Leading altcoin Ethereum (ETH) has seen a remarkable spike in the past week. Its value has climbed nearly double digits and currently trades at $3,672.

However, hopes of a sustained rally towards the $4,000 mark may face headwinds as a significant increase in sell orders has been observed in the coin’s futures market.

Ethereum Sellers Dictate Price Trends

CryptoQuant’s data shows a surge in sell orders in the ETH futures market, with its taker buy-sell ratio remaining below one since January 4. Currently, the ratio stands at 0.84.

This metric tracks the proportion of buy orders to sell orders in the futures market. A ratio below one signals more sell orders being executed, reflecting a shift in market sentiment from bullish to bearish. The growing selling pressure could weigh on ETH’s price, potentially erasing some of its recent gains.

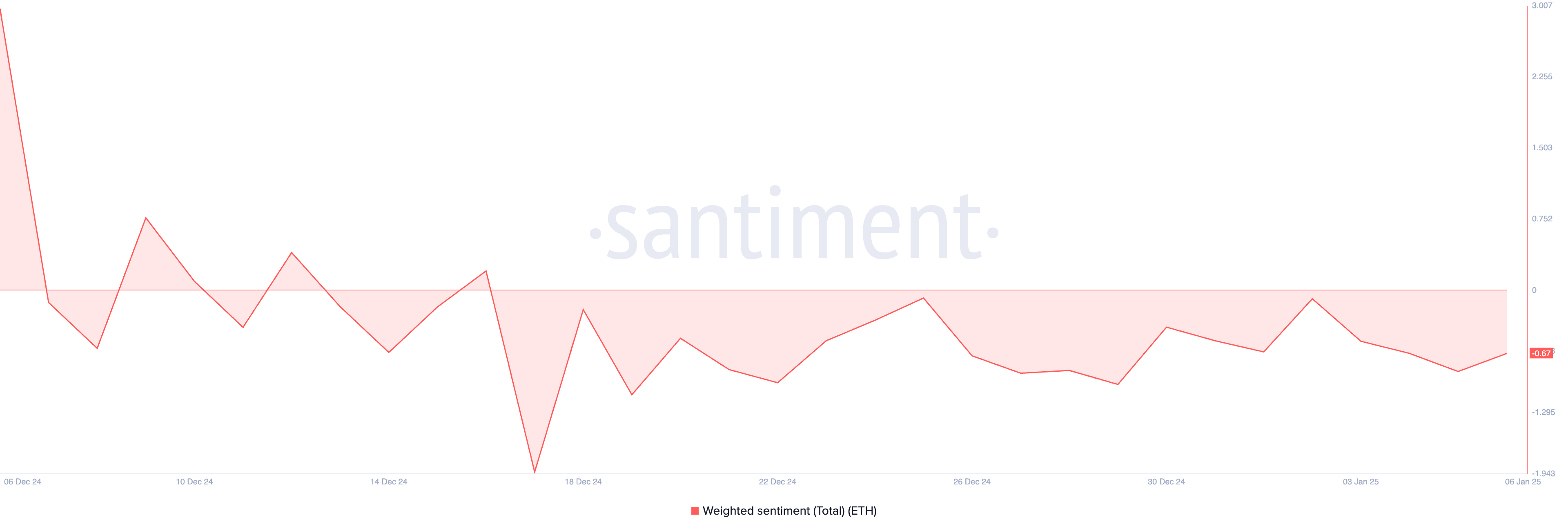

Moreover, the coin’s negative weighted sentiment confirms the likelihood of a price correction. For context, ETH’s weighted sentiment has returned predominantly negative values since December 17. At press time, this stands at -0.67.

This metric measures the overall sentiment expressed towards a particular asset, considering both the sentiment polarity (positive or negative) and the volume of social media mentions. As with ETH, a negative weighted sentiment indicates that the prevailing sentiment towards the asset is predominantly negative, suggesting potential bearish market conditions.

ETH Price Prediction: $4,000 Target Feels Distant

ETH currently trades at $3,654, slightly above support formed at $3,332. If futures market selloffs intensify, this support level will be tested. A breach of this zone could occasion an ETH price drop to $2,509, further from the highly coveted $4,000 mark.

On the other hand, if selling activity stalls and buying pressure resurges, it could propel ETH’s price above the $4,000 mark and toward the four-year high of $4,783.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Abiodun Oladokun

https://beincrypto.com/eth-price-faces-surge-in-sell-orders/

2025-01-07 15:00:00