VIRTUAL, the token powering Virtuals Protocol, surged to an all-time high of $5.25 on January 2. However, it has since entered a steep decline, losing 35% of its value over the past week.

This downturn has positioned VIRTUAL as the worst-performing asset among the top 100 cryptocurrencies during this period, with its price setting new lows daily since reaching its peak.

Low Demand for VIRTUAL Pushes Price to New Lows

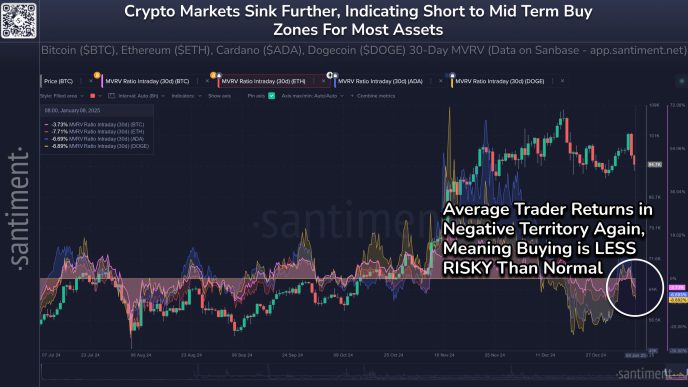

Apart from the general market’s consolidation, VIRTUAL’s double-digit decline is partly driven by the fall in new demand for the token since it peaked at $5.25. On-chain data from Santiment shows an 88% drop in the daily count of new addresses created to trade VIRTUAL since January 2.

When new demand for an asset drops, it means fewer buyers are entering the market, reducing overall buying pressure. This could lead to an extended VIRTUAL token price decline as selling pressure outweighs demand.

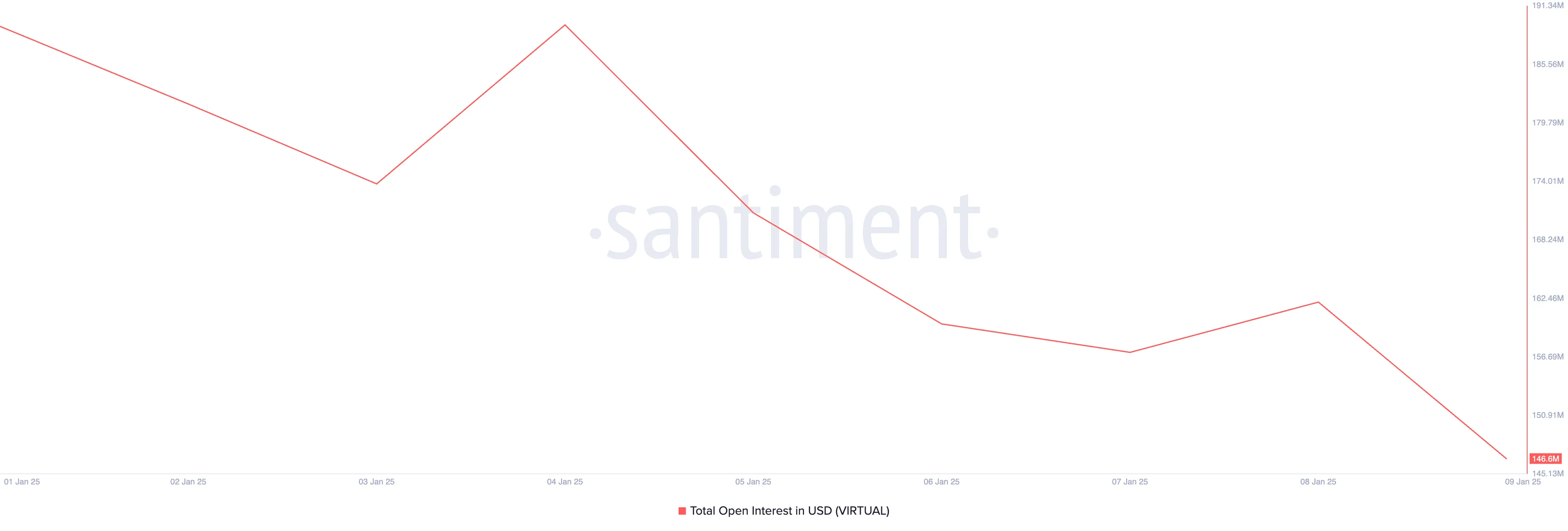

Notably, the altcoin’s plummeting open interest confirms this falling demand. At press time, it stands at $146 million, down 23% over the past seven days.

Open interest refers to the total number of outstanding derivative contracts, such as futures or options, that have not been settled. When it falls during a price decline, traders are closing positions, signaling weaker conviction and a lack of new participants entering the market.

VIRTUAL Price Prediction: Selloffs Could Worsen the Dip

On the daily chart, VIRTUAL’s Relative Strength Index (RSI) is poised to break below the 50-neutral line, confirming the spike in selloffs.

This momentum indicator measures an asset’s overbought and oversold market conditions. When set up this way, the bearish momentum is increasing. Traders interpret it as a signal that the asset’s downtrend will continue. If VIRTUAL’s buying pressure weakens further, its price could fall to $1.31.

On the other hand, if market sentiment shifts and becomes more positive, the VIRTUAL token price could witness a rebound and attempt to reclaim its all-time high.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Abiodun Oladokun

https://beincrypto.com/virtual-token-price-hits-weekly-low/

2025-01-09 15:00:00