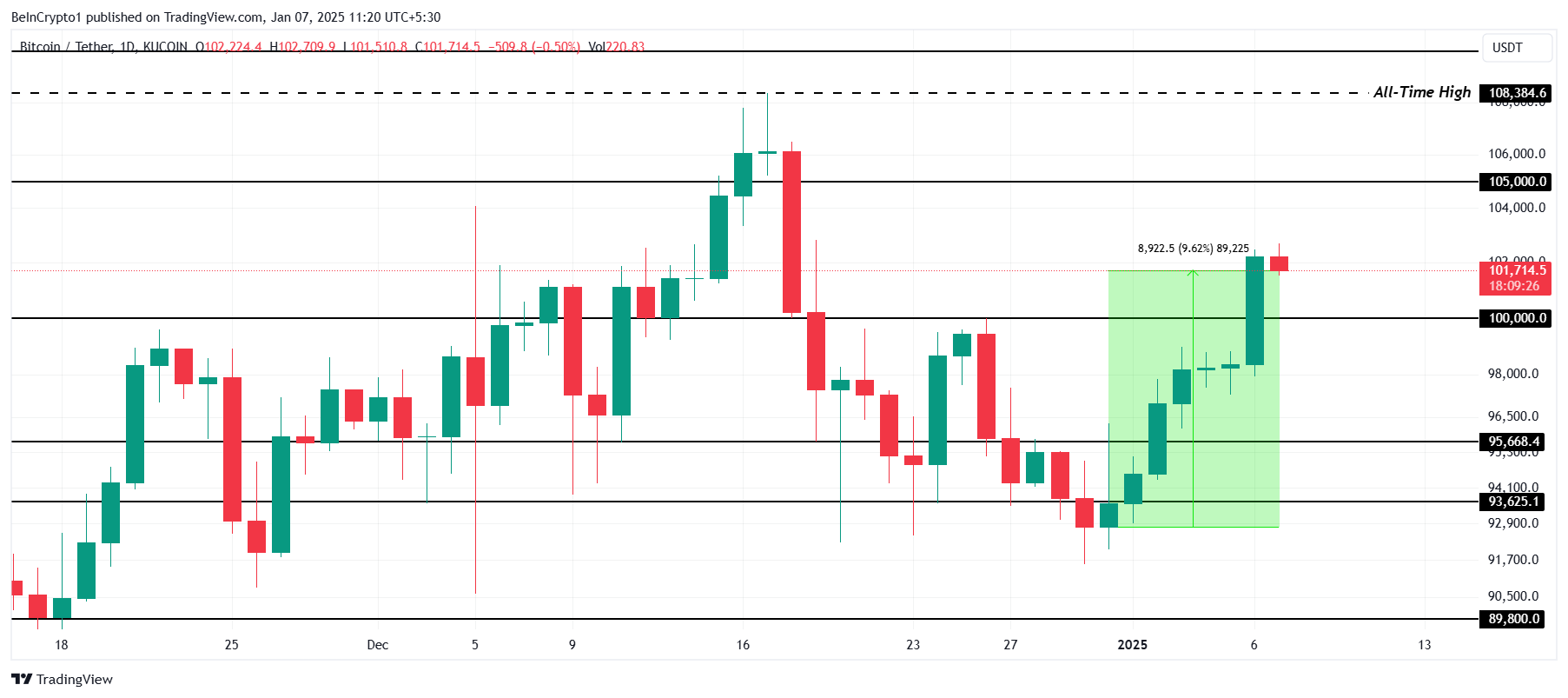

Bitcoin’s price has risen consistently over the past week, breaching the $100,000 mark and settling at $101,714. This 9% weekly growth reflects the resilience of the crypto king after weeks of consolidation.

However, concerns linger as short-term holders begin to see significant profits, stirring fears of a potential market reaction.

Bitcoin Investors Give No Hint

Despite Bitcoin crossing the $100,000 mark, investor sentiment appears muted. Historically, Bitcoin’s price has often moved opposite to the expectations of the retail crowd. The current lack of euphoric buying or despair-driven selling indicates a cautious approach.

This quiet sentiment contrasts sharply with past reactions when Bitcoin crossed major price thresholds. Social media timelines filled with extreme optimism or pessimism have previously signaled strong market moves. In the absence of such extremes, the prevailing uncertainty suggests a cautious outlook among both seasoned investors and retail traders.

