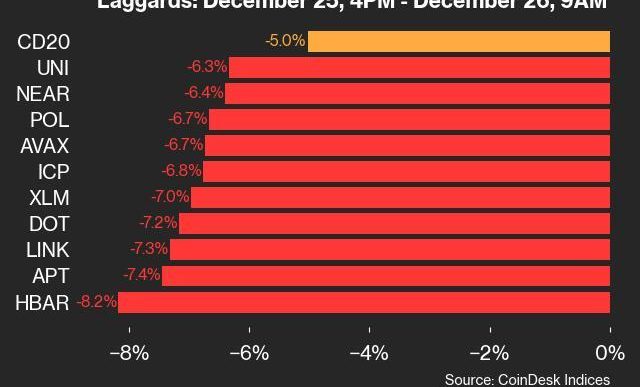

XRP’s macro momentum also shows bearish tendencies, with the Relative Strength Index (RSI) sliding downward. This decline indicates that bearish momentum is gaining strength, adding to the challenges for XRP. However, the RSI remains above the neutral line, suggesting that selling pressure is not yet overwhelming.

The RSI’s position leaves room for potential recovery, but the downward trajectory is a warning sign for cautious investors. Without increased buying activity, XRP could face further consolidation or even a downward breakout, emphasizing the need for traders to monitor momentum closely.

XRP Price Prediction: Staying In The Lane

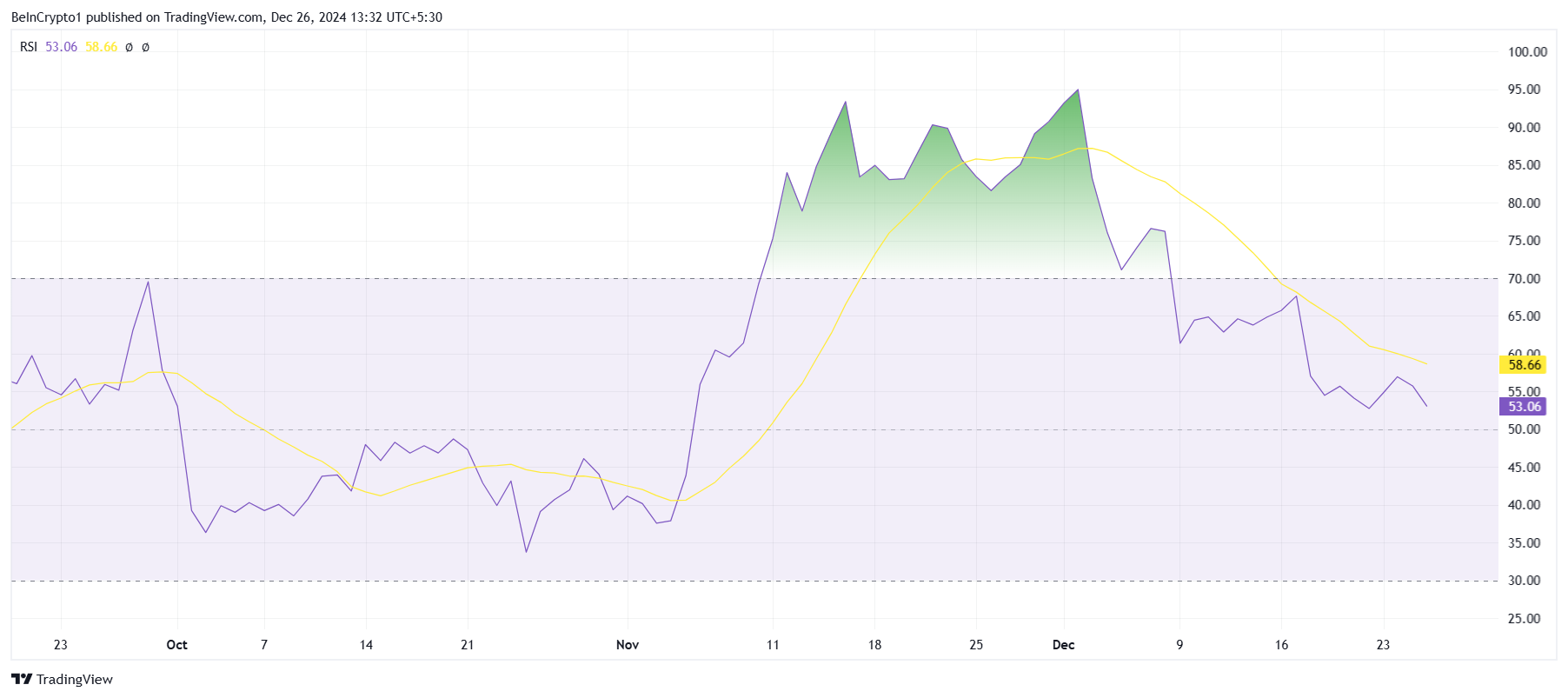

XRP is currently consolidating between $2.73 and $2.00, a range it has been stuck in for the past three weeks. This prolonged consolidation has kept the altcoin from breaking out, delaying its chances of forming a new ATH and leaving it vulnerable to market shifts.

The current ATH of $3.31 remains 48% away from XRP’s trading price of $2.24. For XRP to target this level, it must first break out of its current range and flip $2.73 into support. This move would signal renewed bullish momentum and set the stage for a potential rally.

If XRP fails to hold above the critical support of $2.00, the bullish thesis will be invalidated. A breakdown below this level could lead to a sharp decline, putting the altcoin at risk of further losses.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Aaryamann Shrivastava

https://beincrypto.com/xrp-rally-stifled-by-bearish-traders/

2024-12-26 13:00:00