Cardano’s (ADA) price has been on a steady decline, recently falling to a multi-week low of $0.84. This ongoing downtrend reflects broader market challenges, with investors displaying diminished optimism.

ADA’s inability to hold critical support levels has further contributed to its weakened position heading into 2025.

Cardano Investors Are Skeptical

The Price DAA Divergence indicator is currently flashing a sell signal, highlighting Cardano’s deteriorating market sentiment. This signal emerges from the combination of declining prices and reduced network participation. Such patterns suggest investors are losing confidence, with uncertainty surrounding ADA’s potential for recovery.

Adding to the bearish outlook, ADA’s participation metrics reveal a shrinking active user base. This declining interest reflects broader hesitation among investors. The reduced activity aligns with the downtrend, suggesting that market participants are increasingly backing away from the asset as recovery appears uncertain.

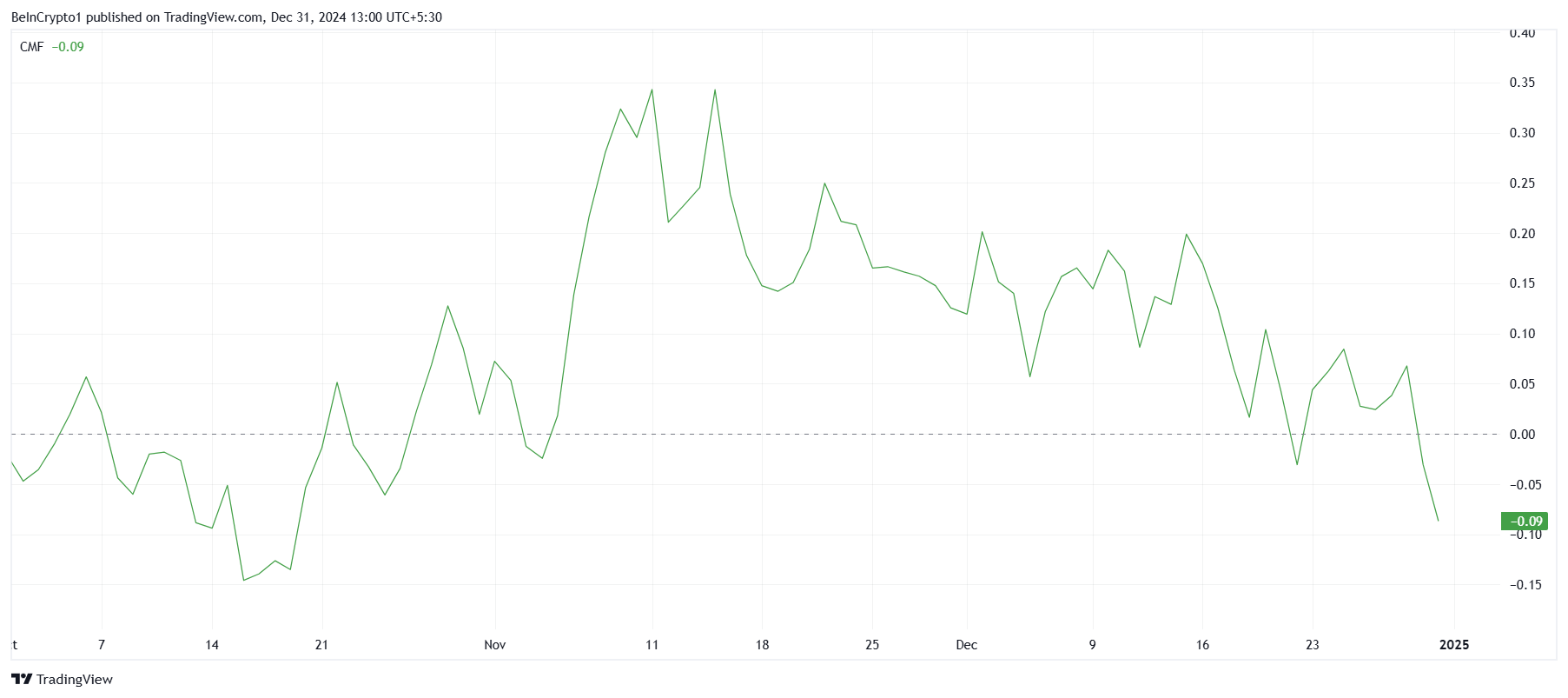

Cardano’s macro momentum shows further weakness, with the Chaikin Money Flow (CMF) indicator hitting a two-and-a-half-month low. This trend signals that outflows are currently dominating ADA’s market activity, reflecting a lack of fresh capital entering the ecosystem. The prolonged negative CMF highlights the challenges ADA faces in attracting investor confidence.

The lack of clear price direction is compelling ADA holders to exit their positions with selling pressure mounting, and the asset risks further decline. Unless macroeconomic or network-specific factors shift significantly, this trend is likely to persist, exacerbating ADA’s struggles as outflows continue to dominate.

ADA Price Prediction: Aiming At Recovery

Cardano’s current price of $0.84 has slipped below the crucial support level of $0.85. While ADA had managed to sustain itself above this mark in recent days, the last 24 hours have seen renewed pressure, resulting in further losses. This decline places ADA in a precarious position.

If ADA fails to reclaim the $0.85 support level, it risks falling to $0.77. Such a drop could be compounded by the ongoing high outflows, which weaken the asset’s price stability. This scenario would likely heighten bearish sentiment and further discourage investor participation.

Conversely, reclaiming $0.85 as support could provide ADA with a chance to recover. Successfully flipping this level could enable ADA to target $1.00 as a support floor once again. However, such a recovery depends heavily on improving sentiment and reducing capital outflows.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Aaryamann Shrivastava

https://beincrypto.com/cardano-outflows-increase-amid-prolonged-downtrend/

2024-12-31 09:33:05