XRP’s price action remains stagnant, with the crypto consolidating for six weeks and failing to reach its all-time high (ATH) of $3.31.

Investors, frustrated by the lack of momentum, are opting to cash out, signaling increased profit-taking activity. This trend may impact the altcoin’s price trajectory in the coming weeks.

XRP Investors Are Bowing Out

Realized profits spiked significantly in the last 24 hours, with nearly 695 million XRP, valued at over $1.6 billion, sold. This increase in profit-taking highlights growing investor dissatisfaction with XRP’s stagnant price movement. Such behavior has been observed before during prolonged consolidations and could exacerbate selling pressure.

The ongoing consolidation has previously triggered minor sell-offs, which have kept XRP from gaining upward momentum. As selling frequency increases, the token’s price may face further challenges, though the resilience of key support levels offers hope for stability.

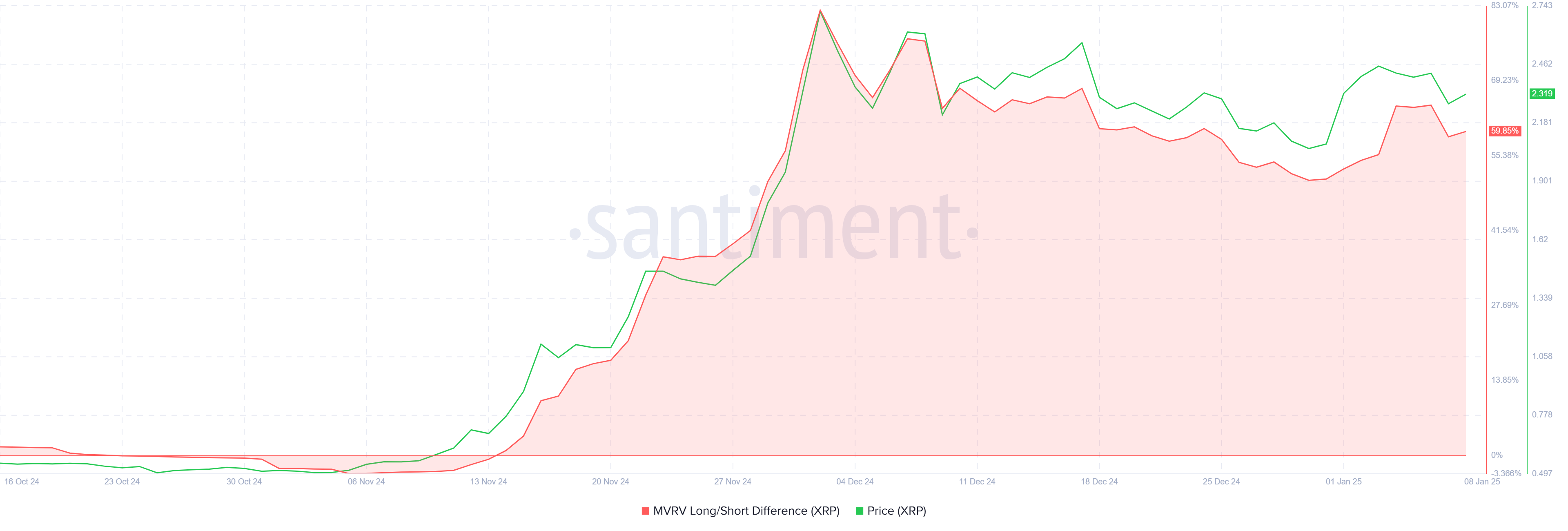

The MVRV Long/Short Ratio reveals that long-term holders are still sitting on profits, contributing to XRP’s stability. These investors, essential for the health of any cryptocurrency, are demonstrating resilience by holding their positions despite market stagnation.

This resilience has helped XRP maintain its support level at $2.00, even amid increased profit-taking. As long as these holders continue to back the asset, XRP is unlikely to experience a major decline in value, barring an unexpected spike in selling activity.

XRP Price Prediction: No Escape

XRP is currently trading at $2.31, confined to a consolidation range between $2.00 and $2.73. This sideways movement, persisting for six weeks, has stalled any significant price growth for the altcoin.

The consolidation has kept XRP from breaching the $2.73 resistance level and approaching its ATH of $3.31. Given the current market conditions and sentiment, this trend of price stagnation is likely to continue in the near term.

However, a rise in selling pressure could threaten XRP’s support at $2.00. Losing this critical level could lead to a price drop, potentially reaching $1.50 or lower. Such a scenario would invalidate the current bullish-neutral outlook, resulting in significant losses for investors.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Aaryamann Shrivastava

https://beincrypto.com/xrp-investors-sell-after-price-consolidates/

2025-01-08 07:03:32