Tron’s T3 Financial Crime Unit, formed through a partnership between Tron, Tether, and TRM Labs, has frozen $100 million in Tether’s USDT since its inception in September.

The unit focuses on identifying and blocking illicit activities involving the stablecoin.

Crypto Money Laundering Remains a Critical Challenge

T3’s efforts included analyzing millions of transactions across five continents. According to a recent statement, the unit monitored over $3 billion in USDT transactions.

TRM Labs provides blockchain intelligence tools to help identify and freeze funds tied to criminal activity on the Tron blockchain.

With $60 billion in USDT circulating on Tron, it represents the second-largest stablecoin network after Ethereum. The most common source of frozen funds stems from “money laundering as a service,” where criminals use dark web services to clean illicit proceeds.

Meanwhile, other targets include investment scams, drug trafficking, terrorism financing, blackmail, hacking incidents, and violent crime.

T3 also uncovered $3 million in USDT linked to North Korean actors. These funds were allegedly used to support the regime’s fundraising efforts through crypto exploits.

Financial Crime and Crypto Regulation in Focus

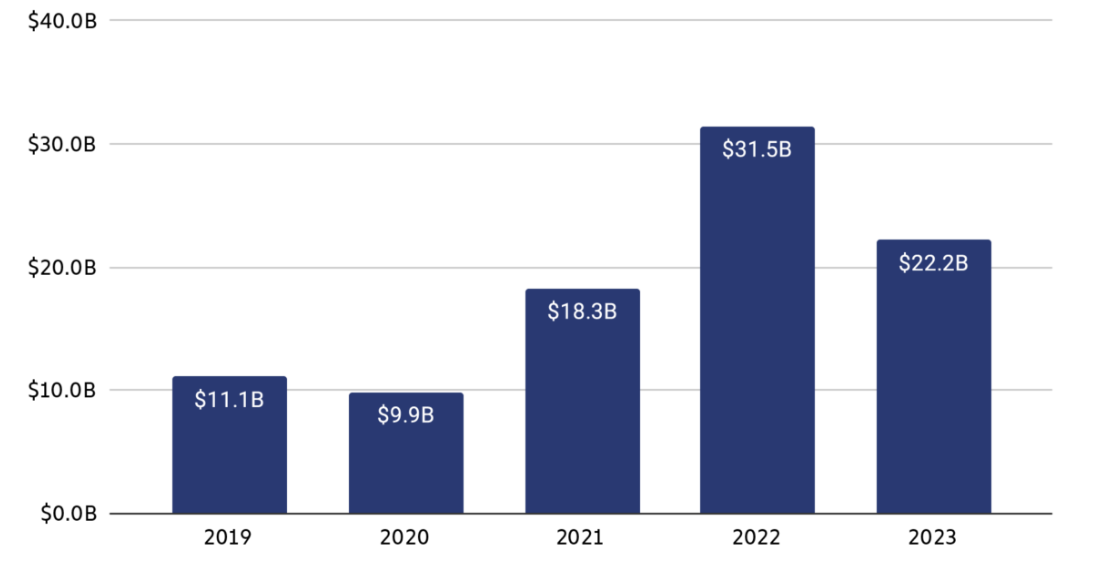

Preventing money laundering has remained a central concern for both regulators and the crypto industry. This focus intensified in 2024 and is expected to remain a top priority in 2025.

Earlier in 2024, Binance faced a $4.4 million penalty in Canada for breaching anti-money laundering (AML) regulations. Despite repeated warnings, the exchange failed to comply with national AML laws.

Additionally, Binance and its former CEO Changpeng Zhao (CZ) are defendants in a class-action lawsuit filed in Seattle. The suit alleges that the exchange’s lapses in AML measures enabled crypto money laundering activities, leaving three investors unable to recover stolen assets.

In another high-profile case, Alexey Pertsev, a Tornado Cash developer, received a 64-month prison sentence from a Dutch court. Pertsev was convicted of laundering $1.2 billion through the crypto-mixing platform.

Meanwhile, a US federal appeals court overturned the Treasury Department’s sanctions against Tornado Cash. The decision reignited discussions about regulating blockchain tools while balancing privacy concerns and crime prevention.

Also, USDT issuer Tether also came under fire in 2024 for similar laundering acquisitions. In October, a Wall Street Journal report alleged that third parties might have used Tether to facilitate activities such as drug trafficking, terrorism financing, and hacking.

However, Tether CEO Paolo Ardoino dismissed these claims. He denied any ongoing crypto money laundering investigation against the company.

Efforts like those led by Tron’s T3 unit reflect the growing need for accountability and oversight within the crypto sector. Global regulators and industry stakeholders will continue working to curb financial crimes.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.

Source link

Mohammad Shahid

https://beincrypto.com/crypto-money-laundering-tron-t3-freezes-100m-usdt/

2025-01-02 23:52:53