Solana’s recent price action highlights its ongoing battle to secure $200 as a stable support level. The altcoin has been hovering around this key price point, reflecting broader market uncertainty.

However, shifting market conditions suggest the potential for a reversal, paving the way for an uptrend.

Solana Investors’ Profits Dip

The Net Unrealized Profit/Loss (NUPL) for Solana is edging closer to the Fear Zone, signaling cautious sentiment among investors. Historically, a dip into this zone has been followed by recoveries in price, as the market begins to stabilize. This trend indicates that Solana could experience a similar rebound if unrealized profits continue their downward trajectory.

Investor sentiment remains critical in determining the next phase of Solana’s price movement. Should the NUPL enter the Fear Zone, it may create an opportunity for renewed buying activity, fostering optimism. This could be the catalyst needed to drive the altcoin back into a bullish trend.

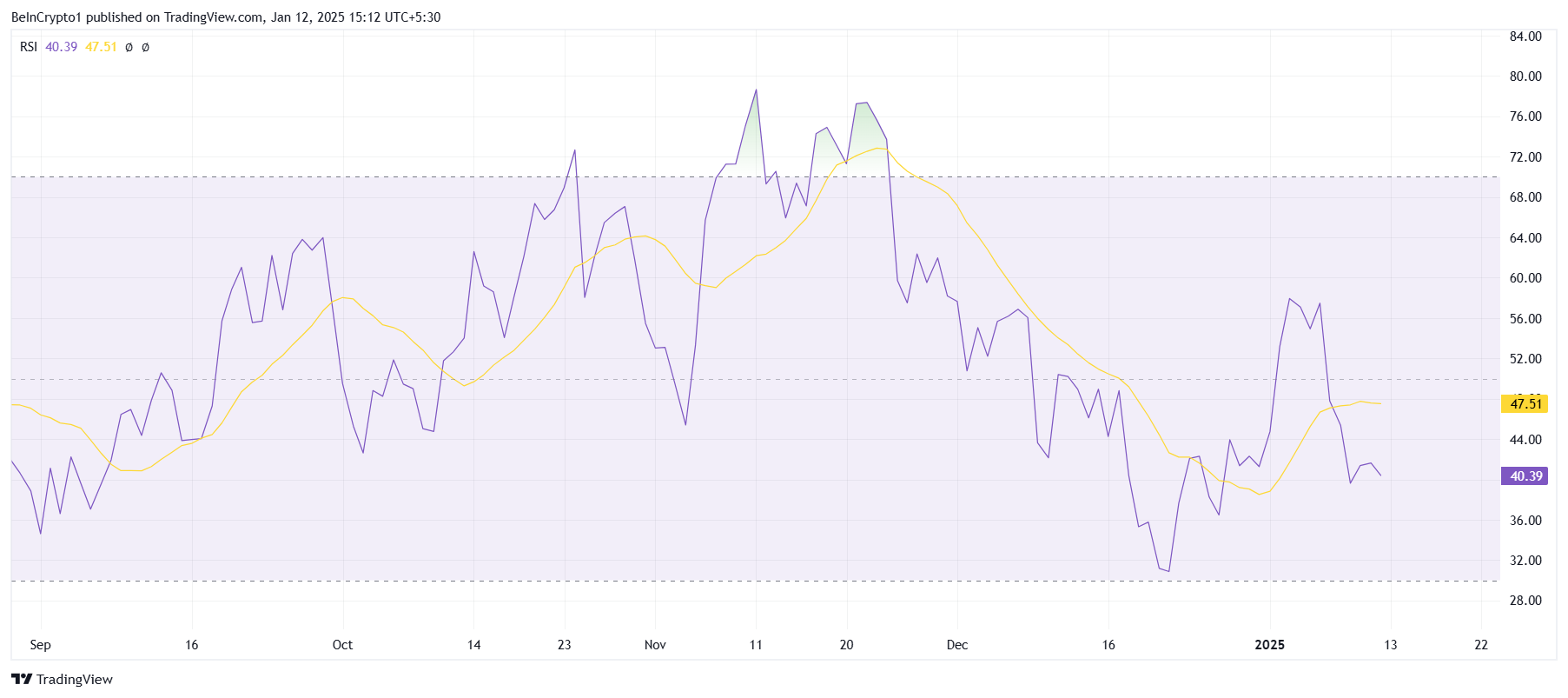

Solana’s macro momentum is showing signs of recovery. The Relative Strength Index (RSI) recently rebounded after nearing the oversold zone last month. While the RSI has yet to establish the neutral 50.0 line as support, its upward trajectory suggests building bullish momentum that could strengthen in the coming days.

The improving RSI aligns with market indicators, pointing to a potential reversal. If Solana continues to gain strength, it could reinforce investor confidence and lay the groundwork for a sustained recovery above critical price levels.

SOL Price Prediction: Reclaiming Support

Solana’s price briefly breached the $201 resistance in early January but has since fallen by 15%, retracing to the support level of $183. This pullback reflects the ongoing volatility in the market but also provides a foundation for recovery if key conditions improve.

Should the aforementioned factors continue to strengthen, Solana could reclaim $200 as a support level. Sustained momentum might then push the price to $221, effectively recovering recent losses and signaling the beginning of a stronger uptrend.

However, failure to break the $201 resistance could result in prolonged consolidation above $183. If the altcoin loses this support, it risks falling further to $169, which would dampen bullish sentiment and delay recovery efforts. Such a scenario would highlight the challenges Solana faces in securing a definitive uptrend.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Aaryamann Shrivastava

https://beincrypto.com/solana-hits-a-historical-rebound-zone/

2025-01-12 17:45:00