XRP supporter and pro-crypto lawyer John Deaton says he wants to help the incoming Trump Administration investigate “Operation Choke Point 2.0.”

Deaton says on the social media platform X that he wouldn’t take a salary and just wants the opportunity to “uncover multiagency coordination and possible corruption” related to the government’s alleged efforts to de-bank crypto firms.

The lawyer argues that Custodia Bank’s legal battle against the U.S. Federal Reserve is the “most important filed case” in the crypto industry.

“At their core, Custodia Bank’s fight and Choke Point 2.0, go beyond digital assets, banking charters or blockchain. It’s about whether unelected bureaucrats can arbitrarily deny access to essential financial infrastructure, effectively picking winners and losers in the marketplace. It’s about whether government agencies can wield unchecked power to restrict lawful businesses from accessing the critical financial infrastructure necessary to survive and thrive in a free market economy.

If these actions go unchallenged, it creates a dangerous precedent where regulatory bodies can quietly suppress entire industries they disfavor, stifling innovation, competition, and economic opportunity.

Custodia and Choke Point 2.0 are much bigger than crypto. They define whether America remains a place where the rule of law protects free enterprise, or where bureaucratic discretion is allowed to dismantle it.”

Deaton isn’t the only person talking about Operation Choke Point 2.0.

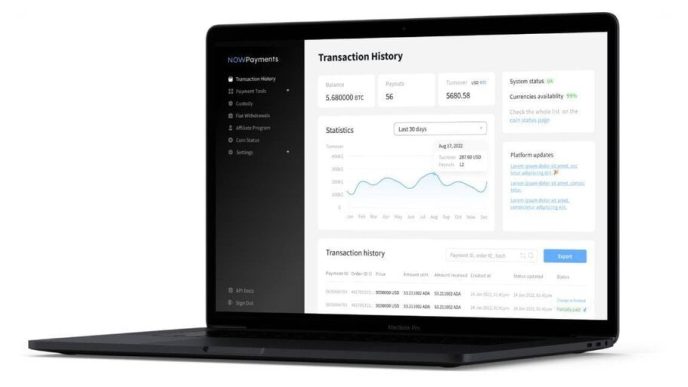

Coinbase’s chief legal officer Paul Grewal recently argued that documents secured by the exchange show that the Federal Deposit Insurance Corporation (FDIC) was attempting to sabotage a wide variety of activity in the crypto industry.

Coinbase filed Freedom of Information Act requests related to the FDIC’s letters to banks about crypto services.

Grewal says there is clear evidence of a deliberate effort by the government to stifle the growth of crypto in the US.

“We finally got the unredacted OCP 2.0 letters from [the FDIC]. It took a court order but you can now read them for yourself… They show a coordinated effort to stop a wide variety of crypto activity – everything from basic BTC transactions to more complex offerings.

Note that FDIC magically found TWO more pause letters in this search after saying before that it had complied with an earlier Court order. It’s hard to believe in their good faith when their sweater further unravels every time we pull on the thread. The new Congress should launch hearings on all this without delay.”

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Daily Hodl Staff

https://dailyhodl.com/2025/01/07/pro-crypto-lawyer-john-deaton-volunteers-to-lead-federal-investigation-into-operation-chokepoint-2-0/

2025-01-07 17:55:56