Binance Labs announced today that it will undergo a rebrand without providing details about its new direction. The firm focused on several of its biggest achievements in 2024, providing clues into its next priorities.

Biotech and AI will be special areas of interest in 2025, but the company is “always on the lookout” to invest in crypto projects with strong fundamentals, such as real-world usage or sustainable business models.

Binance Labs’ Rebrand

Binance Labs, a research subsidiary of one of the world’s leading exchanges, discussed this rebrand via social media. Earlier this year, the firm conducted research on investment strategies for the impending bull market, and many of its ideas paid off. While announcing the rebrand, it also summarized its activities over the past year:

“Out of the 46 deals [we invested in], 10 fall under DeFi, 7 in AI, 7 in the BTC ecosystem, 4 in Restaking, 3 in Gaming, 2 in ZK, 2 in RWA, and 2 in consumer apps. The remaining investments spanned infrastructure—from security to wallet and chain abstraction—and emerging sectors like the Move ecosystem and DeSci,” the group’s statement stated.

A particular interest was in the MVB program, which BNB Chain operates. Of the “Most Valuable Builder” projects this group identified, Binance Labs financially contributed to 14 of them. It predicts a favorable year in 2025 for a variety of reasons, not least of which is President Trump’s re-election.

The fund claimed that the most intriguing sectors in 2025 were Biotech and AI, alongside general crypto/blockchain development. In the past few months, Binance Labs has invested in several of these, entering the DeSci space with BIO Protocol in November and contributing $43 million to decentralized AI research in August.

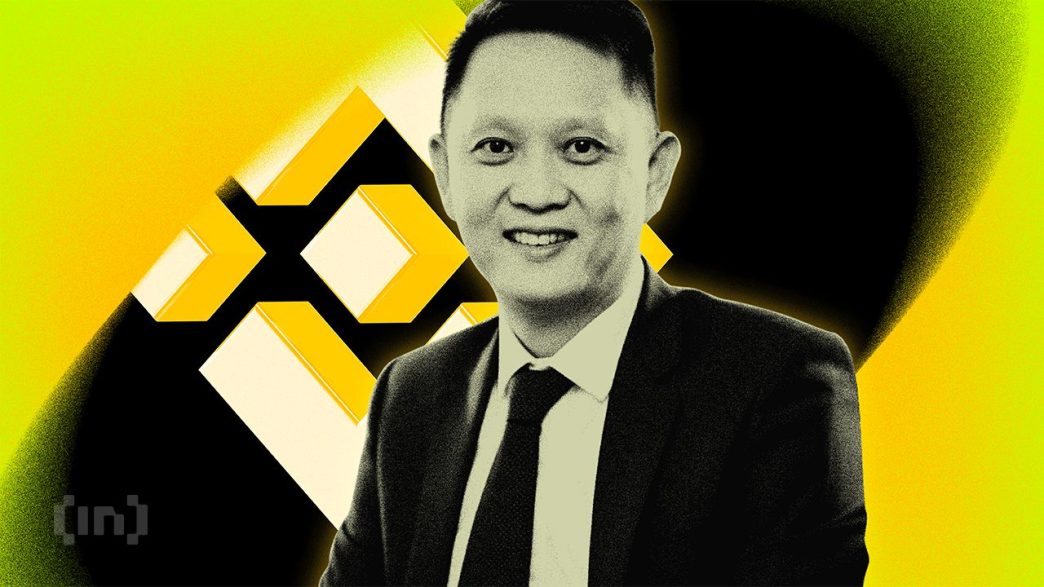

Additionally, the group noted that its former CEO Changpeng “CZ” Zhao would be “back in action.” CZ was released from prison in September, although with the caveat that he will never regain his former position. Still, as a free man, he will apparently have an influential presence in Binance’s future direction.

The statement concluded by saying Binance Labs will expand its scope of investment after the rebrand. It will expand beyond primary market deals to “any type of deal, including liquid in the secondary, OTC, etc.”

Also, the organization stressed its chain-agnostic nature and willingness to invest in any product with durable fundamentals that will last through multiple market cycles.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Landon Manning

https://beincrypto.com/binance-labs-rebrand-2025-investments/

2024-12-31 19:29:14