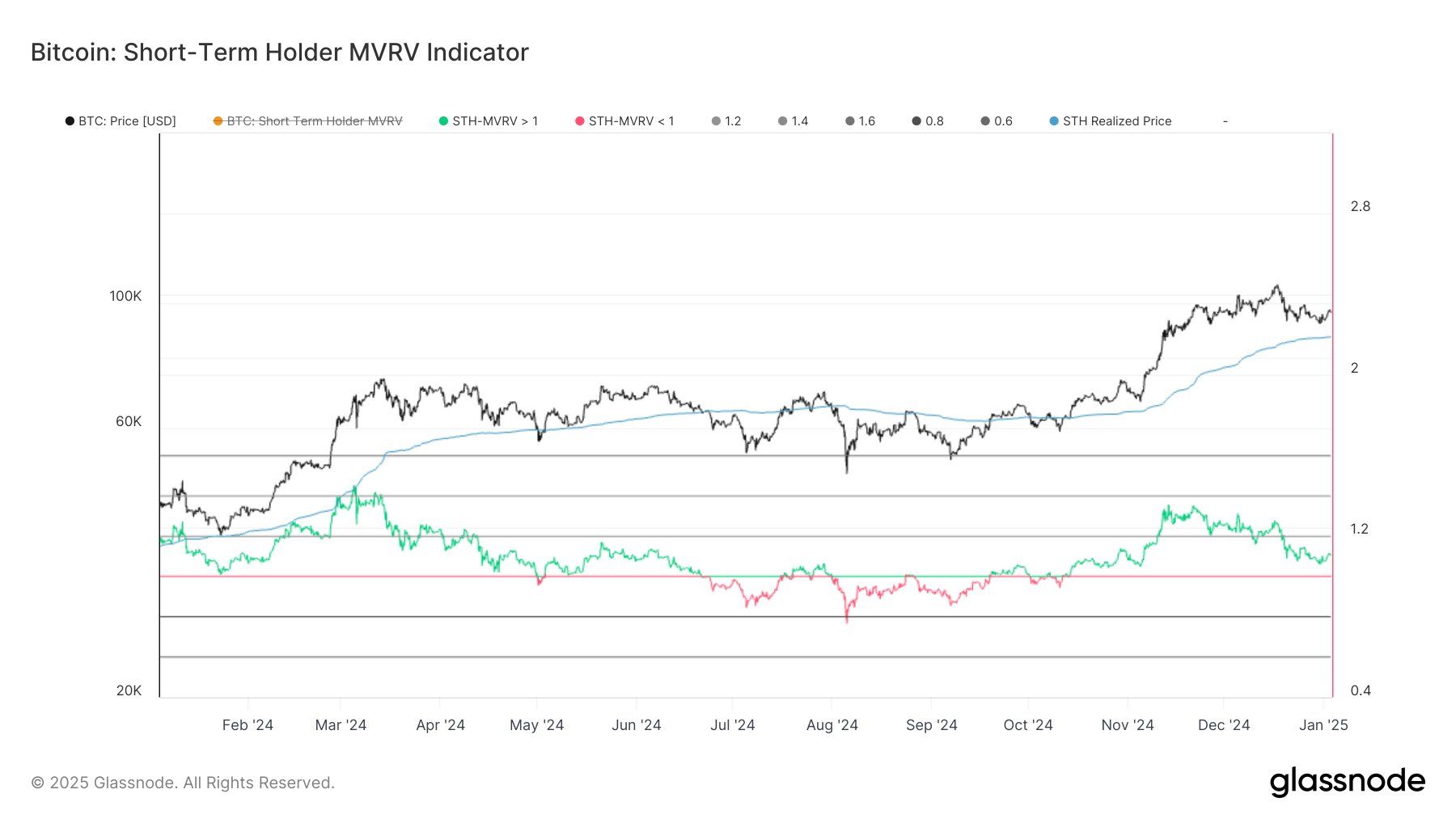

Bitcoin’s short-term holder (STH) MVRV ratio is signaling a critical moment. Currently, short-term holders are averaging a 10% profit, which raises concerns about profit-taking activity. These investors have historically been quick to sell at signs of gains, potentially triggering a market downturn.

The ratio’s current levels suggest that a sell-off could be imminent as the profitability of these holders increases. The broader market, however, remains resilient, with long-term investors continuing to hold, mitigating fears of a sharp decline. Nonetheless, the potential for profit-taking remains a risk factor.

BTC Price Prediction: Reclaiming Key Support

Bitcoin’s price is now at $101,714, marking a significant recovery above the $100,000 threshold. This momentum positions BTC to potentially target $105,000 if the support at $100,000 is secured. The positive market cues and investor optimism could further fuel this rally, solidifying Bitcoin’s uptrend.

However, maintaining the $100,000 level as a support floor is crucial. Failing to do so could trigger a correction, pushing Bitcoin down to $95,668. This would invalidate the bullish outlook and erase a significant portion of the recent gains, dampening investor enthusiasm.

If Bitcoin successfully flips $100,000 into support, the market may see renewed bullish momentum, driving prices toward new highs. However, vigilance is key as short-term holders may act as a disruptive force.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Aaryamann Shrivastava

https://beincrypto.com/bitcoin-price-rise-leads-to-eery-silence/

2025-01-07 06:27:38