Bitget’s native token, BGB, has noted a 4% price surge over the past 24 hours. This rally has made it the market’s top gainer among the top 100 cryptocurrencies by market capitalization during that period.

However, while this price uptrend might seem bullish, a look at BGB’s technical indicators reveals a potential looming decline. This analysis explains why.

Bitget Climbs, But the Rally May Not Last

BGB’s Balance of Power (BoP), observed on a 12-hour chart, hints at a potential correction in the token’s price. As of this writing, the indicator is below zero at -0.12.

The BoP indicator measures the strength of buyers versus sellers in the market by analyzing price movements within a given period. As with BGB, a divergence is formed when the indicator’s value is negative during a price rally.

This divergence suggests that sellers are exerting significant influence, potentially weakening the rally’s momentum or indicating a lack of strong buyer conviction. This indicates that the upward price movement may not be sustainable or could reverse if selling pressure increases.

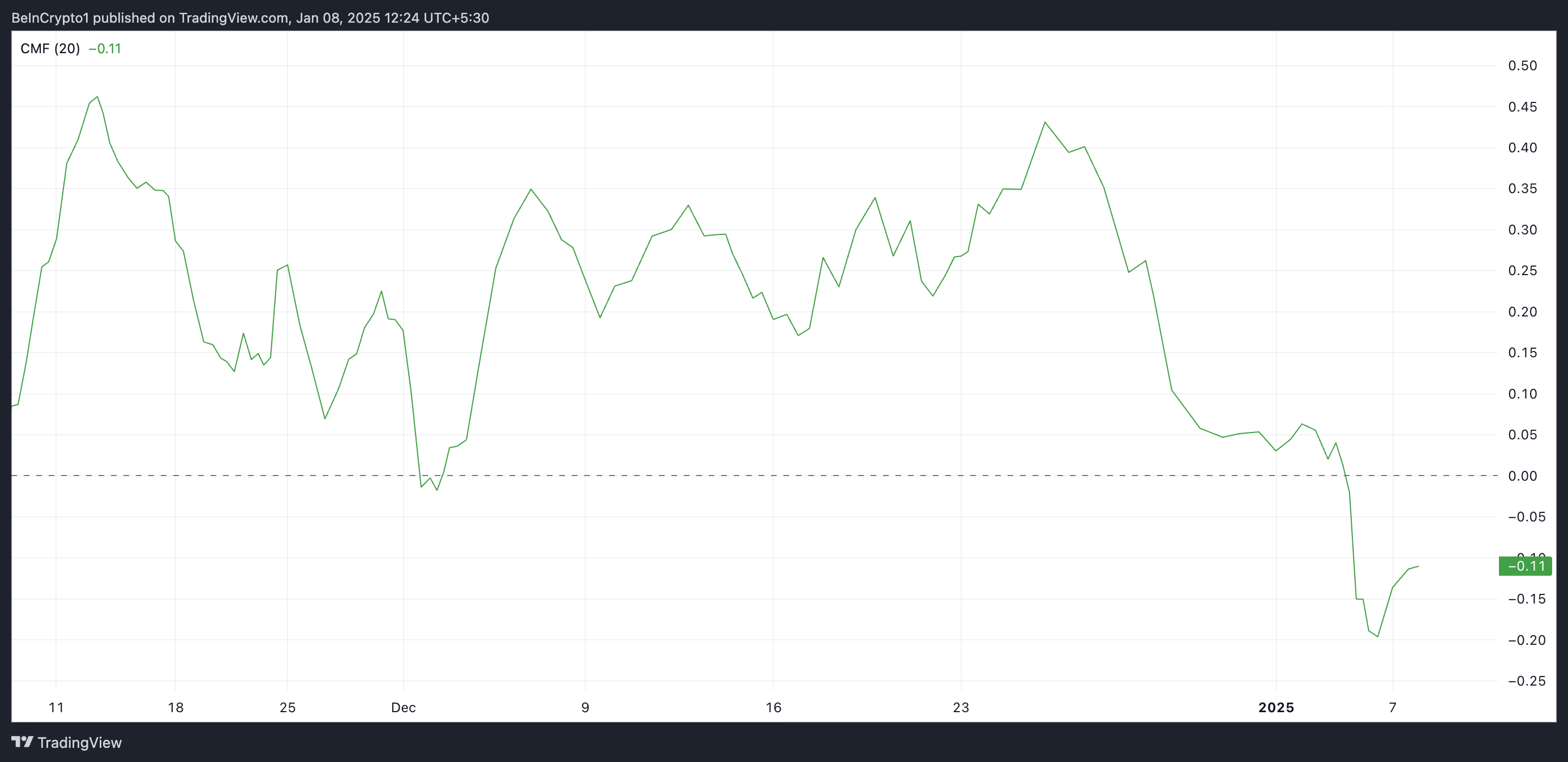

Further, BGB’s Chaikin Money Flow (CMF), which measures the flow of money into and out of the market, is below the zero line, confirming this bearish outlook. At press time, this is at -0.11.

When an asset’s CMF is negative, it indicates that selling pressure dominates, with more trading volume associated with price declines than price gains. This signals a bearish sentiment, suggesting weakness in the Bitget token price rally and an imminent reversal in the uptrend.

BGB Price Prediction: The Case for a New All-Time High

At press time, BGB trades at $6.44. If bearish pressure intensifies, it will shed its current gains and further its decline.

According to its Fibonacci Retracement tool, its next major support lies at $4.42, which may be tested as selling pressure strengthens.

On the other hand, a resurgence in buying activity could propel the Bitget token price toward its all-time high of $8.50 and above.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Abiodun Oladokun

https://beincrypto.com/bitget-token-outperforms-market/

2025-01-08 08:30:00