HBAR has struggled with stagnant price action throughout the last month, leaving investors skeptical about the potential for further gains.

Despite this lack of growth, broader market cues continue to support a bullish outlook, offering a glimmer of hope for a price recovery in the near future.

Hedera Hashgraph Faces Outflows

The Chaikin Money Flow (CMF) indicator for HBAR is currently below the zero line, signaling that outflows are dominating the asset. This trend reflects growing investor skepticism, with many pulling their funds out due to the lack of momentum supporting a price rise. Such outflows often weaken bullish sentiment and increase the risk of a price drop.

Investor doubt remains a significant hurdle for HBAR. If confidence continues to erode, selling pressure could intensify, further suppressing upward movement. The ongoing outflows exhibit the need for stronger market participation to reverse the current sentiment and support a potential recovery.

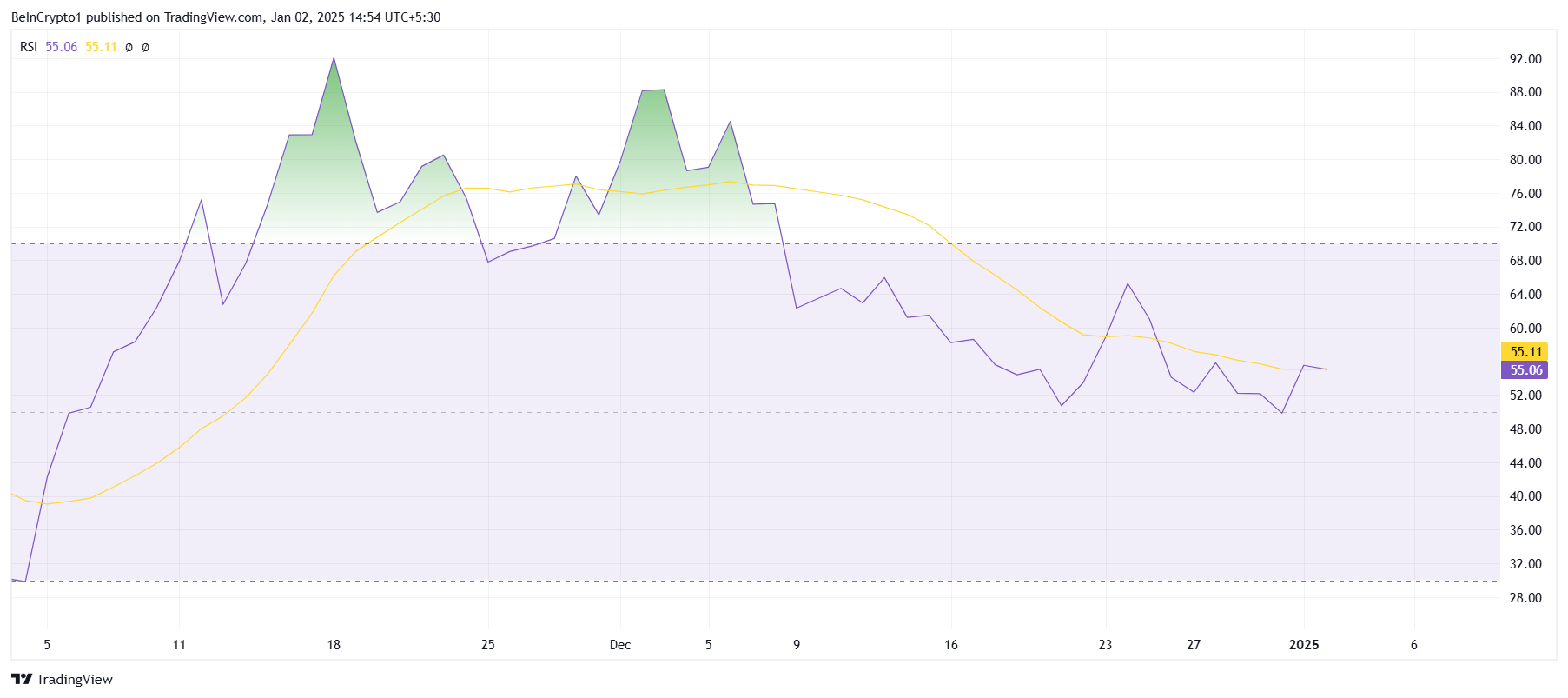

Despite the challenges, HBAR’s Relative Strength Index (RSI) remains above the neutral line at 50.0, indicating that the broader market is still providing some bullish support. This stability in the RSI suggests that while HBAR faces resistance, a complete breakdown may be avoided if market cues remain favorable.

The RSI’s position reinforces the possibility of maintaining the current price levels. Broader macroeconomic factors could play a crucial role in determining whether HBAR can sustain its position and potentially regain upward momentum. A shift in external conditions could provide the catalyst needed for a breakout.

HBAR Price Prediction: Breaking Resistances

HBAR is currently trading sideways, stuck between $0.39 and $0.25. Throughout December, the altcoin has only tested the $0.39 resistance once, highlighting the lack of sustained momentum. This range-bound behavior highlights the challenges HBAR faces in mounting a significant recovery.

Given the current sentiment and technical factors, it is likely that HBAR will remain in consolidation for the time being. However, if bearish sentiment intensifies, a drop below the $0.25 support level could occur, potentially leading to further declines and dampened investor optimism.

Conversely, a surge in bullishness driven by broader financial market conditions could help HBAR breach the $0.39 resistance. Such a breakout would invalidate the bearish-neutral outlook, reviving investor confidence and setting the stage for renewed upward movement. The coming weeks will be pivotal in determining HBAR’s trajectory.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Aaryamann Shrivastava

https://beincrypto.com/hbar-price-faces-recovery-struggles/

2025-01-02 15:00:00