Dogecoin has made some notable recovery during the past week, but social media users have remained bearish. Here’s why this could be good for the rally.

Dogecoin Weighted Sentiment Has Remained Negative Recently

As pointed out by analyst Ali Martinez in a new post on X, the Dogecoin Weighted Sentiment still has a red value. The “Weighted Sentiment” here refers to an indicator from the analytics firm Santiment that tells us about the dominant sentiment related to a given asset that’s present on the major social media platforms.

This metric is based on two other indicators: Sentiment Balance and Social Volume. The first of these, the Sentiment Balance, calculates the net sentiment present on social media.

It works by putting the various posts/messages/threads through a machine-learning model to differentiate between positive and negative posts. Then, it takes the two counts and subtracts them to determine the net market situation.

While the Sentiment Balance does provide a rough overview of social media, it may not always be the best representation of the majority of the users, as all it can do is take into account the data of the posts currently present. That is, it only says about the sentiment of the active users, regardless of whether they are actually a minority by count.

To mitigate this problem and achieve more accuracy, the Weighted Sentiment incorporates the second element: the Social Volume. This indicator measures the total unique number of posts on social media that mention the cryptocurrency.

Thus, by weighting the Sentiment Balance by this metric, the Weighted Sentiment ensures that its value only registers a spike (in either direction) when there is both a significant tendency towards one sentiment and a large number of users voicing said sentiment.

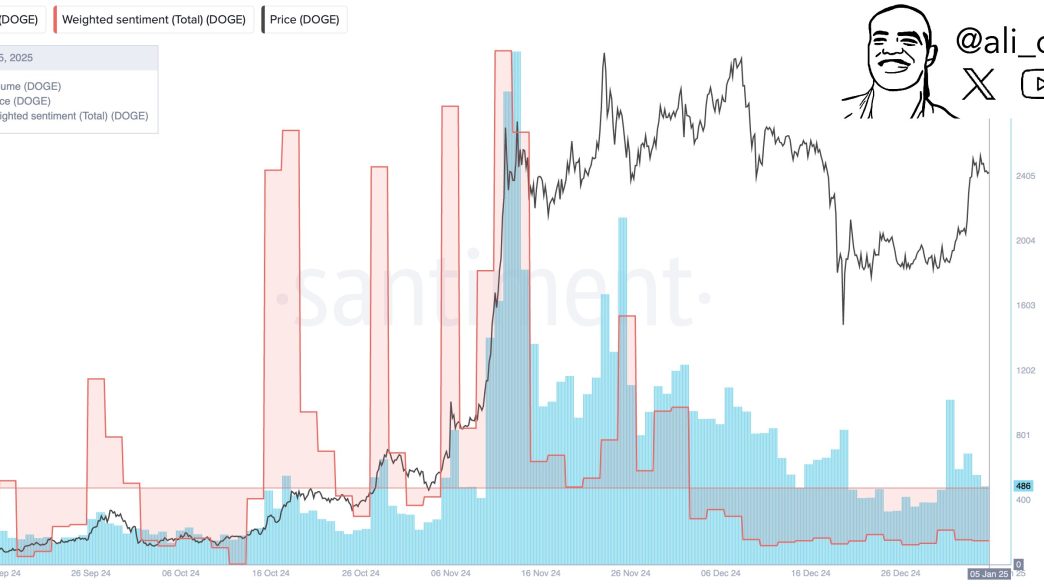

Now, here is the chart for the Weighted Sentiment for Dogecoin shared by the analyst that shows the trend in its value over the past few months:

As displayed in the above graph, the Dogecoin Weighted Sentiment turned negative in December as the meme coin’s bull rally hit an obstacle, and its price reversed to the downside.

The negative sentiment hasn’t changed in 2025 so far, but interestingly, the trend in the price has. Over the past week, the asset has seen a recovery rally of more than 20%. The continued bearish sentiment would imply this run hasn’t been enough to change the opinion of social media users yet.

Historically, digital assets have tended to move in a way that’s opposite to the expectations of the majority. From the chart, it’s apparent that Dogecoin’s tops in November were accompanied by sharp positive spikes in the Weighted Sentiment.

Therefore, considering that the traders are pessimistic towards DOGE right now, chances may be that this latest rally could have further room to run before encountering a wall.

DOGE Price

Following its recovery during the last few days, Dogecoin has seen its value climb to the $387 mark.

Source link

Keshav Verma

https://www.newsbtc.com/news/dogecoin/dogecoin-jumps-19-social-media-bearish-green-rally/

2025-01-07 01:30:35